Santos, as operator of the Barossa LNG project, today announced a final investment decision (FID) has been taken to proceed with the US$3.6 billion gas and condensate project, located offshore the Northern Territory.

Barossa FID also kick-starts the US$600 million investment in the Darwin LNG life extension and pipeline tie-in projects, which will extend the facility life for around 20 years. The Santos-operated Darwin LNG plant has the capacity to produce approximately 3.7 million tonnes of LNG per annum.

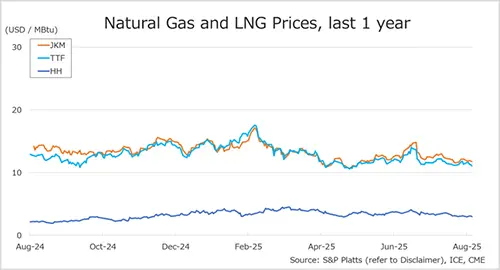

Barossa is one of the lowest cost, new LNG supply projects in the world and will give Santos and Darwin LNG a competitive advantage in a tightening global LNG market. The project represents the biggest investment in Australia’s oil and gas sector since 2012.

Commenting on the announcement, Seb Kennedy tweeted:

Santos takes FID on Barossa natural gas mega project, but only after swallowing more project equity and #LNG market risk than it had wanted.

Santos only managed to pre-sell less than half the LNG output under one long-term contract, and couldn’t find a buyer for the 10% equity stake it had intended to offload

If you can’t find buyers today for project equity or future LNG cargoes, you’re exposed yourself to being caught ‘long’ next time there’s a bear market – which happens periodically in the #LNG game

This is a 20-year investment. Looking at the state of global economies, health and the climate, would you bet against another epic crash happening between now and 2043?

Santos Managing Director and Chief Executive Officer Kevin Gallagher said FID on Barossa was consistent with Santos’ strategy for disciplined growth utilising existing infrastructure around the company’s core assets.

“Our strategy to grow around our five core asset hubs has not changed since 2016. As we enter this next growth phase, we will remain disciplined in managing our major project costs, consistent with our low-cost operating model,” Mr Gallagher said.

Santos and JERA continue to progress the binding sale and purchase agreement for JERA to acquire a 12.5 per cent interest in Barossa.

Completion of the sell-downs to SK E&S and JERA will see Santos’ interests in Bayu-Undan and Darwin LNG change to 43.4 per cent, and in the Barossa project to 50 per cent.

The Barossa investment decision will see approximately 380 million barrels of oil equivalent resources commercialised to 2P reserves at Santos’ expected 50 per cent interest in the project following the sell-down to JERA.

Source: Santos LNG, Seb Kennedy (Energy Flux)