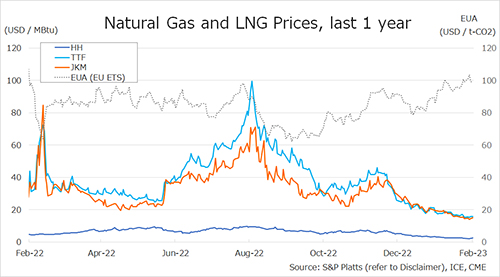

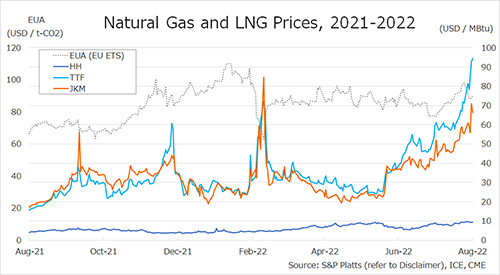

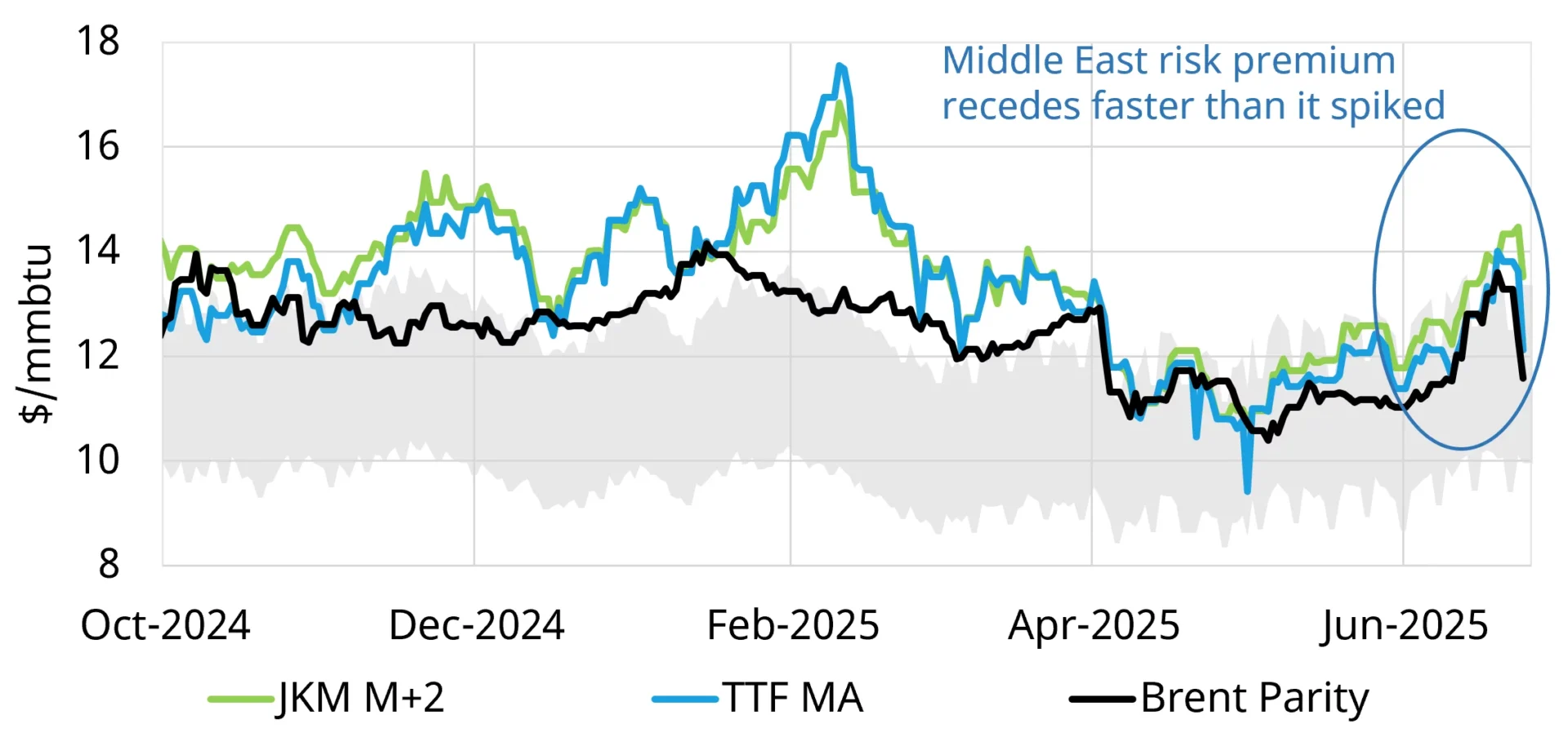

Jusqu’ici tout va bien: gas market tensions significantly moderated down in the last two months. European gas prices more than halved, while storage levels are standing 40% (or 20 bcm) above their 5y average.

