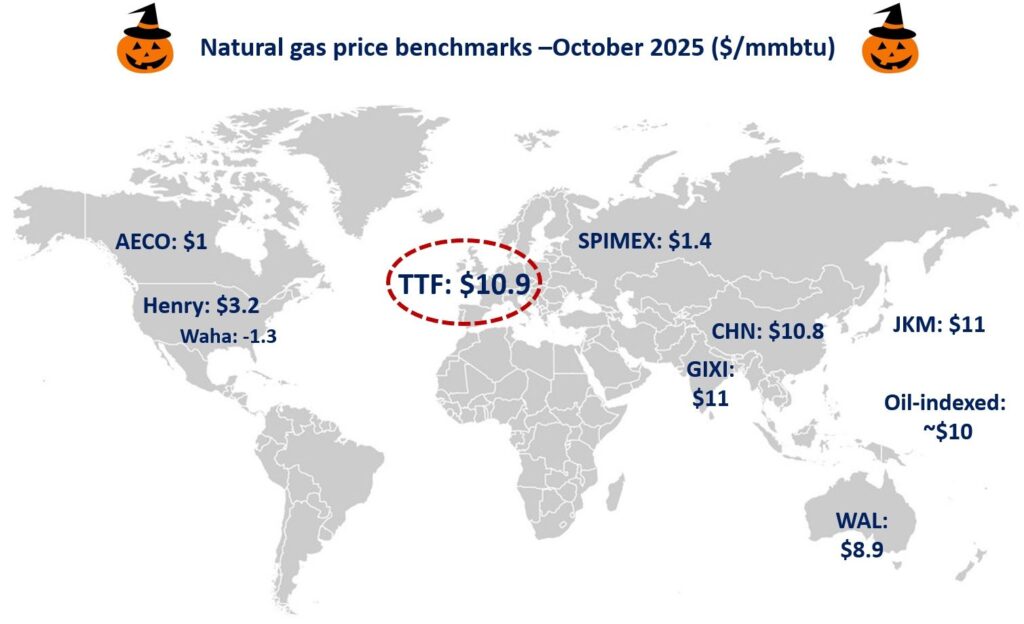

Global gas prices declined in October 2025 amid rising LNG supply and weaker Asian demand.

Asia and European gas prices continued their downward trend in October amid improving LNG supply availability and relatively weak Asian demand.

Global LNG production grew by a staggering 9% yoy in Oct which moderated price levels across key import markets.

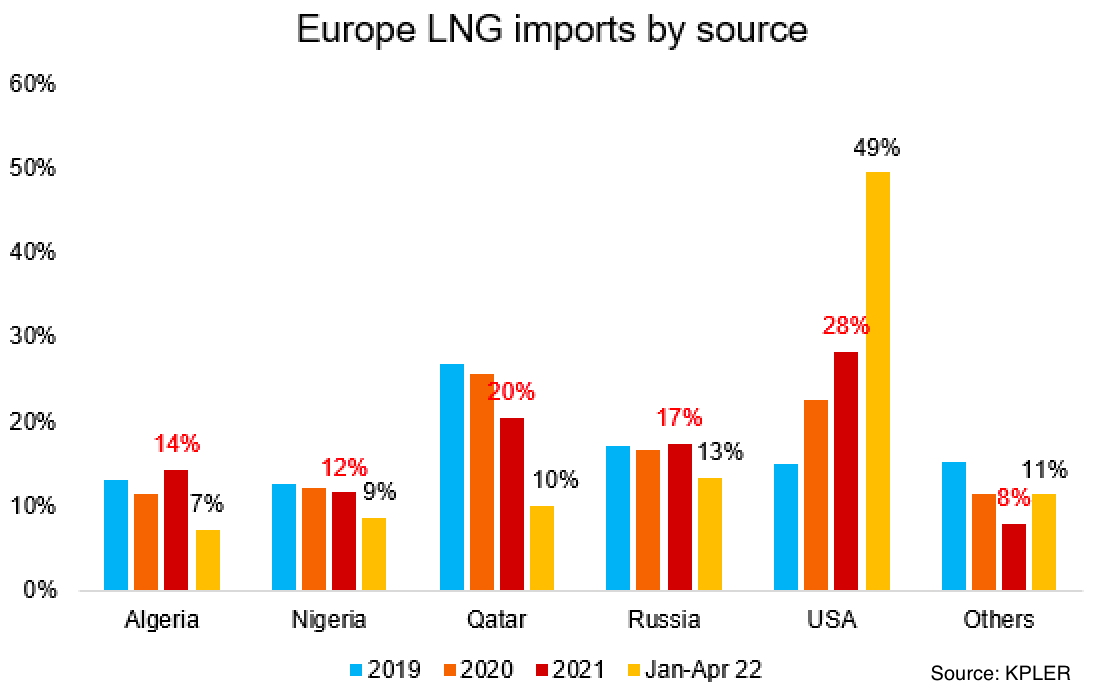

In Europe, TTF month-ahead prices dropped to just below $11/mmbtu -standing 15% below their last year’s levels. This is despite lower stock levels (down by 13% yoy), higher gas-fired powgen and weaker piped gas imports.

