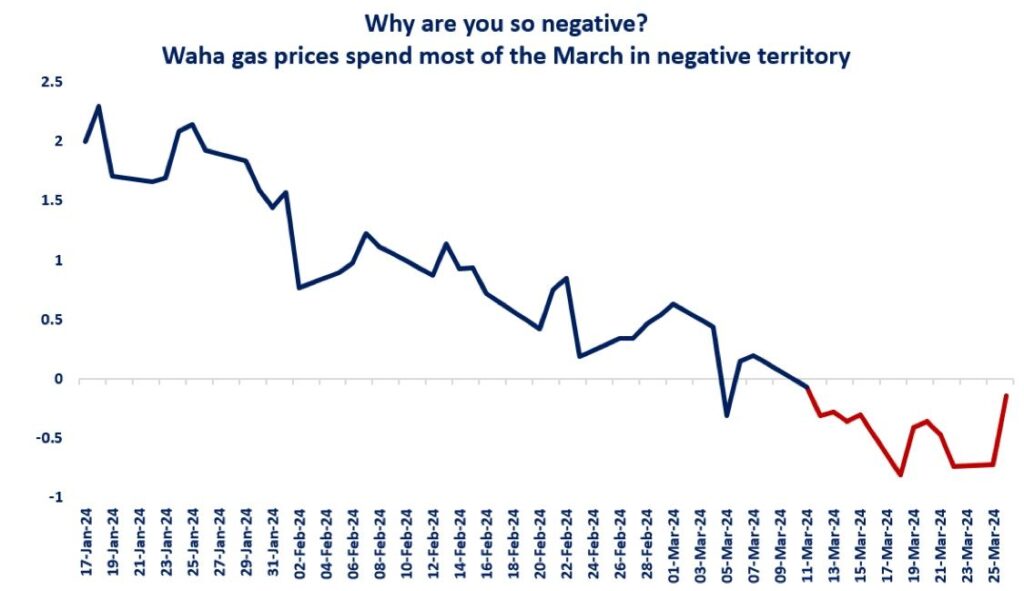

Waha gas prices in the Permian spent most of their time in March in negative territory, with prices averaging at -0.2/mmbtu, their lowest monthly average since May19.

So what is driving this?

(1) Strong associated gas production: higher oil prices are supporting oil production growth in the Permian, which in turn drives associated gas production from more gassy fields. gas production in the Permian rose by more than 10% yoy in Q1 2024;

(2) Pipeline constraints from the Permian, as takeaway capacity is being limited by maintenance, including on the El Paso pipeline;

(3) Weak US gas demand: unseasonably mild weather is pushing down gas consumption in the residential and commercial sectors, which dropped by more than 20% yoy in March;

(4) High storage levels: storage sites in the Central Storage region are 70% full, standing well-above their historic averages, which in certain cases can also weigh on injection capacity.

Source: Greg MOLNAR