With significant LNG oversupply, all of this competing gas will have an impact on global LNG prices in the short and medium term. Comparisons with how pricing evolved in the UK (1990s) and Europe (2000s) gives us an insight into what will most likely happen with Asian and global prices.

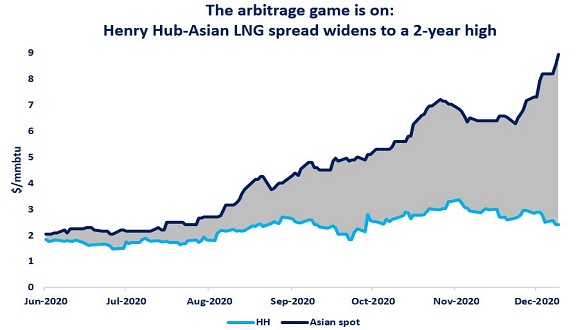

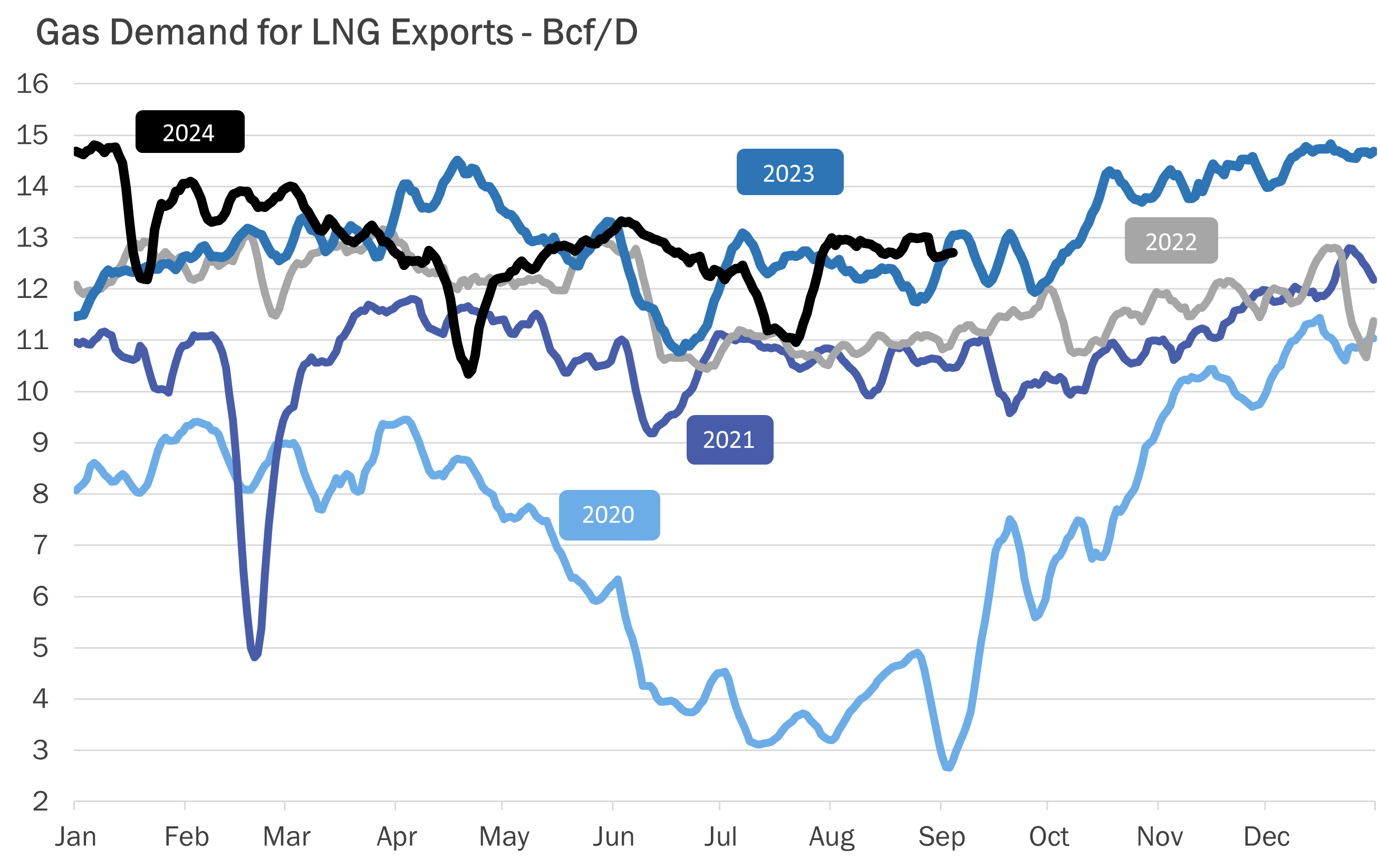

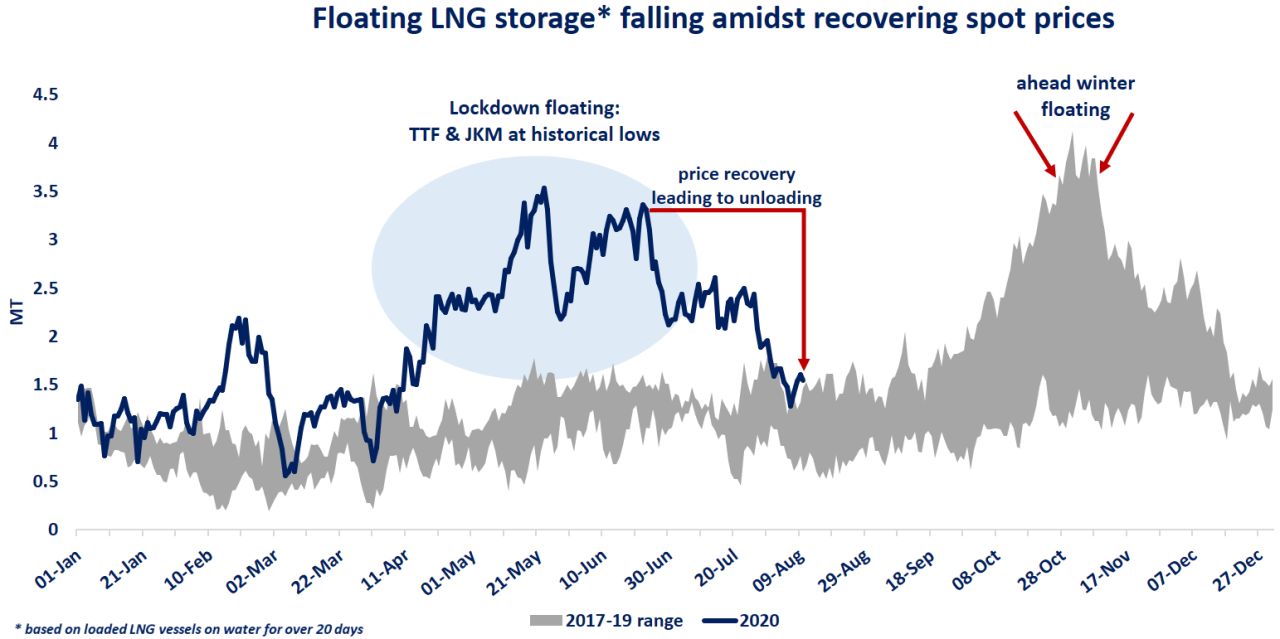

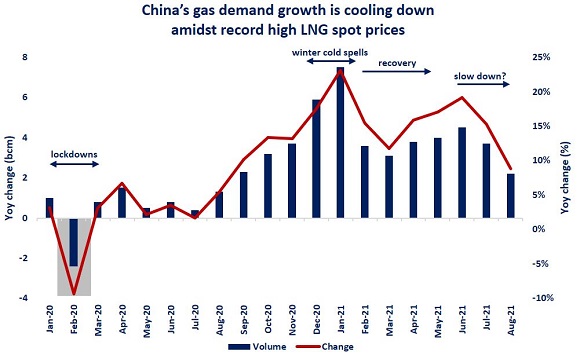

• We have a proliferation of LNG supplies that are already impacting on Asian gas markets, especially in the spot price

• Some of the largest and most significant gas markets are contemplating some kind of market reform or unbundling, which could spur a price discovery process, and

• Oil price volatility continues to create havoc with gas pricing and market stability

Gaffney Cline and Associates have been following and advising on the market reform processes that many Asian gas and LNG buyers are going through, or at least contemplating, that will start to erode the old way of doing things. In Japan, the market reform is well underway with Power being opened up in April 2016 and Gas to follow in April 2017.

In Thailand, there is a detailed market reform plan being debated by the Energy Regulatory Committee, though they have yet to decide on implementation. Vietnam has published a policy goal to enable gas market prices to be set through competition, and of course the process in Indonesia is well underway. China has established a competitive mechanism for setting gas prices, which will begin to establish a mechanism that will respond to wholesale supply and demand. India, South Korea and Malaysia are all to follow.

By end 2016, with a potential uptick in oil prices, there is potential improvement for oil indexed contracts, up to around the $9-10/MMBTU mark. Comparing this to the long run marginal cost of new LNG supplies this could render some projects once again profitable, especially with some of the cost saving measures many of the projects targeting.

