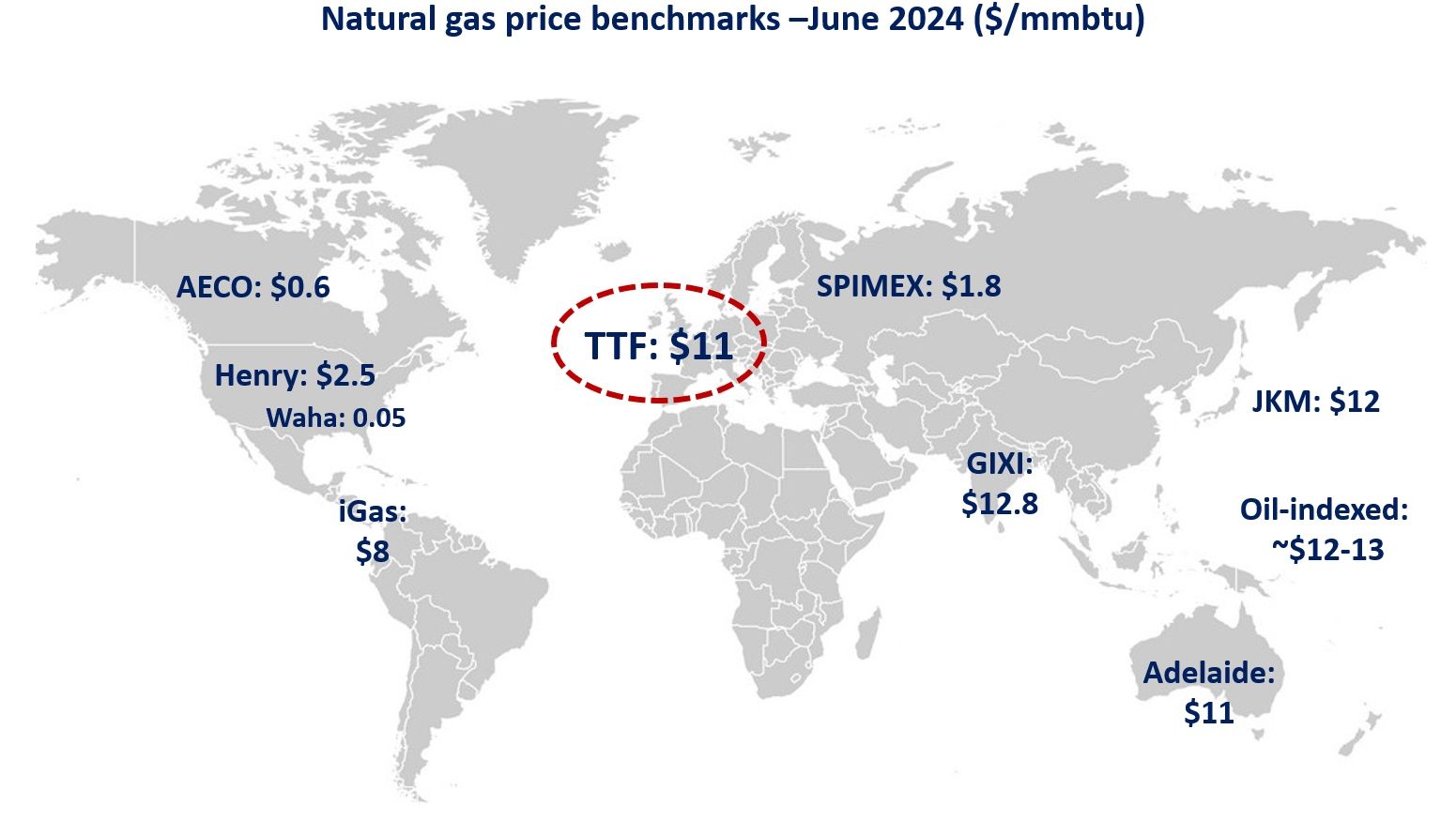

A tighter summer gas market is shaping up, with all gas benchmarks recording strong gains in April and heading to multi-year highs.