So it seems that after the gas supply shock triggered by Russia, markets are calming down and we are entering a more balanced environment.

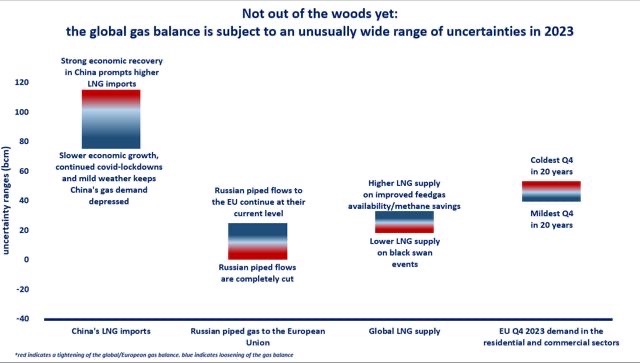

This improved outlook should not lead to overoptimistic conclusions: global gas supply is set to further tighten in 2023, while the gas balance is subject to an unusually wide range of risks and uncertainties.

Four key exogenous risks can easily renew market tensions:

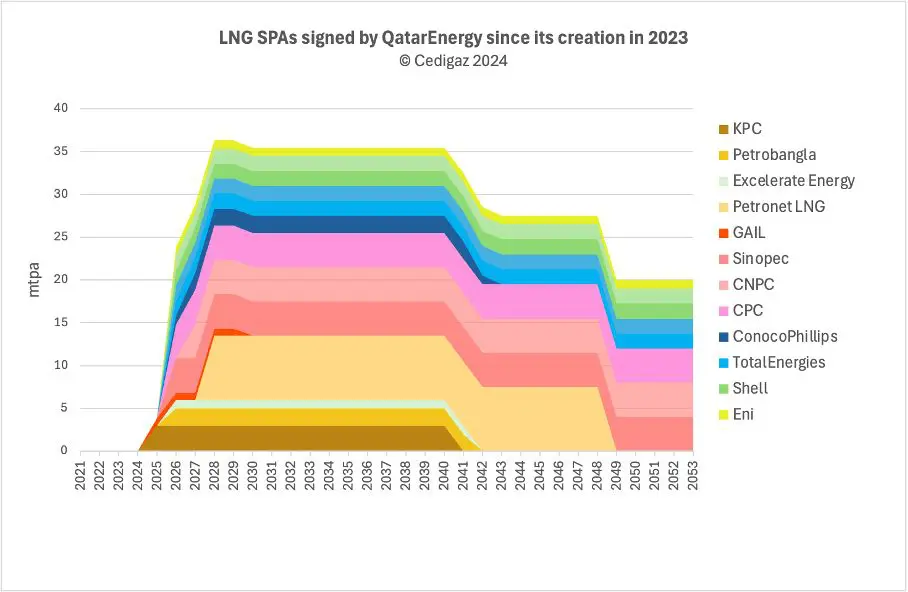

1. China’s LNG appetite returning to its historic levels -the country has around 110 bcm of contracted LNG, so it can easily ramp-back imports;

2. Russia cutting completely gas supplies to the EU;

3. Unexpected outages pushing down LNG supply: the risk of outages is especially elevated i light of postponed maintenance;

4. A cold Q4: Europe was lucky in the last 3 winters… but what if the next one turns out to be colder than usual?

In light of these risks and uncertainties, the IEA will convene tomorrow a special Gas Ministerial among key consumers and responsible producers to discuss actions needed to strengthen supply security in a structural manner.

What is your view? What are the key risks ahead 2023? how to mitigate them?

Jusqu’ici va bien is a legendary rap song from the early 2000s, the title says “so far so good”…

Source: Greg MOLNAR (LinkedIn)