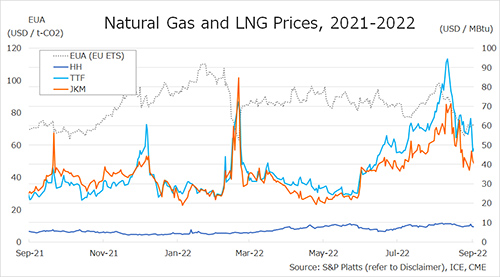

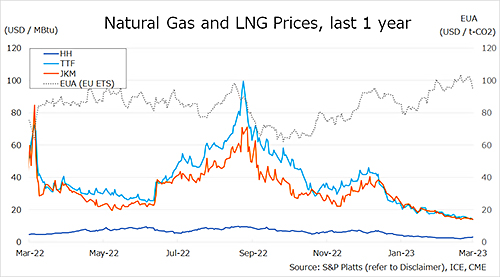

The Northeast Asian assessed spot LNG price JKM for the previous week (27 February – 3 March) fell for three consecutive business days to USD 14/MBtu on 1 March from USD 15/MBtu the previous week due to weak buying interest amid mild weather and high LNG inventories.

JKM rose to USD 15/MBtu on the next day due to Thailand PTT and other buyers’ cargo procurement but then fell to USD 14/MBtu on 3 March as low demand for prompt delivery cargoes in Japan, China, and Korea persisted.

According to METI, Japan’s LNG inventories for power generation totaled 2.40 million tonnes as of 26 February, up 0.08 million tonnes from the previous week, up 0.71 million tonnes from the end of the same month last year and up 0.47 million tonnes from the average of the past five years.

The European gas price TTF fell for two consecutive business days to USD 14.5/MBtu on 28 February from USD 15.8/MBtu the previous week due to warm weather, and high gas inventories.

TTF then rose slightly to USD 14.7/MBtu the next day but fell for two consecutive business days to USD 14.0/MBtu on 3 March due to thin liquidity and weak demand. ACER published the 3 March spot LNG assessment price for delivery in Northwest Europe at EUR 43.59/MWh (equivalent to USD 13.56/MBtu), down EUR 1.21/MWh from the previous week. According to AGSI+, the average European underground gas storage rate as of 3 March was 59.72%, down from 62.67% the previous week.

The U.S. gas price HH rose for three consecutive days to USD 2.8/MBtu on 1 March from USD 2.5/MBtu the previous week due to cold weather forecasts and bullish predictions of gas-fired power generation demand.

HH was flat on 2 March despite modest withdrawal from natural gas storage reported by EIA but then rose to USD 3.0/MBtu on 3 March due to expectations of increased heating demand by colder-than-expected weather forecast in the Northeastern and Midwest U.S.

According to the EIA Weekly Natural Gas Storage Report released on 2 March, the U.S. natural gas underground storage on 24 February was 2,114 Bcf, down 81 Bcf from the previous week, up 27.1% from the same period last year, and up 19.3% from the historical five-year average.

Updated 6 March 2023

Source: JOGMEC