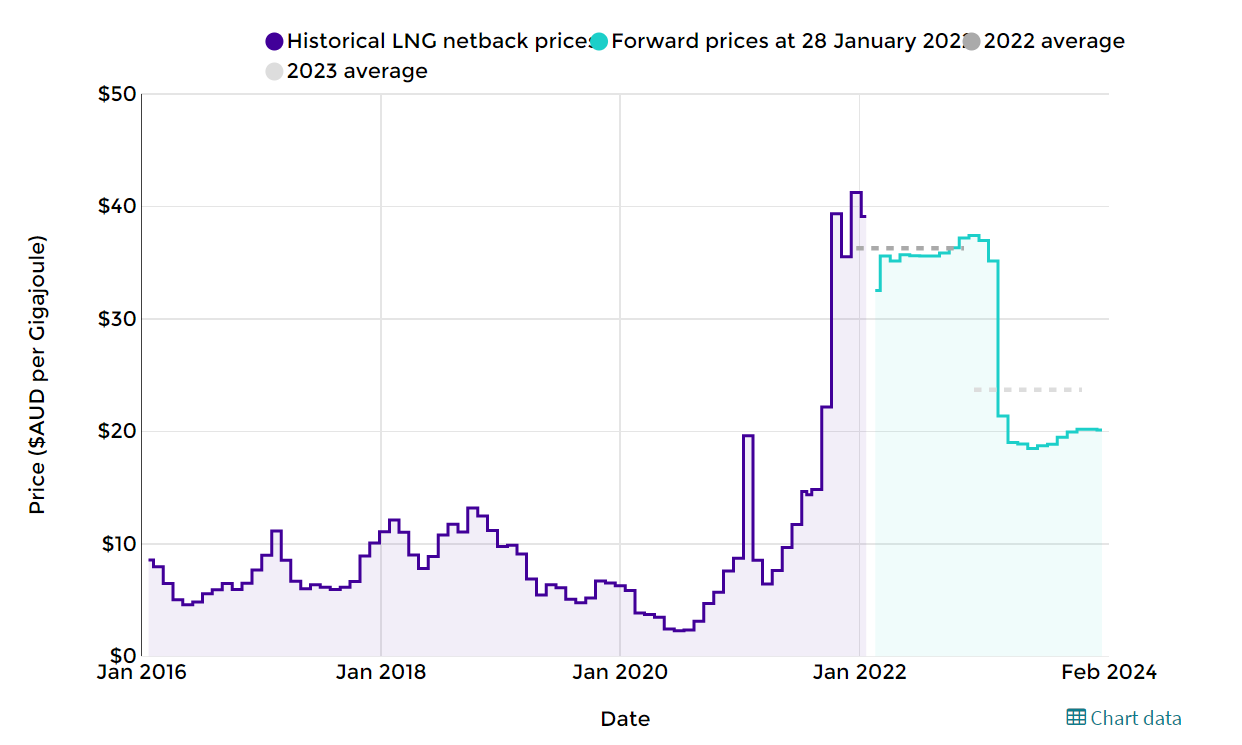

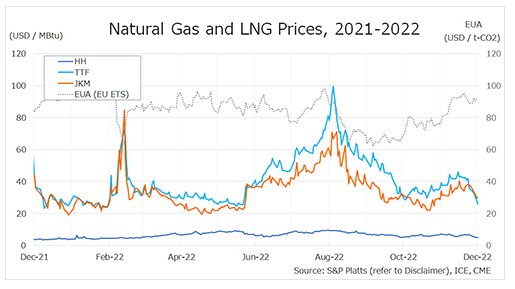

The Northeast Asian assessed spot LNG price JKM for the previous week (19 December-23 December) fell for the fifth consecutive day to USD 30/MBtu on 23 December from USD 38/MBtu the previous week due to a lull in year-end season, high LNG inventories in the Northeast Asian region, falling European gas prices, and market participants watching the potential impact of a European market correction mechanism.

According to METI, Japan’s LNG inventories for power generation totaled 2.44 million tonnes as of 18 December, down 0.24 million tonnes from the previous week and marking the lowest level in six weeks, but up 0.1 million tonnes from the end of the same month last year and up 0.6 million tonnes from the average of the past five years, indicating a steady inventory.

The European gas price TTF fell for the fifth consecutive day to USD 25.8/MBtu on 23 December from USD 35.9/MBtu the previous week, reflecting forecasts for eased cold weather in Europe, strong UK wind power generation and subdued trading ahead of the holiday season, as well as progress in FSRU deployment in Germany.

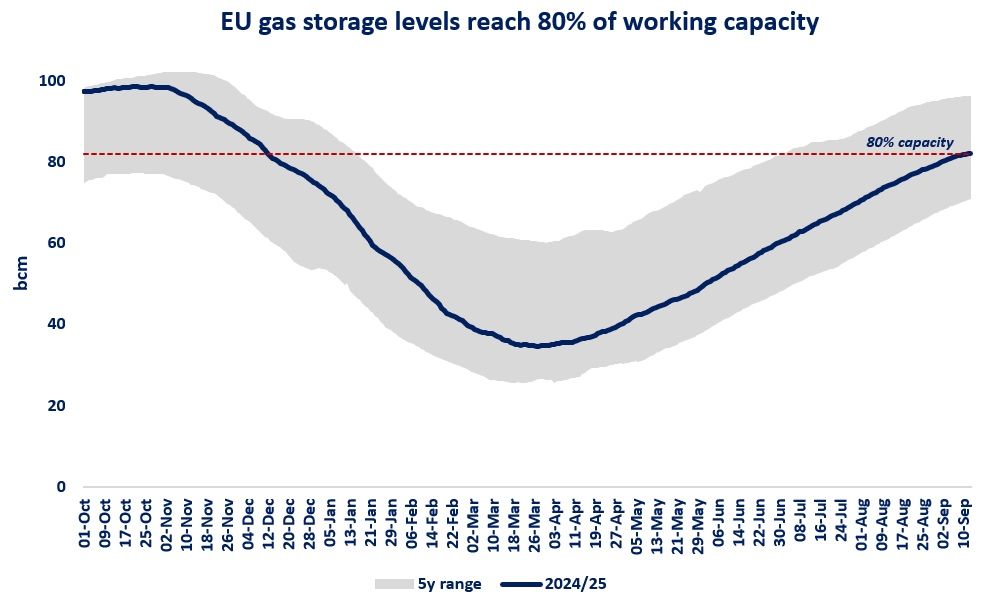

On 19 December, European energy ministers agreed to set a gas price ceiling at 180 euros/MWh (about USD 56/MBtu). According to AGSI+, EU average underground gas storage peaked at 95.6% on 13 November and began to decline, falling to 82.9% as of 23 December, down 1.7% from the previous week.

The U.S. gas price HH fell for the second consecutive day to USD 5.3/MBtu on 20 December from USD 6.6/MBtu the previous week. After remaining flat at USD 5.3/MBtu on 21 December, it fell again to USD 5.0/MBtu on 22 December, but rose slightly to USD 5.1/MBtu on 23 December in response to Freeport LNG’s announcement of a rescheduling of its initial operation restart to the second half of January.

HH was bearish in response to the easing of the weather forecast, which was previously predicted extremely cold. According to the EIA Weekly Natural Gas Storage Report released on 22 December, the U.S. natural gas underground storage on 16 December was 3,325 Bcf, down 87 Bcf from the previous week, down 1.3% from the same period last year, and up 0.7% from the historical five-year average.

Updated 26 December 2022

Source: JOGMEC