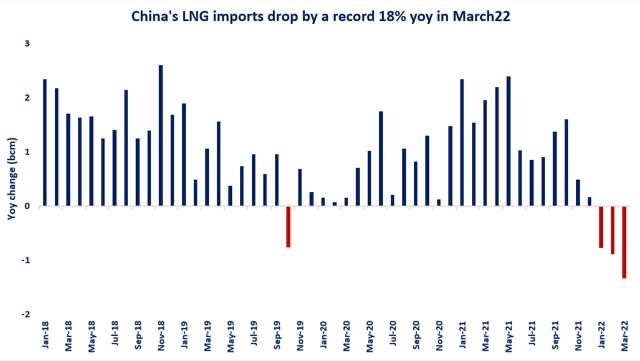

When the Dragon don’t drag on LNG: China’s LNG imports dropped by 18% in March, its steepest drop since China became a major LNG importer.

Since the beginning of the year, China’s LNG imports dropped by over 10% (or 3 bcm) compared to last year.

Consequently, China lost its position as the world’s largest LNG importer to Japan in Q1 2022.

What is driving China’s lower LNG imports?

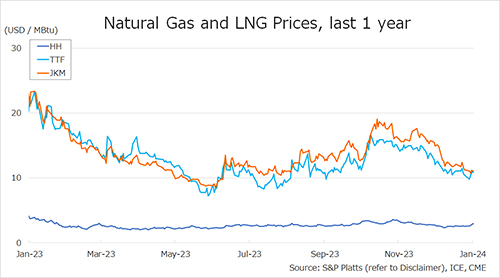

(1) record high spot LNG prices: Chinese offtakers minimised their short-term procurements, and are now relying mostly on their long-term supply contracts;

(2) higher pipeline imports: in contrast with LNG, piped imports were up by 9% yoy, as they have substantially lower prices (eg Russia ~$5/mmbtu vs $30 over the spot);

(3) demand response: record high gas prices are incentivising switching away from gas in the power and industrial sectors. this also means higher coal burn.

(4) lockdowns are weighing on economic activity and as such on energy and gas demand;

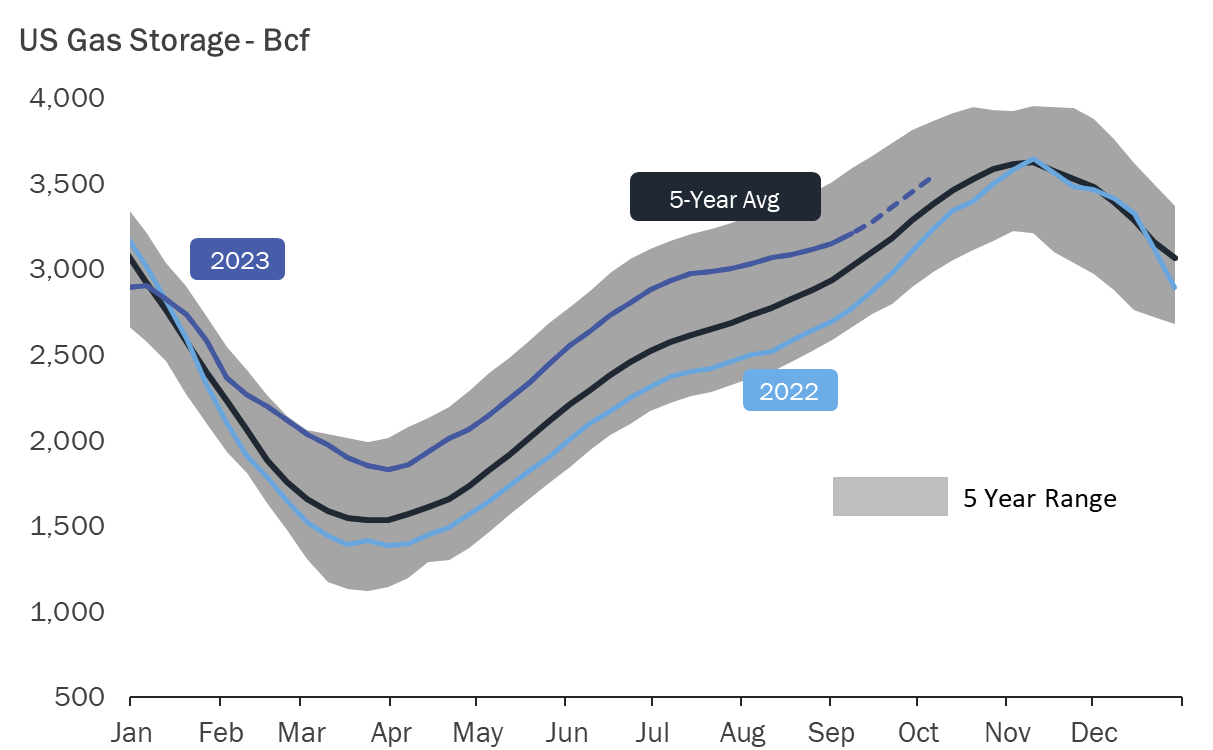

(5) high stocks after the heating season: although there is limited visibility on China’s gas storage, rumours says that LNG stocks are above historical averages for this period of the year.

China’s gas and LNG demand was seen for a long time as untouchable. Strong policy drive for gas-to-coal switching lead to an unprecedented demand growth.

This might change in market with spot LNG prices bouncing between $25-35/mmbtu for the last 6 months.

What is your view? How will China’s LNG demand evolve this year? Can we expect a comeback later on this year? Closer to the next heating season? What does it mean for coal?

Source: Greg MOLNAR