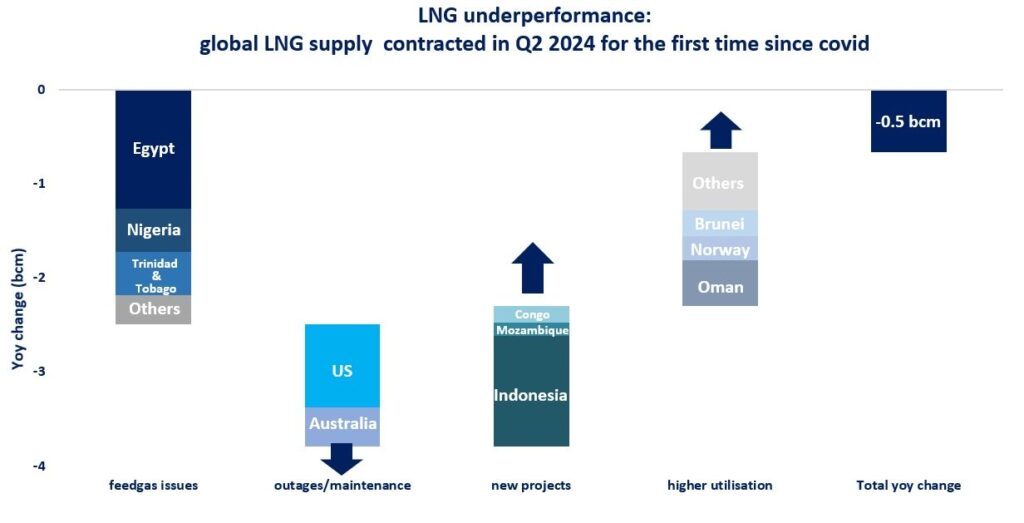

Global LNG supply dropped in Q2 2024 for the first time since covid, amid growing feedgas supply issues at legacy producers and unplanned outages in Australia and the US.

Global LNG supply contracted by around 0.5% yoy in Q2 2024, which in turn tightened market fundamentals and provided upward pressure on gas prices both in Europe and Asia.

The key driver behind lower LNG availability is the worsening feedgas supply issues at legacy producers: (1) in Egypt domestic production plummeted by almost 15% yoy Jan-Apr, forcing the country to switch from LNG exports to imports; (2) in Nigeria security issues, pipeline vandalism and outages at key processing plants continue to weigh on feedgas supply; (3) in Trinidad & Tobago, the reduced output from aging gas fields also limited LNG production.

In the US, unplanned outages and expansion works reduced the output of Freeport LNG by more than 33% and led to a contraction in overall US LNG supply. in Australia, the unplanned outage at Wheatstone LNG lasted for almost two weeks, reducing Aussie LNG supplies to Asian markets.

The ramp-up of new projects in Africa and Indonesia, together with higher utilisation rates in the Middle East was not sufficient to offset the losses due to sliding feedgas supply availability and unplanned outages.

Lower LNG supply, together with strong Asian demand growth, provided upward pressure on gas prices across key LNG imports, with both TTF and JKM gaining more than 30% in Q2.

The ramp-up of new projects is expected to provide some relief to the global LNG market in the second half of 2024, including Plaquemines LNG which is nearing start-up in Louisiana. altogether we expect global LNG supply to increase by around 15 bcm in 2024, with two-thirds of the incremental supply coming to the market in H2 2024.

The LNG supply decline in Q2 2024 is temporary, however it highlights that the issue of feedgas supply availability should not be overlooked, especially in the case of legacy producers.

More than 250 bcm/y of LNG liquefaction capacity is set to be added by 2030, however some of that will be replacing lower LNG supply from legacy suppliers and not necessarily meeting new demand.

Source: Greg Molnar (LinkedIn)