New analysis from McKinsey based on its 2025 LNG Buyers’ Survey finds that LNG contracts are evolving as buyers adapt to shifting geopolitics, new supply, and the prospect of softer prices. The market has moved from the tight conditions of 2021–22 into a more balanced phase, led by additional US and Qatari supply, prompting buyers to prioritise flexibility and risk management.

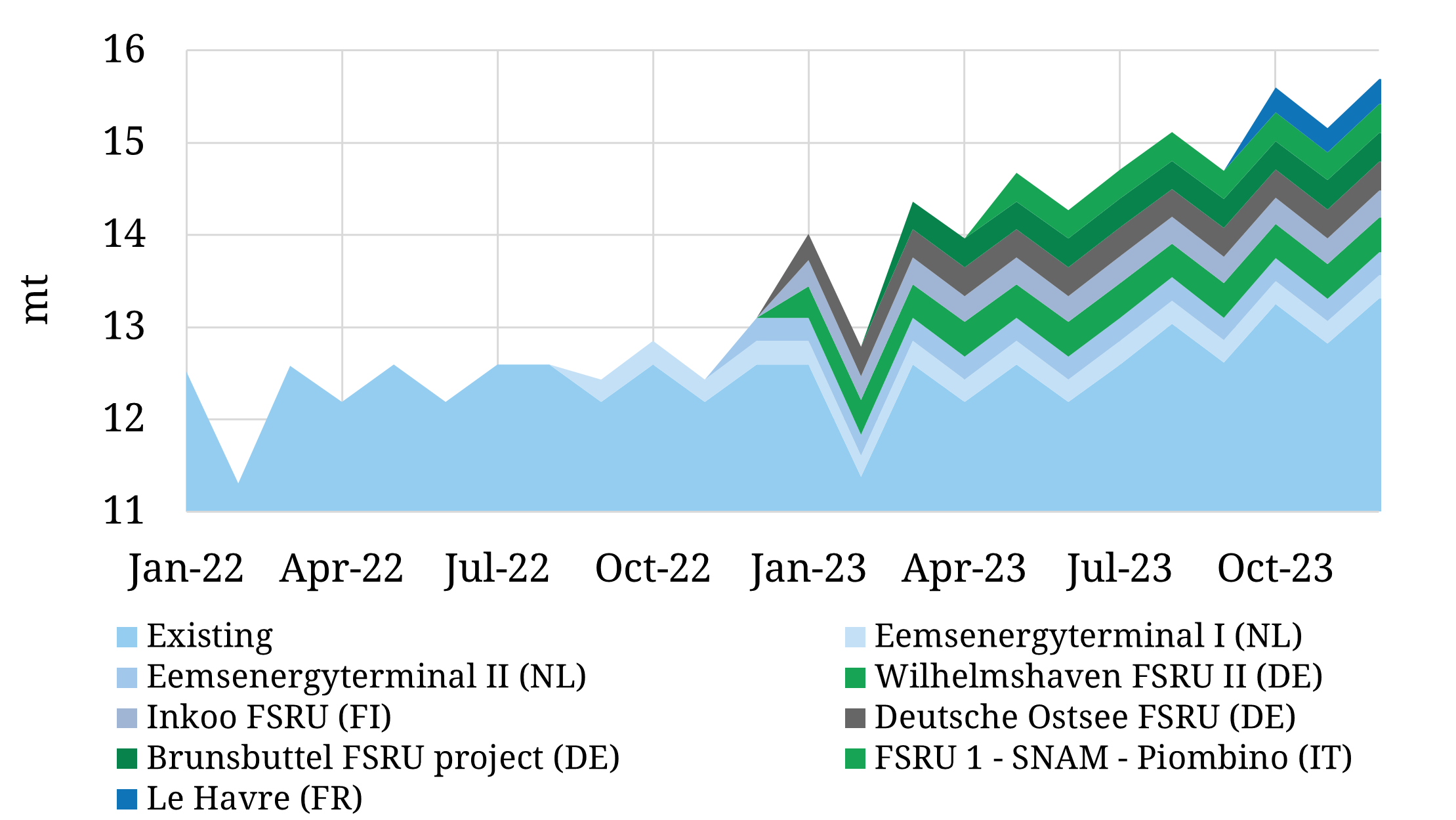

The survey, conducted in July 2025 among 41 LNG buyers, finds that the market has moved from the tight, high-price conditions of 2021–22 into a more balanced phase as new supply—particularly from the United States and Qatar—comes online.

As a result, buyers are increasingly prioritising flexibility and risk management rather than simply securing volume at any price.

