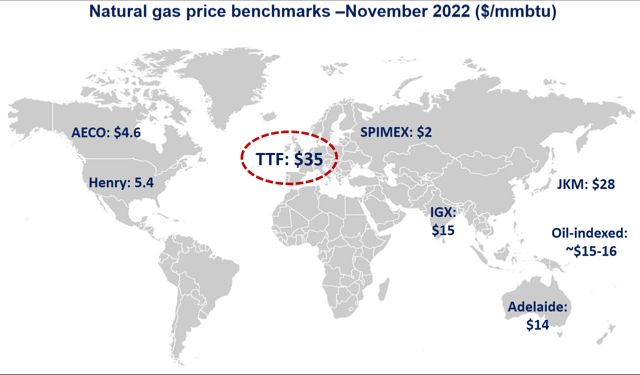

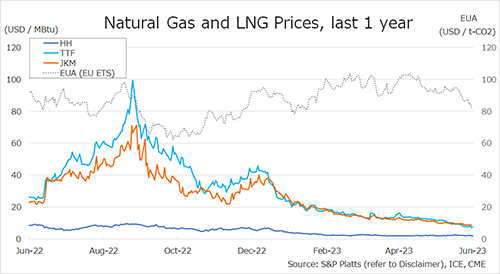

The Northeast Asian assessed spot LNG price JKM for the previous week (29 May – 2 June) fell from USD 9/MBtu the previous week to late USD 8/MBtu on 30 May, but rose slightly on 1 June on supply concerns due to the re-stoppage of Norway’s Hammerfest LNG and the emergence of demand in Northeast Asia.

According to METI, Japan’s LNG inventories for power generation totaled 2.48 million tonnes as of 28 May, up 0.01 million tonnes from the previous week, up 0.37 million tonnes from the end of the same month of last year and up 0.47 million tonnes from the average of the past five years.

The European gas price TTF rose to USD 8.4/MBtu from USD 7.7/MBtu the previous week on the back of lower wind power output and expected higher demand in the Netherlands, as well as the 31 May shutdown of Norway’s Hammerfest LNG (4.8 MTPA) due to a gas leak.

The price then dropped to USD 7.2/MBtu on 1 June after the gas leak at the export terminal was resolved and normalization of operations has progressed, but rose again the next day to USD 7.5/MBtu.

ACER published the 2 June spot LNG assessment price for delivery in the EU at EUR 23.2/MWh (equivalent to USD 7.3/MBtu). According to AGSI+, the European underground gas storage rate as of 2 June was 69.2%, up from 67.3% the previous week.

The U.S. gas price HH settled back down to USD 2.2/MBtu on 2 June after a slight fluctuation from USD 2.2/MBtu the previous week.

According to the EIA Weekly Natural Gas Storage Report released on 1 June, the U.S. natural gas underground storage on 26 May was 2,446 Bcf, up 110 Bcf from the previous week, up 29.5% from the same period last year, and up 16.6% from the historical five-year average.

Updated 05 June 2023

Source: JOGMEC