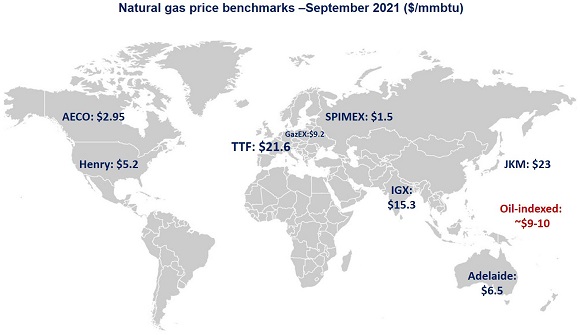

Nobody can stop us: gas benchmarks reached new highs in September, as the global gas market is entering a period of unprecedented tightness.

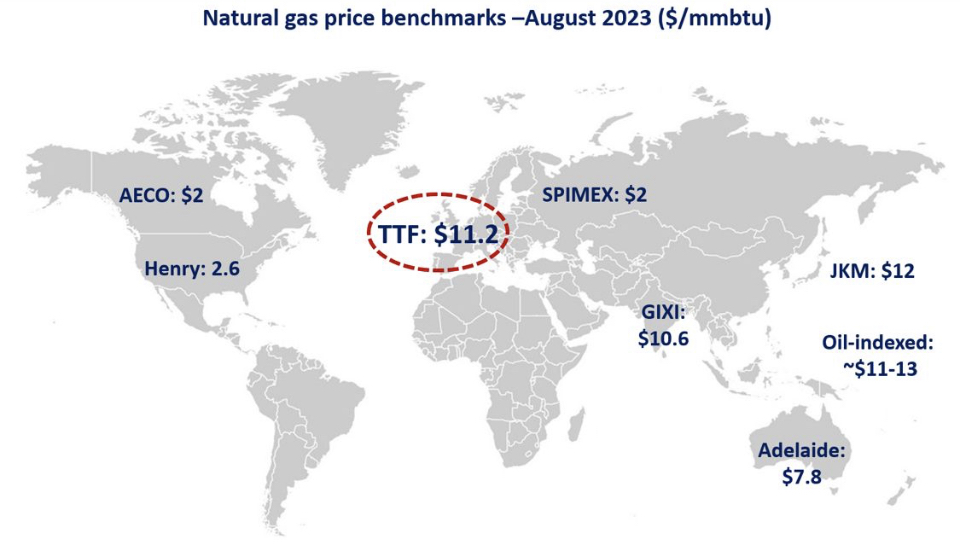

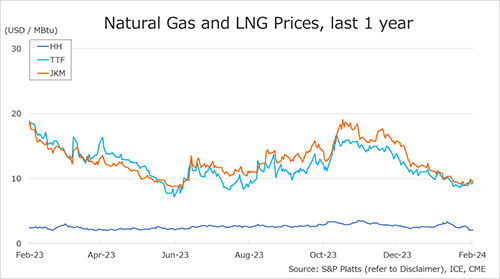

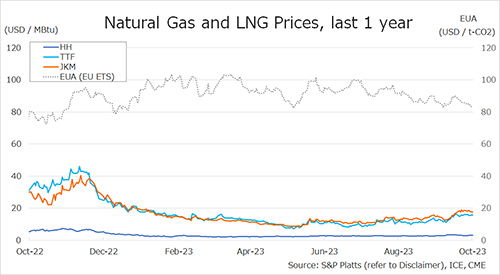

In Europe, TTF averaged at $21.6/mmbtu, highest level on record and up by 40% compared to August. This has been driven by strong storage injections, low wind and tighter supply, as Russian flows to the EU dropped by over 10% yoy.

In Asia, JKM followed a similar path, with prices averaging at a record of $23/mmbtu, on strong competition with TTF. China’s LNG imports were up by almost 20%, probably driven by restocking needs ahead of the winter season. Oil-indexed LNG is now less less than half of the spot.

In the US, Henry climbed above $5/mmbtu, to reach its highest September level since 2008. This is despite declining domestic demand, and increasing production. Strong growth in LNG exports and the damage from Ida, as well as low stocks are driving up gas prices. Stronger pipeline imports from Canada (up by 30% yoy) supported AECO, which climbed close to $3/mmbtu.

What is your view? What is next for gas prices this heating season?

Source: Greg Molnar