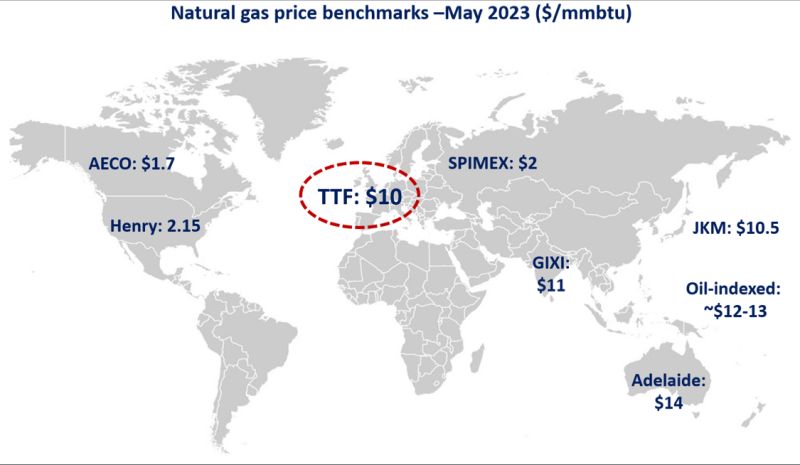

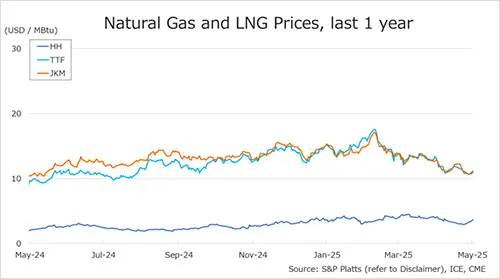

The Northeast Asian assessed spot LNG price JKM for last week (28 April – 2 May, June delivery) was almost unchanged at low-USD 11s/MBtu on 2 May from low-USD 11s/MBtu the previous weekend (25 April).

JKM fell to the mid-USD 10s/MBtu by mid-week amid subdued demand in Asia and ample inventories, but rose again to the low-USD 11s on May 2nd as end-users in China and South Korea actively procured spot cargoes on the back of low prices. METI announced on 30 April that Japan’s LNG inventories for power generation as of 27 April stood at 2.05 million tonnes, down 0.07 million tonnes from the previous week.

The European gas price TTF for last week (28 April – 2 May) rose to USD 11.0/MBtu (June delivery) on 2 May from USD 10.8/MBtu the previous weekend (25 April, May delivery). TTF fluctuated between mid-USD 10s/MBtu and high-USD 10s/MBtu as the European Commission decided to lower the target for EU-wide gas storage level and the urgency of storage disappeared.

However, it rose to USD 11.0/MBtu on May 2nd following the start of maintenance at a gas production facility in Norway and forecasts of falling temperatures in Europe. According to AGSI+, the EU-wide underground gas storage was 41.4% on 2 May, up from 38.1% the previous weekend, down 36.0% from the same period last year, and down 19.6% over the five-year average.

The U.S. gas price HH for last week (25 April – 2 May) fell to USD 3.0/MBtu (June delivery) on 2 May from USD 3.3/MBtu the previous weekend (25 April, May delivery). HH continued to rise as the market rebounded from a sharp drop in natural gas prices for May delivery.

The EIA Weekly Natural Gas Storage Report released on 1 May showed U.S. natural gas inventories as of 25 April at 2,041 Bcf, up 107 Bcf from the previous week, down 17.6% from the same period last year, and 0.2% increase over the five-year average.

Updated: May 7

Source: JOGMEC