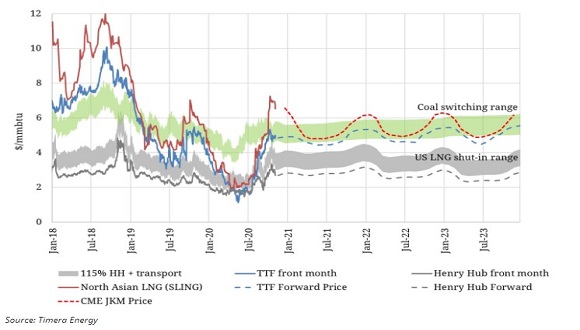

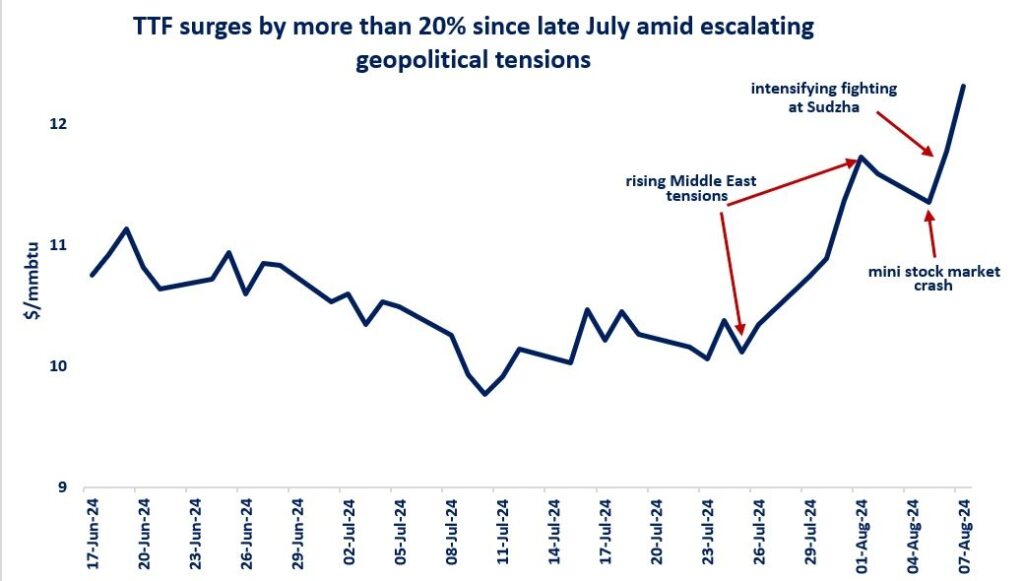

TTF prices surged by more than 20% since late July to over $12/mmbtu – their highest level since early December last year.

This steep increase is not driven by tighter fundamentals but rather by escalating geopolitical tensions in the Middle East and the intensifying fighting between Russia and Ukraine.

In the Middle East, the Hezbollah attacks, the killing of Hamas chief are driving up tensions and bringing closer the prospects of a full scale war.

And while there was no impact on gas production or supply, the Middle East tensions are fuelling up the risk premium in oil and gas markets.

In addition, the fighting between Russia and Ukraine has now moved to the Kursk region, including the small town of Sudzha – which is home to the last operating gas interconnection point between Russia and Ukraine.

Sudzha flows around 40 mcm/d (or 15 bcm/y) of natural gas, primarily destined to Austria and Slovakia. TTF prices jumped by 8% since fighting erupted in the region.

Meanwhile, gas fundamentals have been actually loosening: LNG availability improved in recent weeks, China’s demand is weakening, European storage sites are 86% full, while demand continue to be depressed.

What is your view? How will geopolitics impact gas markets in the coming months? More volatility ahead?

Source: Greg MOLNAR. Join the conversation on LinkedIn