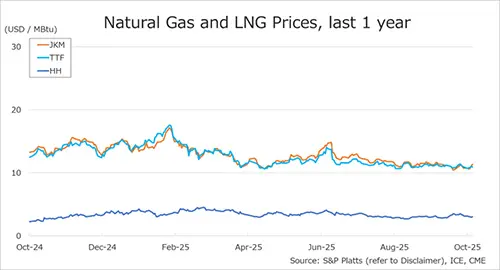

(July 31) The Northeast Asian assessed spot LNG price JKM for the previous week (24 July – 28 July) rose to the high USD 11s on 26 July from the low USD 11s the previous week, with buy tender from Thailand, Bangladesh, and other countries, but dropped to the low USD 11s on 27 July.

A heat wave is hitting Northeast Asia, but buying from countries with high inventories is thin, further dropping to the high USD 10s on 28 July.

According to a 26 July METI release, Japan’s LNG inventories for power generation totaled 1.98 million tonnes as of 23 July, down 0.13 million tonnes from the previous week, down 0.30 million tonnes from the end of the same month of last year and down 0.10 million tonnes from the average of the past five years.

The European gas price TTF rose to USD 10.6/MBtu on 25 July from USD 9.2/MBtu the previous week due to the heat wave in Southern Europe and other regions, but fell to USD 9.3/MBtu on 27 July and USD 8.3/MBtu on 28 July as demand declined due to the easing of the heat wave.

ACER published the 28 July spot LNG assessment price for delivery in the EU at EUR 29.6/MWh (equivalent to USD 9.6/MBtu). According to AGSI+, the European underground gas storage rate as of 28 July was 85.0%, up from 83.0% the previous week.

The U.S. gas price HH fell to USD 2.5/MBtu on 27 July from USD 2.7/MBtu the previous week, with some ups and downs, but rose to USD 2.6/MBtu the following day on 28 July. According to the EIA Weekly Natural Gas Storage Report released on 27 July, the U.S. natural gas underground storage on 21 July was 2,987Bcf, up 16Bcf from the previous week, up 23.7% from the same period last year, and up 13.1% from the historical five-year average.

Source: JOGMEC