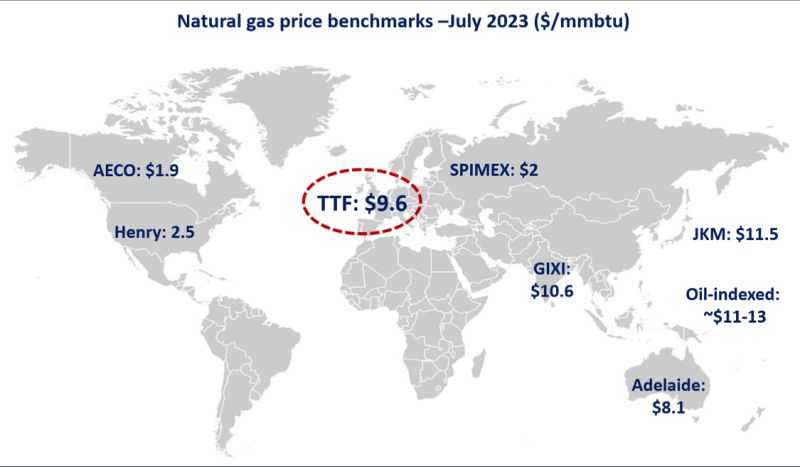

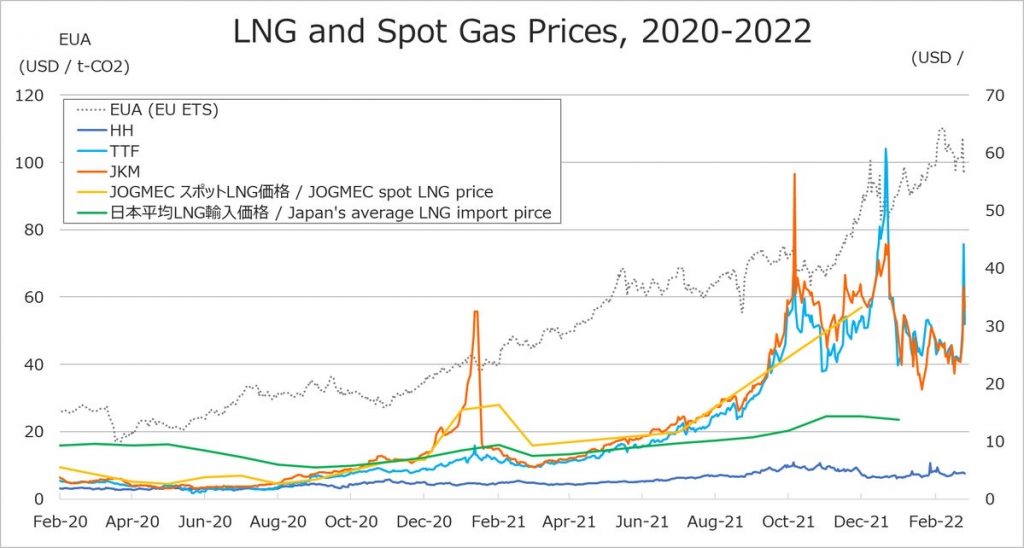

The assessed spot LNG price for near-month delivery to Northeast Asia, JKM hovered in the high of USD 20s per million Btu to the middle of February, then jumped to USD 36 on 24 February due to the Russian Attack to Ukraine and fell to USD 33 on 25 February.

JKM has been moving in line with European gas prices. There are concerns over disruptions of LNG production in Malaysia and Australia, cold weather forecast in Northeast Asia, and lingering uncertainty over gas supply to Europe due to geopolitical tensions.

JOGMEC announced in its monthly report of spot LNG prices for delivery to Japan that the average price of spot LNG cargoes for delivery to Japan contracted in January 2022 and scheduled to be delivered from the month onward (contract-based price) was USD 26.0.

The average price of spot LNG cargoes that were contracted and delivered in Japan within the month (arrival-based price) was not disclosed as only one or less company submitted the report for the month.

The Henry Hub Natural Gas Futures price temporarily rose to the USD 5.5 at the beginning of February and fell to below USD 4 and hovering in the middle of USD 4 range toward the end of the month. According to the U.S. Energy Information Administration (EIA), the increasing natural gas prices reflect a relatively cold weather in January, the demand of heating and electricity, and continued strong demand for U.S. LNG. EIA forecasts an average of USD 3.82 in the first quarter of 2022 and average USD 3.79 for all of 2022. U.S. LNG exports were estimated to be about 7.2 million tonnes in January 2022, higher than the average of approximately 6.7 million tonnes per month in the fourth quarter of 2021. EIA expects the U.S. LNG export capacity will contribute to LNG exports rising to about 86 million tonnes in 2022, up 16% from the previous year.

The Dutch TTF Gas Futures price continued rising from USD 27 at the beginning of February to low of USD 20s by the middle of the month and turned upward as the situation in Ukraine became more tense and surged to USD 44 on 24 February due to the Russian Attack to Ukraine, then dropped sharply to USD 30 the next day.

Based on the preliminary figures from Japan’s customs statistics of the Ministry of Finance, the country’s average LNG import price was USD 13.77 in January 2022. The average landed prices of LNG in Japan from the United States, the ASEAN region, the Middle East, and Russia in the month were USD 15.30, USD 14.40, USD 15.28, and USD 13.67, respectively.

Elsewhere in Asian, average import prices in January were USD 21.92 in Korea, USD 21.35 in Chinese Taipei (As of 25 February, China’s trade statistics have not yet been released.).

The Japan’s average landed crude oil import price (JCC: Japan crude cocktail) declined to USD 79.64 in January 2022 from the previous month but remains high. Japan’s average LNG import price is expected to continue rising, as long-term contracts linked to JCC prices still account for 70%-80% of LNG imports.

Japan imported 6.79 million tonnes of LNG in January 2022, 16% lower than the same month of 2021. While Korea imported 5.00 million tonnes in January 2022, an increase of 13% from the same month of 2021, Chinese Taipei imported 1.43 million tonnes, 1% higher than one year earlier.

In January 2022, Europe (EU and the United Kingdom) increased LNG imports by 2.6 million tonnes from December 2021, effectively replacing the decline in Russian pipeline gas supply (As of 25 February, China’s trade statistics have not yet been released.).

Source: JOGMEC