However, if we consider today’s oversupplied LNG market, it is also possible we could be looking at wholesale pricing nearer to the short run marginal cost, which for LNG supplying Asia could be anywhere in the $2-4/MMBTU range, depending on the project.

As buyers, sellers and gas traders get more imaginative, and all market players build confidence in a wholesale market, it seems likely that all three current pricing mechanisms (oil indexation, gas on gas, spot/short term) will gradually conform in some fashion, and in effect what we will have is a hub price, similar to NBP or TTF, which can reliably be used in contracts.

Buyers and sellers will soon accept that it is in everyone’s interest to abandon oil, and move towards a mechanism that is more representative of the gas market. We will likely see an increasing number of renegotiations, price review discussions, or arbitrations.

Conclusions

Based on UK and Continental European history, we can expect 4 things to feature in the next few years.

1. A process of price discovery will gather momentum, such that prices will be bound by a short term and long term marginal cost, trending towards cash cost of production in the shorter term

2. Led by flexible LNG supplies, there is likely to be a migration towards pricing terms which are based on gas-on-gas competition, and the resulting decline of oil indexation

3. As this process gets underway, hubs will emerge, which will have to be supported with exchange traded contracts, to help build momentum and enough dependability that lenders and others will have confidence to finance projects based on hub pricing

4. With a broadening range of competing supplies, customer pressure to access lower energy costs, and government policy support, change will come much more quickly than everyone expects, and even large companies can get into serious financial difficulties

END.

Article by Nick Fulford (Global Head of Oil and Gas) and Ryan Pereira (Principal Commercial Manager – Global Gas & LNG) of Gaffney Cline and Associates