To save your time, here is just a short brief. Actually, it will be enough to run through the graphs below so that you see how fast LNG suppliers have reacted to the recent changes in price environment.

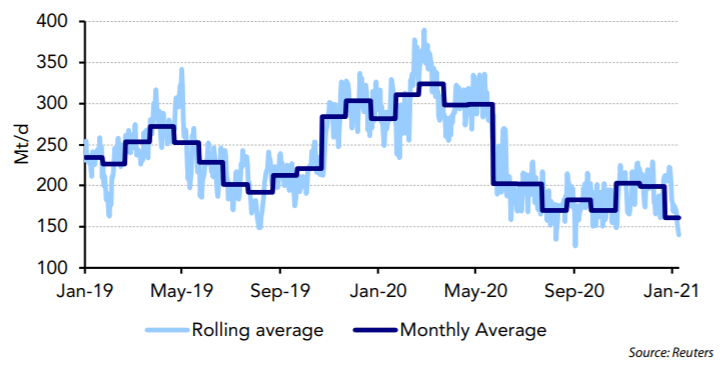

As recently as July 2021, European terminals received around 4.5 Mt of LNG, but amid a significant rise in gas hub prices over the summer period, imports amounted to more than 7 Mt in October 2021. And that was only the beginning 😉

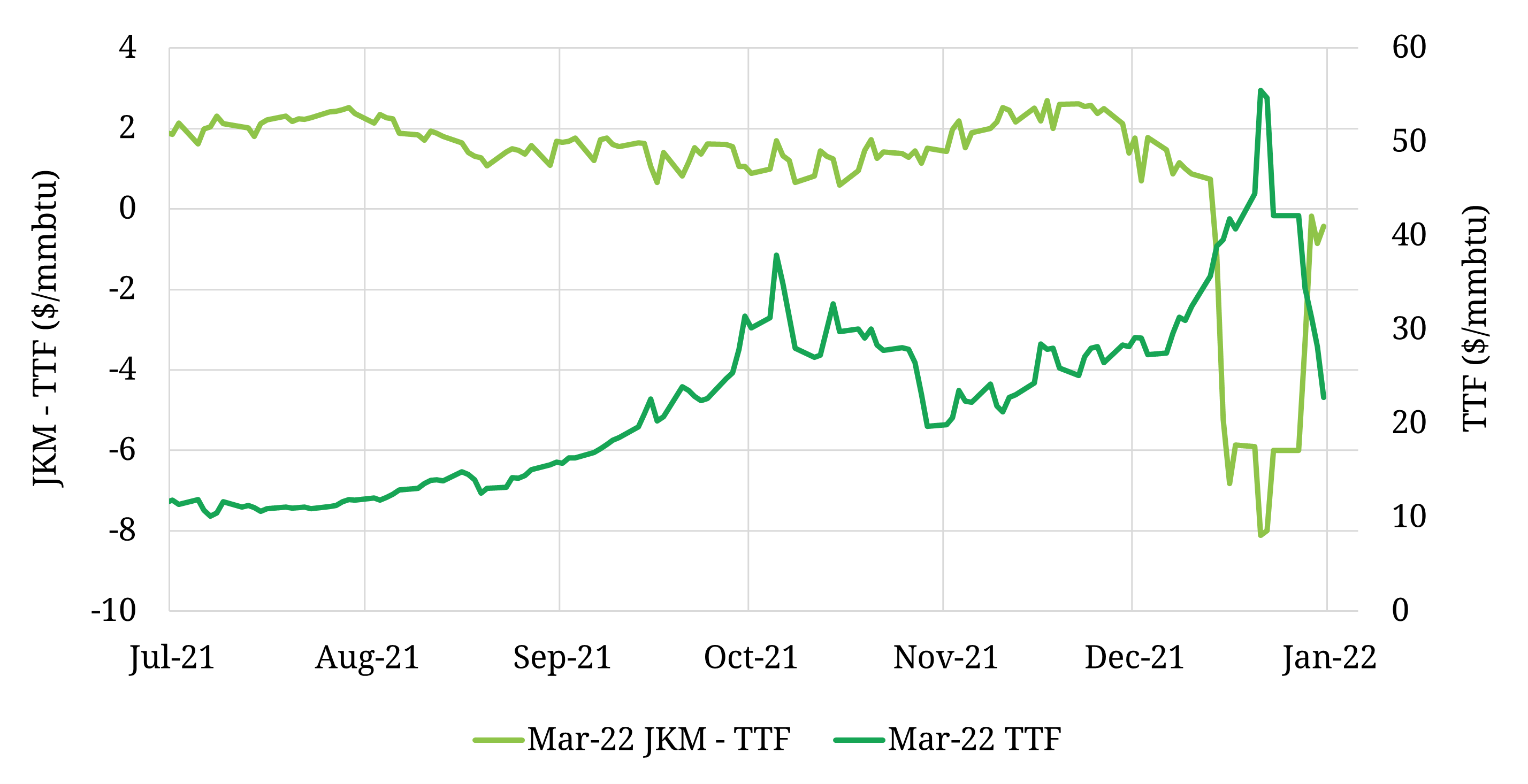

Amid narrow spreads between the JKM and TTF prompt contracts, a total of 8.6 Mt arrived at the European regasification facilities in December 2021. A shift from the TTF-JKM discount to premium further added to the attractiveness of Europe as a destination for cargoes, with the region’s LNG receipts reaching a record monthly high of approximately 12 Mt in January 2022, according to Kpler.

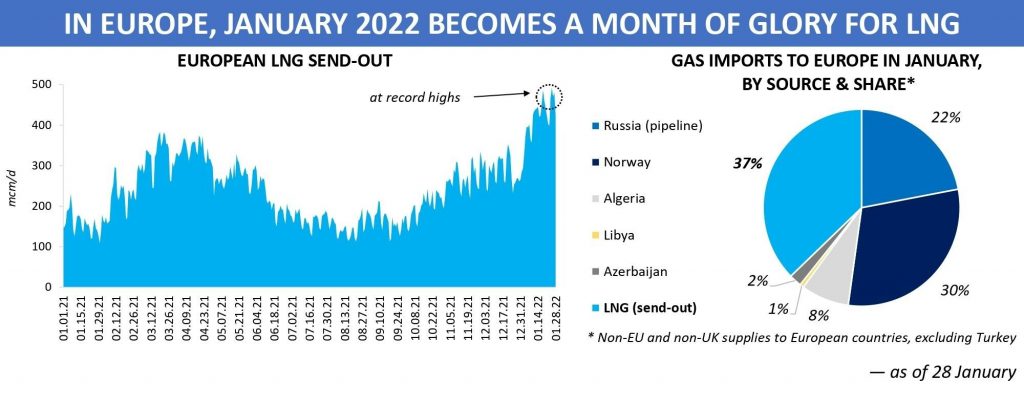

As a result, Europe’s LNG send-out has set a new all-time high. In mid-January, European regasification hit 450 mcm/d for the first time, while the average figure from 1 to 28 January exceeded the level of 400 mcm/d – more than any pipeline gas exporter supplied during the period.

This month, LNG has accounted for more than one-third of gas imports to Europe (excluding Turkey). A true milestone for the region indeed.

Source: Yakov Grabar (LinkedIn)