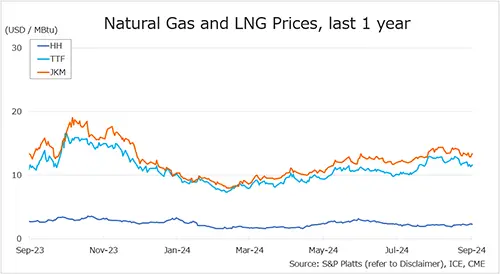

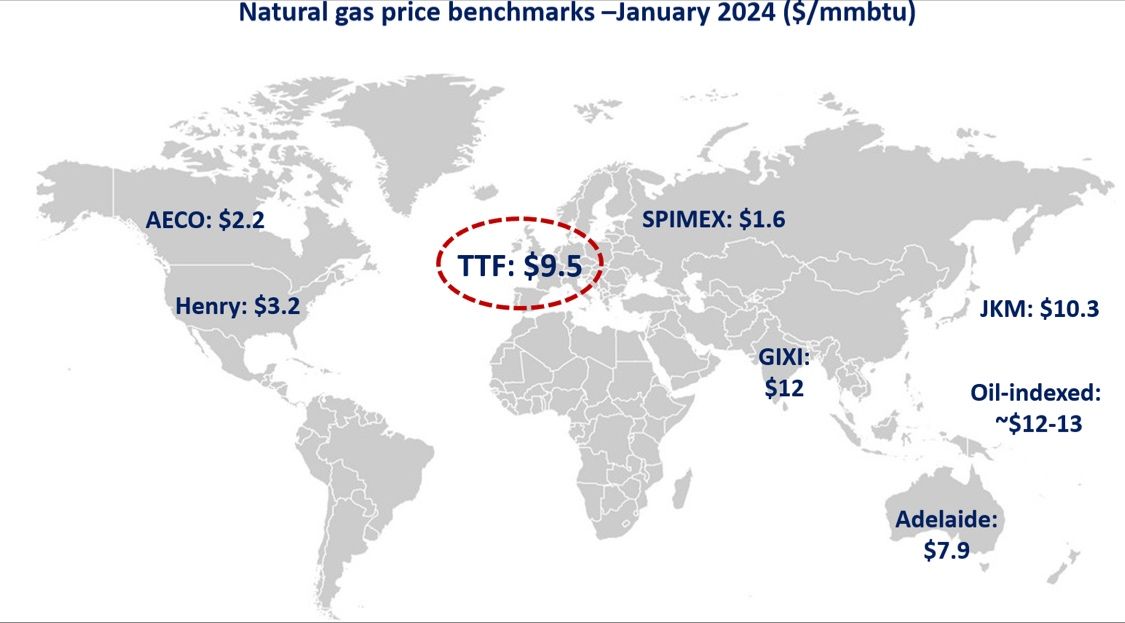

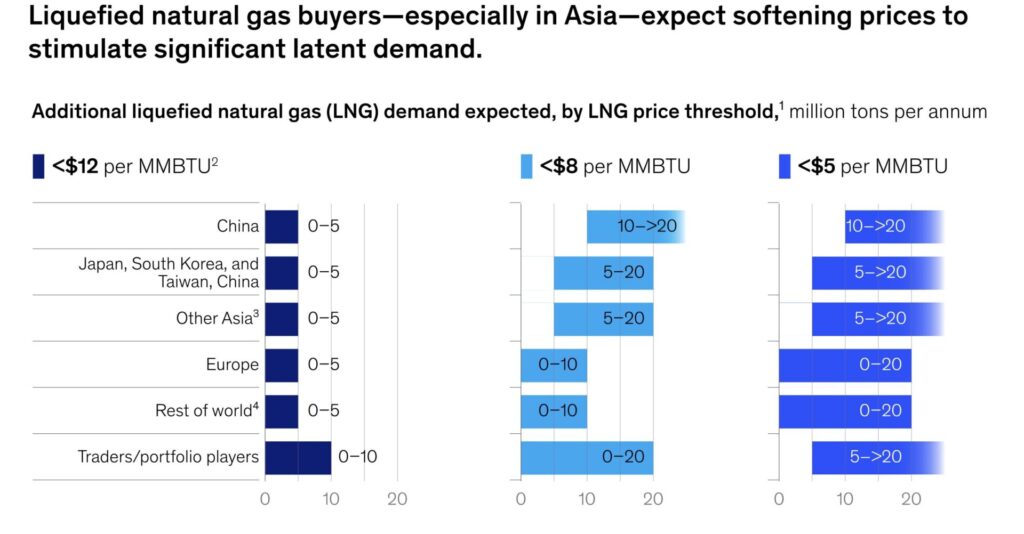

McKinsey’s findings indicate that latent LNG demand could materialise at lower price levels, especially in Asia. Around 60% of respondents expect prices to stabilise at $7–10/MMBtu by 2030. Chinese buyers, in particular, appear highly price-sensitive, reporting that they would switch from coal to LNG at around $8/MMBtu.

Other Asian buyers also expect demand to rise if prices soften, while European buyers anticipate more limited sensitivity due to longer-term declines in gas use.

Geopolitics is playing a growing role in contract decisions. The survey shows that supply diversification has become the primary tool for managing risk, with many buyers seeking to cap exposure to any single supplier and favour more “secure” sourcing routes.

Around one-fifth of buyers also say they value contracts that allow for revision or termination in response to geopolitical shocks.

At the same time, LNG buyers are moving early to secure future supply. About 70% of respondents intend to sign both short- and long-term contracts within the next two to three years.

Interest in short-term contracts has risen sharply since 2023, particularly in Asia-Pacific, while Chinese, Japanese, and South Korean buyers continue to show strong appetite for long-term agreements.

When evaluating contracts, flexibility remains the top priority. Buyers rank flexible destinations and volumes above all other factors, followed by supplier reliability and flexible pricing.

European buyers, however, now place less emphasis on sustainability-linked contract features than they did in 2023, while showing greater interest in investment partnerships with suppliers.

Overall, McKinsey concludes that as new LNG supply enters the market and price volatility eases, buyers are adopting more adaptive procurement strategies—balancing flexibility, security, and long-term planning in an increasingly complex global gas landscape.