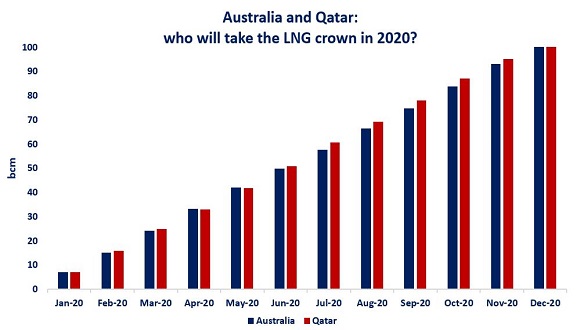

Despite all the challenges, Qatar was able to further increase its LNG production, with some trains running close or above their nameplate capacity through the year. This highlights well the cost-competitiveness of Qatari LNG, benefitting from very low fee gas costs (sometimes below zero, when liquids taken into account).

Moreover, Qatar was able to play on its position between the Asian and European markets, and barely linked during the lockdowns by diverting its flexible flows of LNG from one region to another.

Similarly to Qatar, Australia was able to slightly increase its production, but it is likely to remain below Qatar’s production levels -despite having ~15% higher liquefaction capacity in total. Cargo cancellations, start-up delays and unexpected outages at Gorgon have been driving down the utilisation rate of Australian LNG in 2020.

What is your view? How will LNG markets evolve in 2021? With Prelude set to start commercial operations and overall market conditions improving, will Australian LNG production further increase next year? Are there any risks to that? And what about Qatar? FID in 2021?

Source: Greg Molnar

See original post by Greg on LinkedIn.