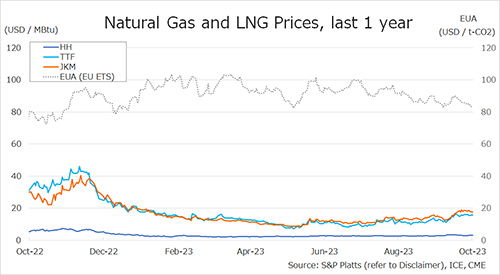

The Northeast Asian assessed spot LNG price JKM for the previous week (23 – 27 October) fell to late USD 17s by 27 October from late USD 18s the previous week on the back of healthy inventories, weak demand and stable supply, although geopolitical risks, including the escalating conflict between Israel and Hamas, remain.

METI announced on 25 October that Japan’s LNG inventories for power generation totaled 2.23 million tonnes as of 22 October, up 0.08 million tonnes from the previous week.

The European gas price TTF fell to USD 15.6/MBtu on 27 October from USD 15.9/MBtu the previous week.

Although there were some ups and downs during the week due to the escalating conflict in the Middle East and pipeline damage in Northern Europe, fundamentals were stable due to high inventories and relatively warm weather.

According to AGSI+, the European underground gas storage rate as of 27 October was 98.8%, up from 98.3% the previous week.

The U.S. gas price HH rose to USD 3.2/MBtu on 27 October from USD 2.9/MBtu the previous week.

According to the EIA Weekly Natural Gas Storage Report released on 26 October, the U.S. natural gas underground storage on 20 October was 3,700 Bcf, up 74 Bcf from the previous week, up 9.2% from the same period last year, and up 5.2% from the average of the past five years.

Updated: October 30

Source: JOGMEC