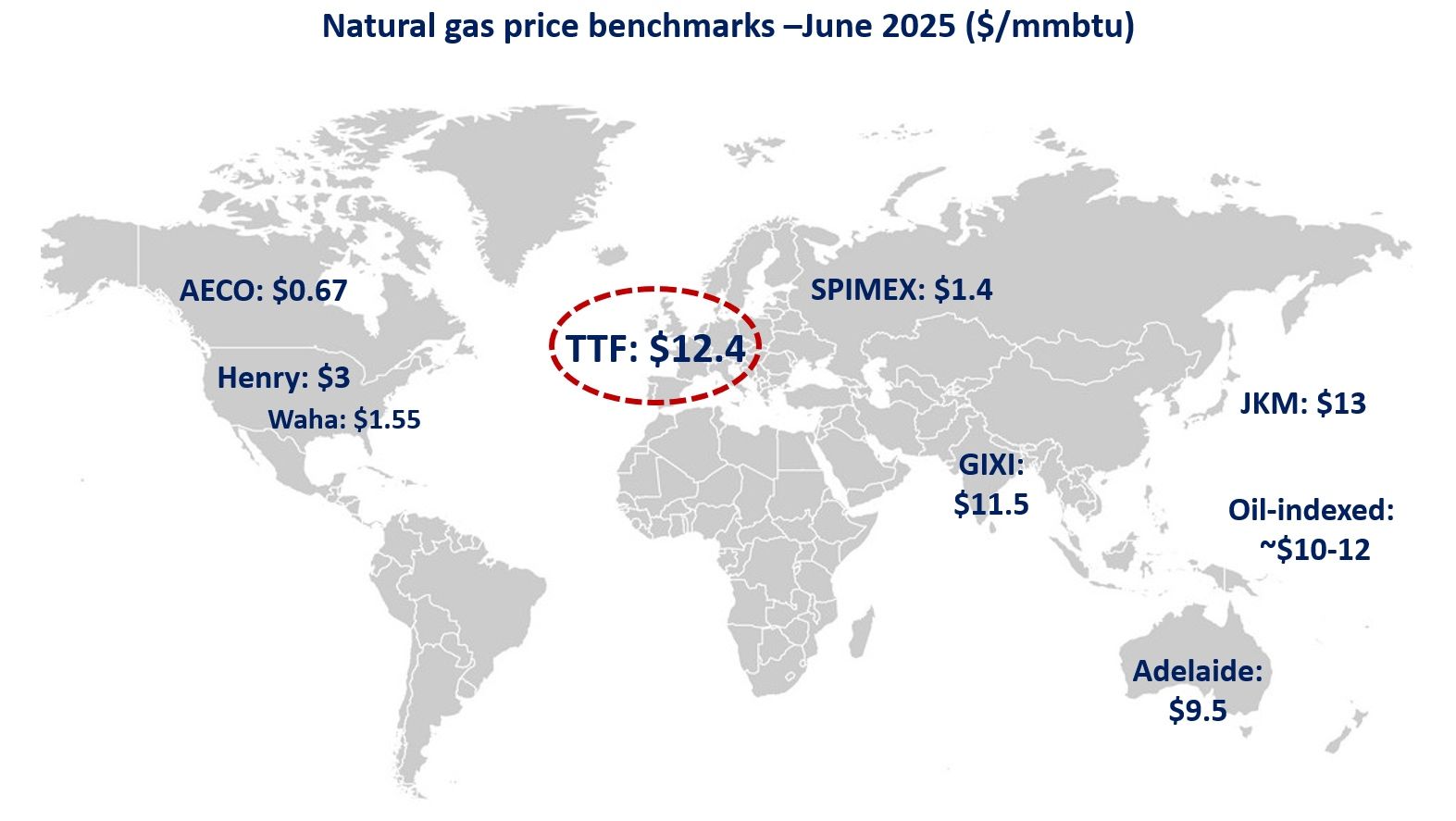

Natural gas price benchmarks moderated down from their October highs, although remaining at historic highs both in Europe and Asia amidst tight market fundamentals.

In Europe, TTF averaged at $27/mmbtu, down by over 10% compared to October when it hit over $30%. this is despite tighter market fundamentals: European demand was up by 6% yoy on colder temperatures and higher space heating demand, while Russian flows to the EU fell by close to 25% yoy. LNG inflows and Norwegian deliveries edged higher, although not enough to make up for the widening supply-demand gap, which led to an aggressive draw down from European storages, standing now below 69%.

In Asia, JKM prices remained steady at $33/mmbtu, with higher shipments to Asia providing some support to the benchmark, despite lower LNG inflows to Japan, Korea and India.

In the US, Henry stood at $5/mmbtu, down by 10% compared to its October levels. production was by 5% yoy, providing some downward pressure on prices, although demand continued to grow stronger, up by 10%.

What is your view? how will prices evolve through December? Market fundamentals are tightening further although market sentiment has been improving… any forecasts in this gassy crystal ball?

Source: Greg MOLNAR (LinkedIn)