This presentation looks at the impact of LNG market evolution on supply contracting and asset value. It covers US exports impact, supply contract flexibility value and commercial considerations for LNG buyers, producers and terminal owners.

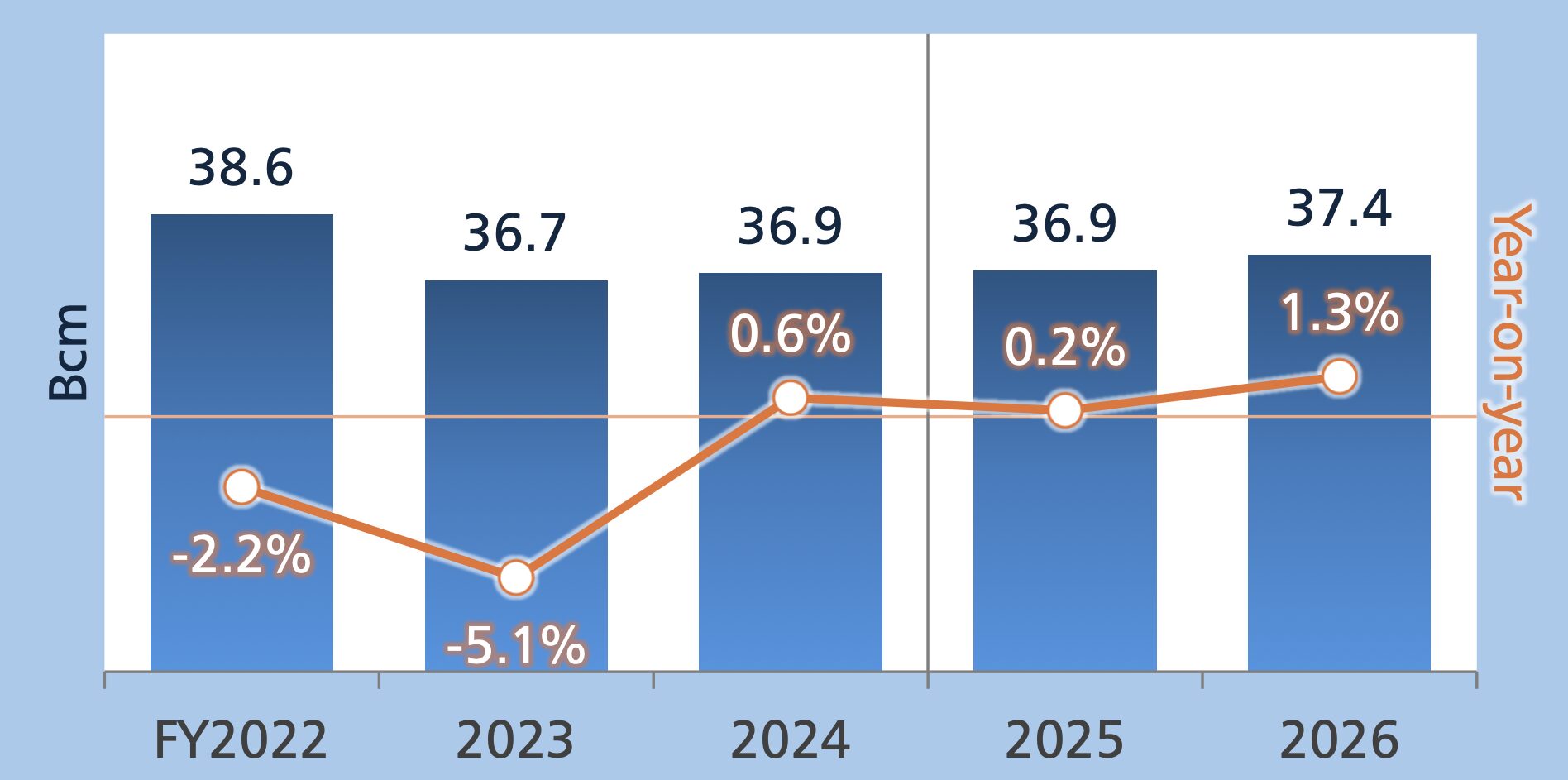

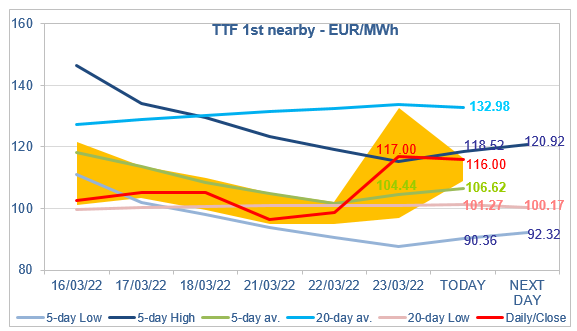

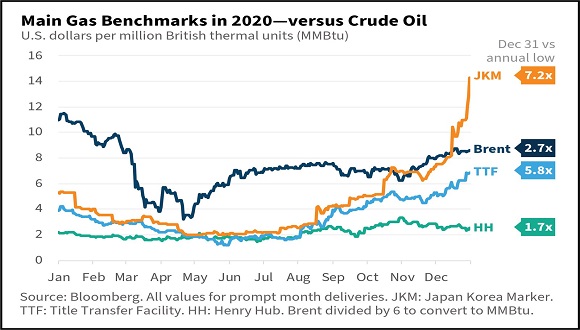

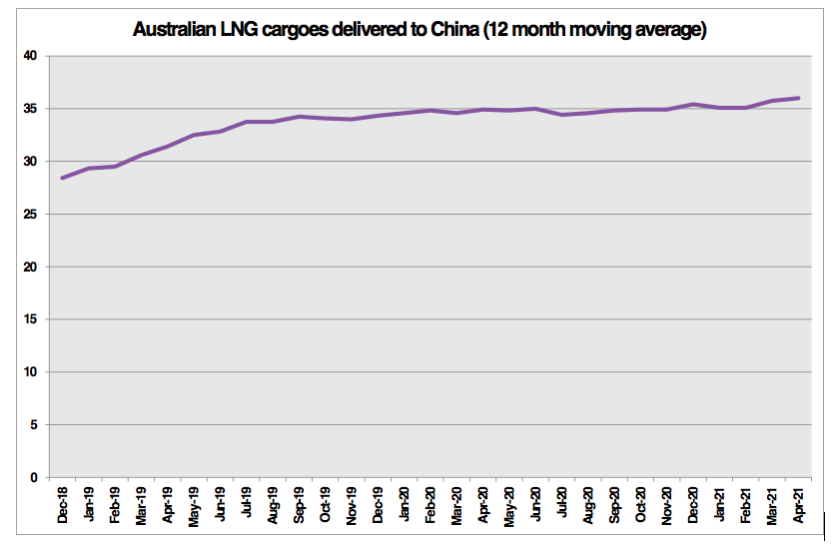

A tight LNG market pre-2015 is likely to support the value of LNG supply flexibility