In the US, #Henry jumped by an impressive 48% yoy, despite domestic consumption falling more steeply than production. however, prices gained support from LNG exports ramping up by almost 50% yoy, driving up overall system demand for gas. net imports from Canada were up by 17%, providing support for AECO, gaining 55% yoy.

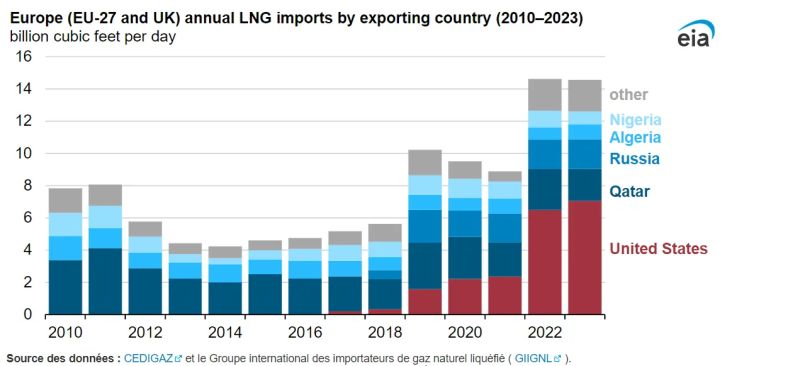

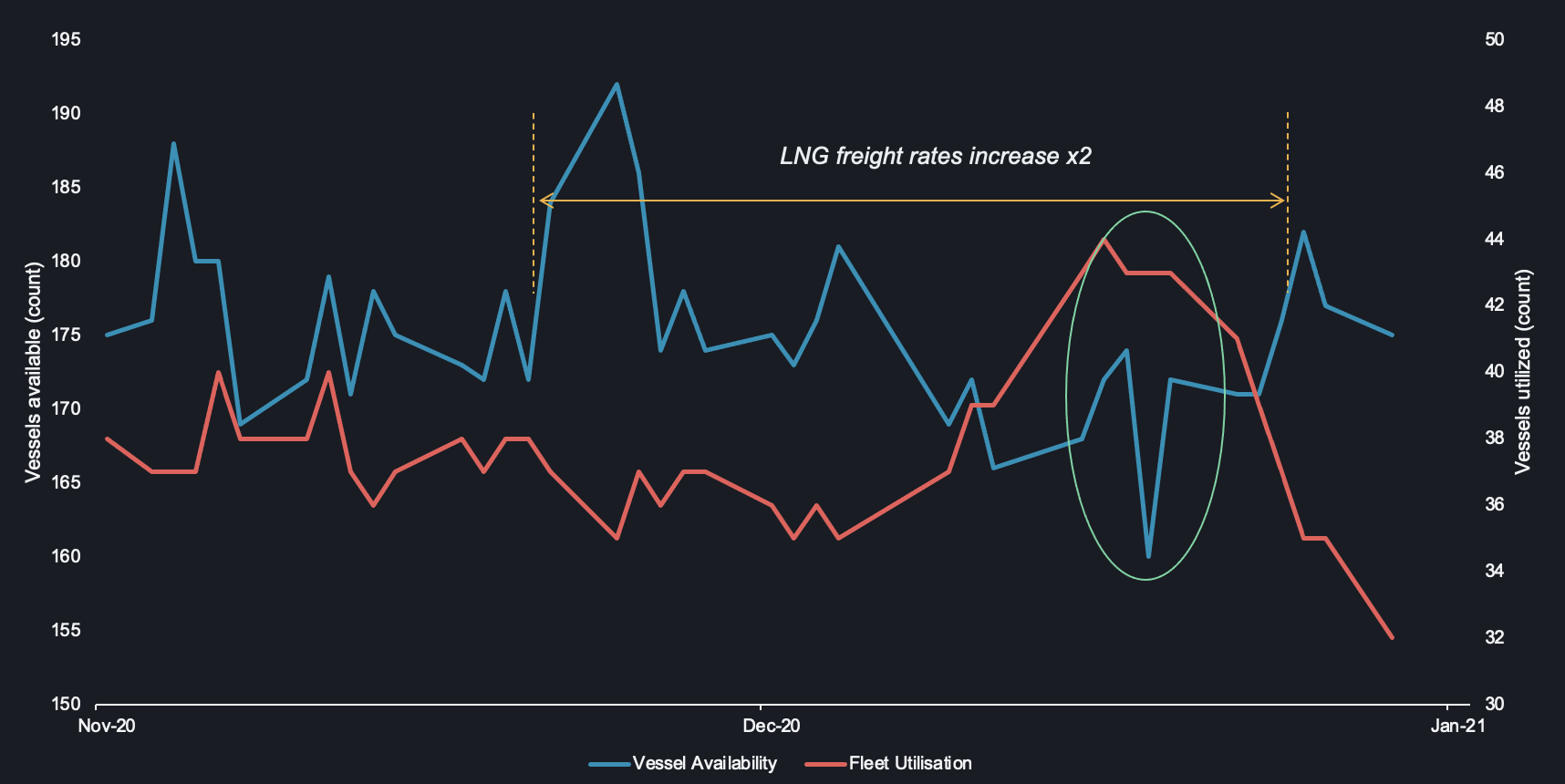

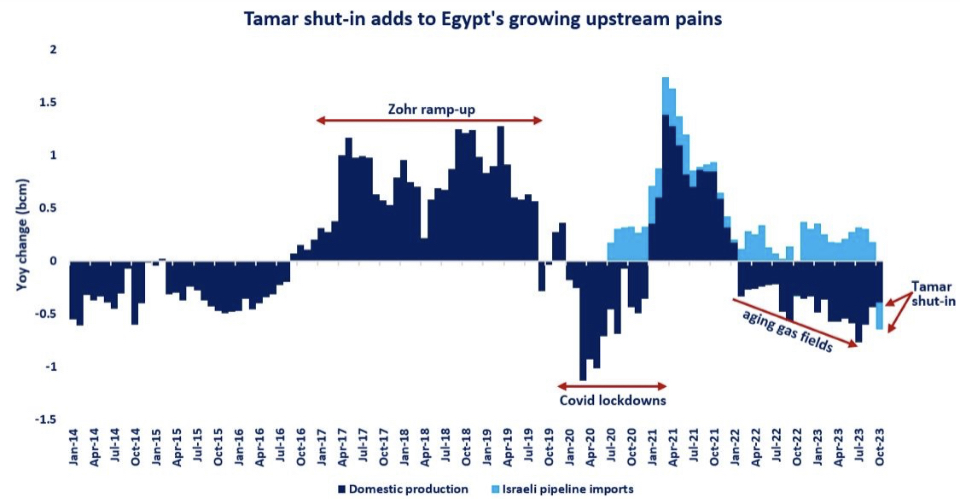

In Europe, TTF April prices more than tripled yoy, reaching their highest April average since 2014. cold temperatures and return of economic activity supported a staggering 45% yoy demand growth, while supply remained tight, with LNG inflow down by 4% and Russian exports to the EU increasing by a mere 3% yoy.

In Asia, JKM continued to gain strength, and similarly to TTF reached its highest April average since 2014. this has been largely driven by strong spot buying interest from China (+18%) and India (+38%). with JKM now climbing to above $9/mmbtu for June delivery, means that oil-indexed prices are becoming increasingly competitive for this summer…

What is your view? How will gas prices behave this summer? European storage inventories are now almost 30% below their 5-year average… the market is heating up!

Source: Greg MOLNAR

Connect with Greg on LinkedIn