Indian Gas Exchange (IGX) has recently launched its first online delivery-based gas trading platform for its customers. The new platform will allow buyers and sellers to trade spot and future contracts for imported natural gas at three physical hubs: Dahej and Hazira in Gujarat and Odoru in Andhra Pradesh.

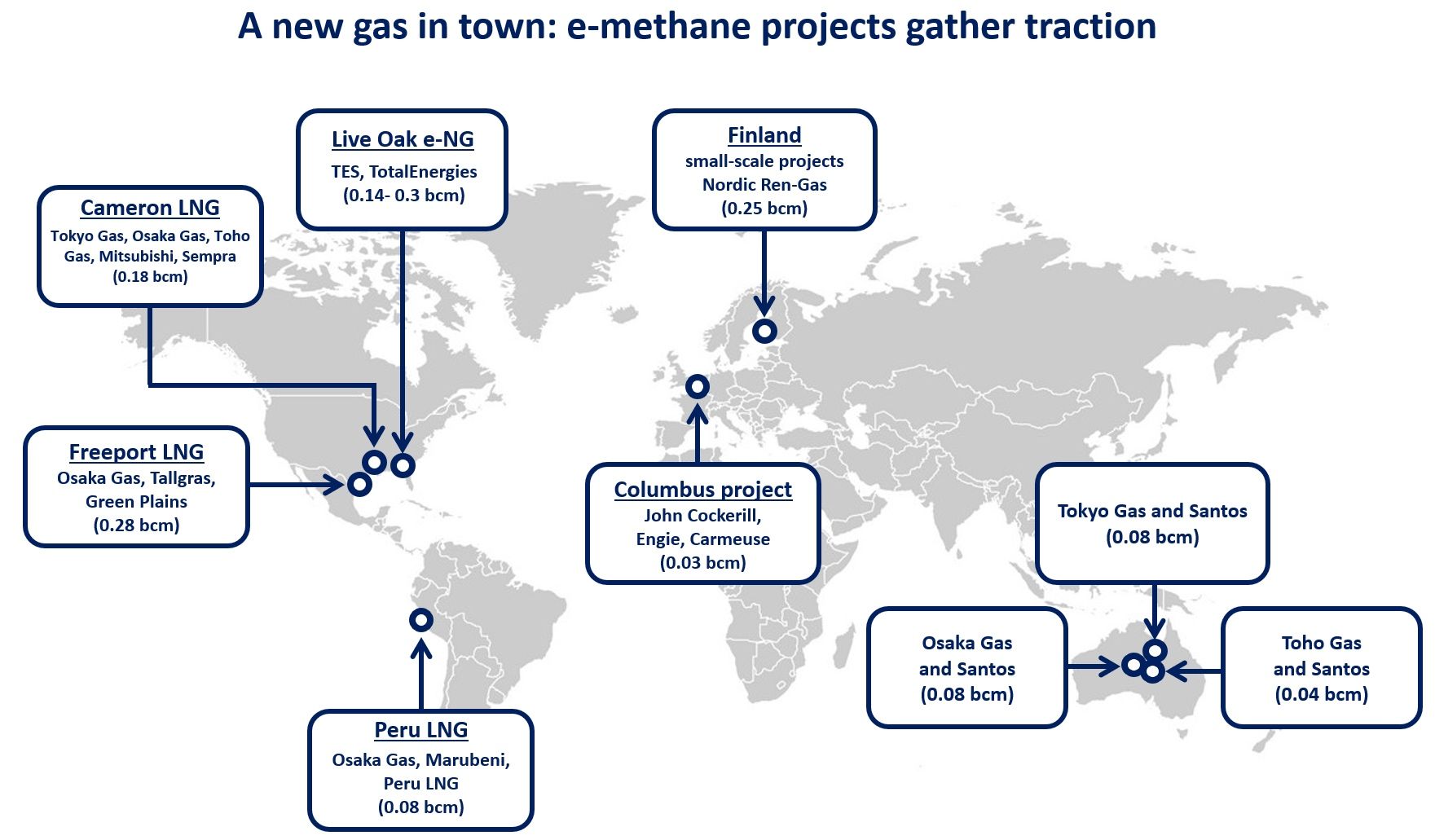

Exhibit 1 shows the existing natural gas pipelines in India as well as those under construction.

Exhibit 1: Natural Gas Pipelines in India

IGX will transform India’s gas market in several ways while increasing overall competitiveness for its natural gas markets. The online delivery-based gas trading platform will facilitate market transparency, stimulate demand, and incentivize domestic investment in the natural gas infrastructure by enabling market-based price discovery of natural gas. Further, the gas trading platform will also minimize sellers’ counterparty default risk across the cross-spectrum of industries and drive competition across the value chain, supporting overall affordability of gas and increasing its outreach.

The availability of natural gas in large quantities at a fair market price will also facilitate rapid expansion of fertilizers, gas-based power plants, pipeline infrastructure, industrial, petrochemical, and city gas distribution sectors.

Gas trading hubs are well-advanced and mature in northwest Europe and North America but have just starting in emerging markets. North American gas prices reflect gas supply-demand balances through gas-on-gas competition while European prices are linked both to oil prices and gas hub prices. European hub which started in the 2000s and can provide valuable insights for IGX’s natural gas trading platform.

The European hub experience highlights market liberalization and the transition of gas pricing to a mechanism that drives competitive markets and allows effective functioning of natural gas hubs. It also signifies the role of government regulations in providing a healthy competitive environment needed for hub development.

IGX’s move will help India in preparing to change its dominant oil indexed long-term contracts to more flexible hub (spot) indexed contracts for its LNG and pipeline gas imports. The online natural gas trading platform will also stimulate India’s energy ties with countries like the U.S. and reduce its dependency on volatile regions such as Middle East.

The recent deal between ExxonMobil and Indian Oil Corporation to deliver natural gas in containers to Indian cities outside the pipeline network is one example that demonstrates this opportunity.

In conclusion, the recent online gas trading platform from IGX is a step in the right direction that will eventually grow India’s regional demand and thereby increase its ability to bargain from a position of strength for lower gas prices. It will simultaneously drive domestic and foreign investment in natural gas infrastructure and contribute in its overall economic growth.

Source: Swati Singh and Uday Turaga, ADI Analytics