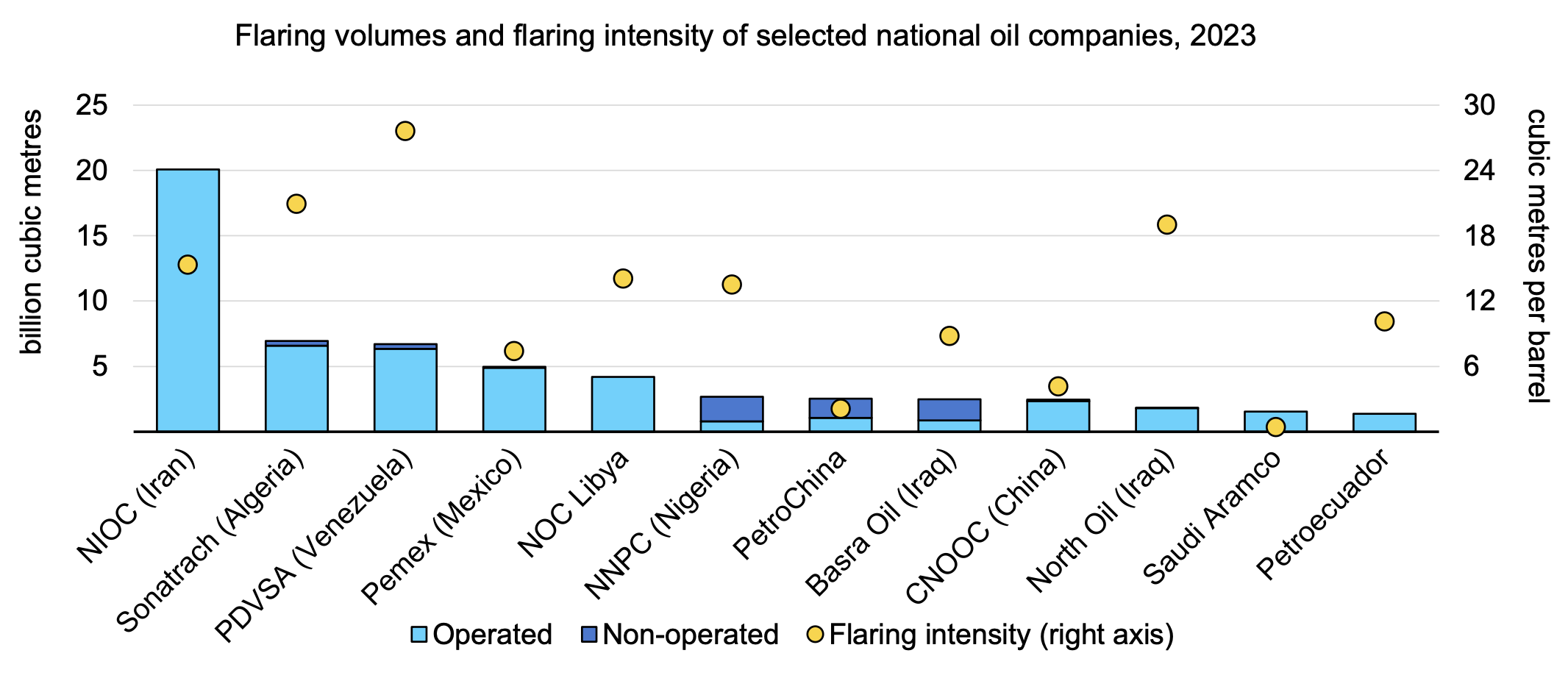

But… several factors may structurally alter the LNG market balance post 2015

