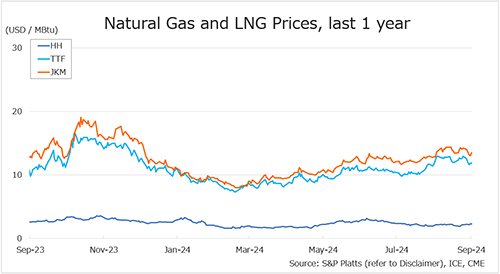

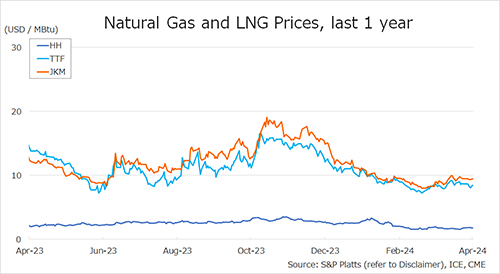

The Northeast Asian assessed spot LNG price JKM for the previous week (1 April – 5 April) remained unchanged at mid-USD 9s on 5 April from mid-USD 9s the previous weekend. The price trended lower mid-week on the back of weak demand in major LNG consuming countries in Asia, but the decline was offset over the weekend by active trading due to demand for inventory injections, especially in Japan. METI announced on 3 April that Japan’s LNG inventories for power generation as of 31 March stood at 1.48 million tonnes, down 0.04 million tonnes from the previous week, down 0.85 million tonnes from the end of the same month(March) last year and down 0.66 million tonnes from the average of the past five years.

The European gas price TTF decreased to USD 8.5/MBtu on 5 April from USD 8.7/MBtu the previous weekend. The price hit USD 8.1/MBtu mid-week due to strong wind power and warm weather, but remained on an upward trend over the weekend due to demand for inventory injection, rising JKM, and unplanned maintenance at Norwegian gas field and gas processing facility. According to AGSI+, the EU-wide underground gas storage increased to 59.7% as of 5 April from 58.7% the previous week.

The U.S. gas price HH remained unchanged at USD 1.8/MBtu on 5 April from USD 1.8/MBtu the previous weekend. HH stabilized at low levels due to low demand and high inventories. The EIA Weekly Natural Gas Storage Report released on 4 April showed U.S. natural gas inventories as of 29 March at 2,259 Bcf, down 37 Bcf from the previous week, up 23.0% from the same period last year, and 38.9% increase over the five-year average.

Updated: 8 April 2024

Source: JOGMEC