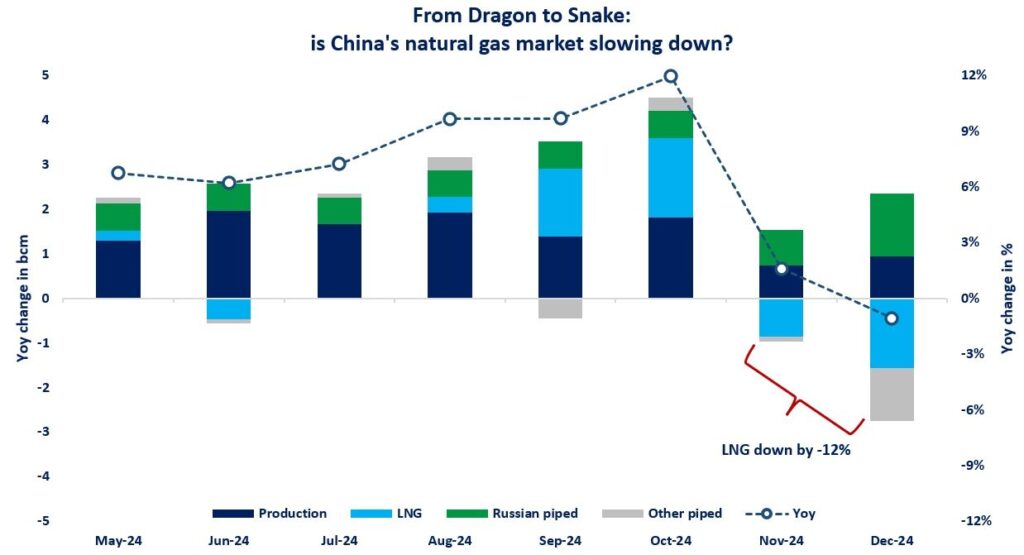

After a stellar year in 2024, China’s robust gas demand growth seems to be slowing down, with the country’s LNG imports down by 18% yoy in Jan25.

China’s gas consumption grew by 8% in 2024, with the country alone accounting for almost 36% of incremental gas demand.

This strong growth was supported by all end-use sectors, including industry, power, rescom as well as transport, with LNG trucks hitting record high sales.

Strong domestic demand fuelled China’s LNG appetite, which surged by 13% in the first ten months of 2024.

New underground storage facilities and restocking needs pushed further upwards LNG imports ahead of the 2024/25 heating season.

China’s gas demand growth slowed down markedly since November. this is only partly due to milder weather.

A weaker macro-economic environment together with high spot LNG prices is also putting downward pressure on China’s gas consumption.

Preliminary data suggests, that China gas demand turned into negative territory through Nov-Dec, while the country’s LNG imports dropped by 12% yoy.

This trend seems to continue in January, with China’s LNG inflows now down by 18% yoy and Chinese LNG importers reselling their cargoes, including to European buyers.

What is your view? how significant could be China’s slowdown? Would China leave the spot market while JKM prices are trading above $12/mmbtu? Could China’s easing LNG appetite loosen the strains on the global gas balance?

Source: Greg MOLNAR