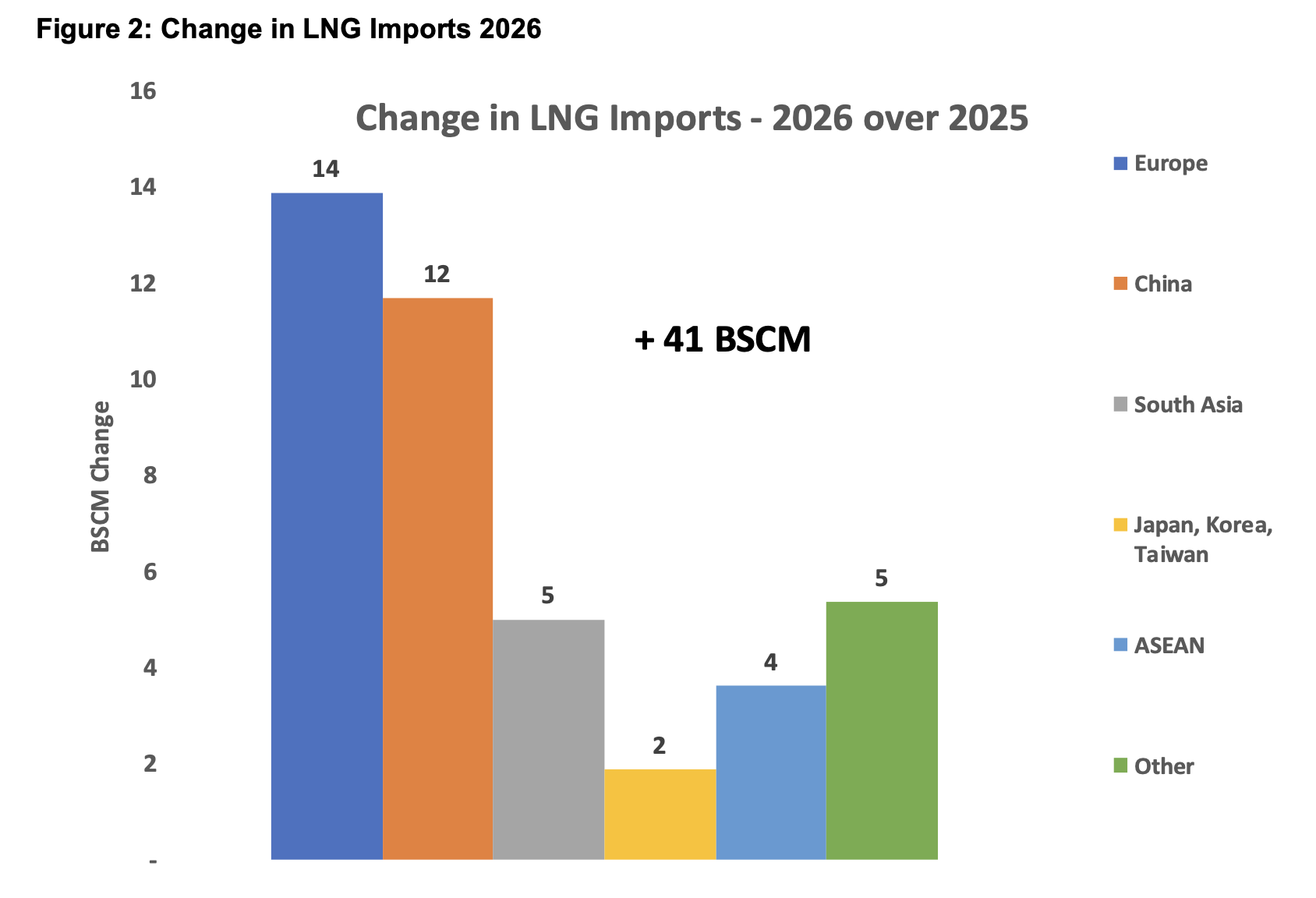

Key risk 1 → LNG supply flexibility value is eroded as price spreads and volatility fall

