The LNG product markets woke up yesterday and some interesting observations:

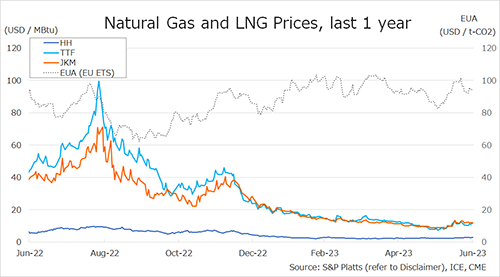

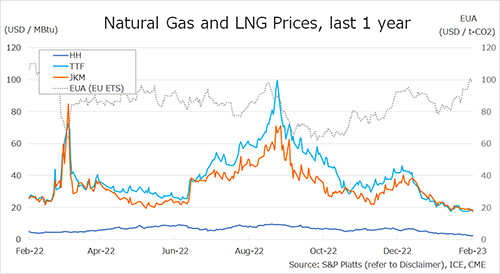

(1) Asian LNG prices are now at a $3/MMBtu premium to European LNG prices incentivizing more cargo flow to Asia. This will mitigate the slump in floating storage recently as more ton mileage will compensate for loss of ton time.

Adjusted for freight there is now approx. $1/MMBtu better economics selling the cargo to Asia although this is spot freight, most freight is contracted freight so spread is higher for most traders. Less Panama congestion is also supporting more trade to Asia.

(2) The spread between European pipeline gas and LNG has almost vanished with spread now around only $1/MMBtu signalling less congestion at import terminals in Europe.

(3) US natural gas prices plummeted yesterday despite cold shock in US with Henry Hub now at a low of $4/MMBtu which is $20/MMBtu less than Asian spot price JKM making for nice arbitrage.

(4) Absolute LNG prices have come down to earth but spot LNG is still expensive at around $140 boe which is about twice the price of contracted LNG which is around 2/3 of the market.