All of this was offset by the a very strong increase in LNG inflows, up by 45% yoy.

In Asia, JKM prices followed a similar trend, down by 17%, to an average of $11/mmbtu. China’s LNG imports continued to decline in Oct, down by 15% yoy.

Weaker manufacturing activity (with the PMI now down to 49) is weighing on the country’s gas demand. And China’s domestic spot prices remain below JKM, further limiting China’s LNG buying appetite.

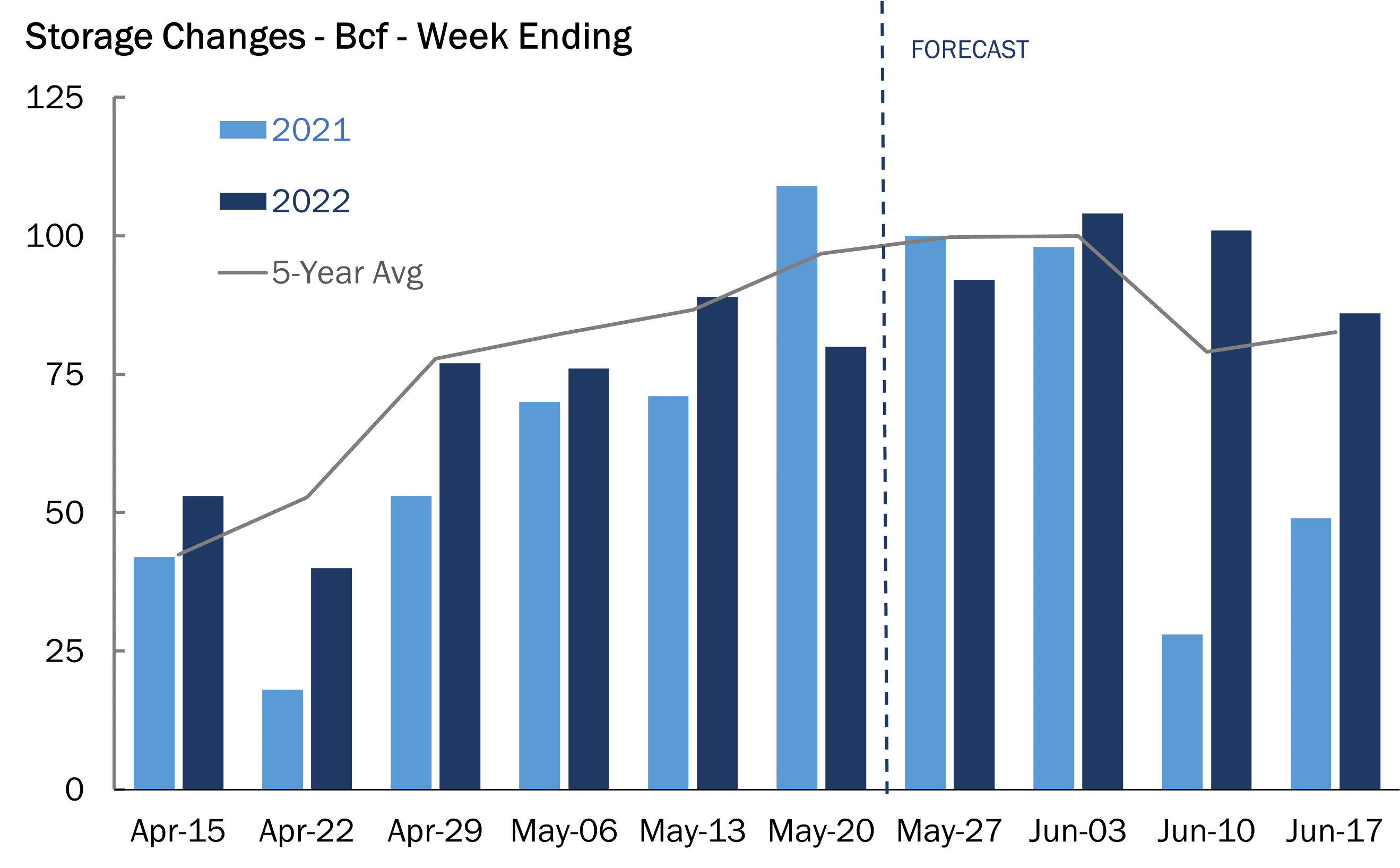

In the US, Henry Hub prices remained broadly flat compared to last month at an average of just above $3/mmbtu. Domestic production stands at near record levels (up by 6%) while storage levels reached a comfortable 90% fill levels by the start of the heating season.

In the Permian, Waha prices collapsed into deep negative territory to an average of minus 1.3/mmbtu – their third lowest monthly level on record.

What is your view? How will gas prices evolve over the heating season? Will the trend towards market easing continue?

Could this be altered by adverse weather and geopolitics?

Source: Greg MOLNAR