Key risk 2 → US exports drive an evolution in supply contract pricing and flexibility

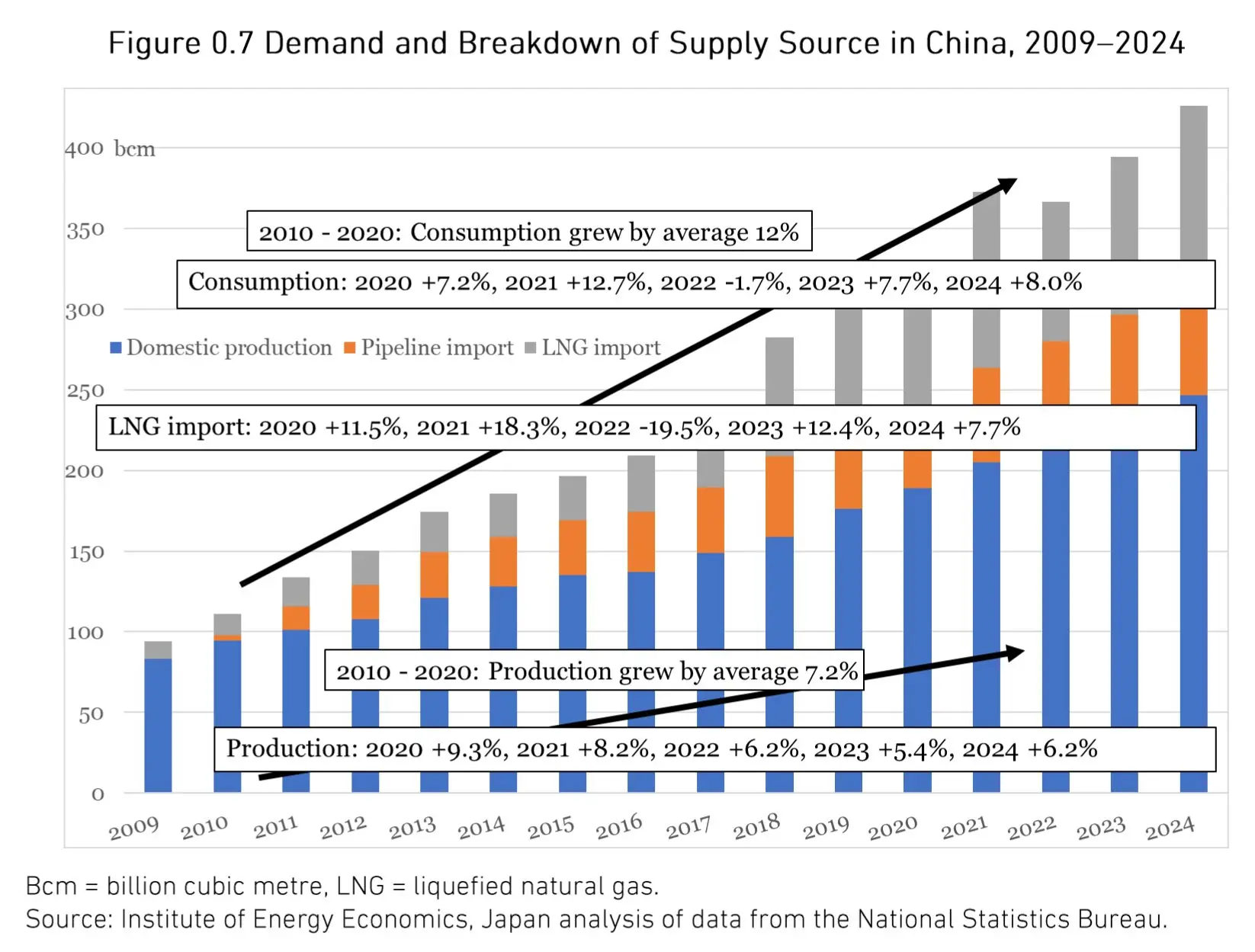

View on market evolution drives approach to monetising asset value

Opportunities exist to create value from different expectations