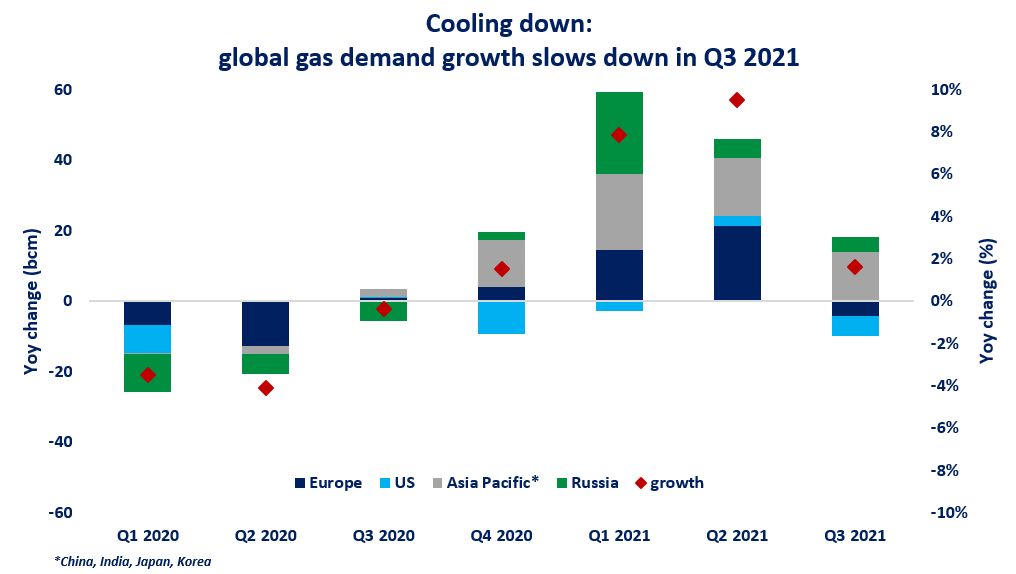

Cooling down: after an extremely strong growth in the first half of 2021, global gas demand has markedly slowed down in the Q3 2021, based on first data estimates.

Gas demand grew by close to 8% in key gas regions in H1, largely driven by colder winter/spring temperatures, droughts and strong economic recovery. demand growth has been almost equally distributed across Europe, Russia and the Asia Pacific region.

When looking at the third quarter, the picture is changing, with gas demand growth moderating to ~1.5% and mainly concentrated in the Asia Pacific region, largely supported by China.

There are three main reasons behind this slow down:

What is your view? How will gas demand evolve in the coming months? China’s winter demand is expected to rise by close to 10% according to PetroChina. In the US and Europe, gas-fired power generation, is set to remain depressed at current price levels, but of course a colder winter could boost up demand…

Source: Greg MOLNAR (LinkedIn)