Woodside Energy’s newly announced selldown in Louisiana LNG to Williams, a US pipeline operator and first-time LNG investor, makes the project a strong contender for the most complicated financing structure of the year.

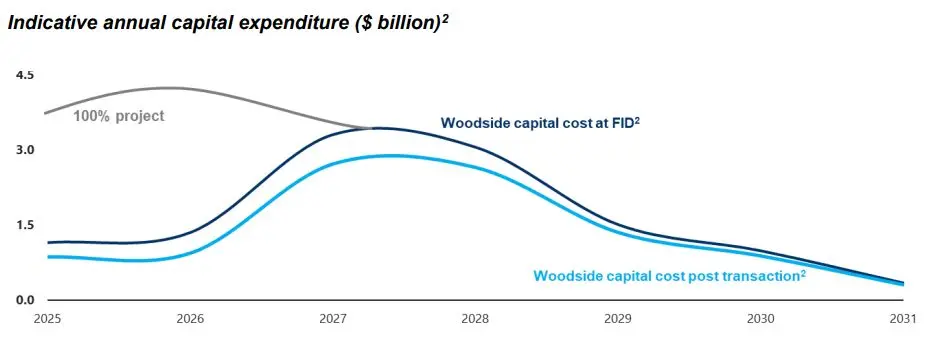

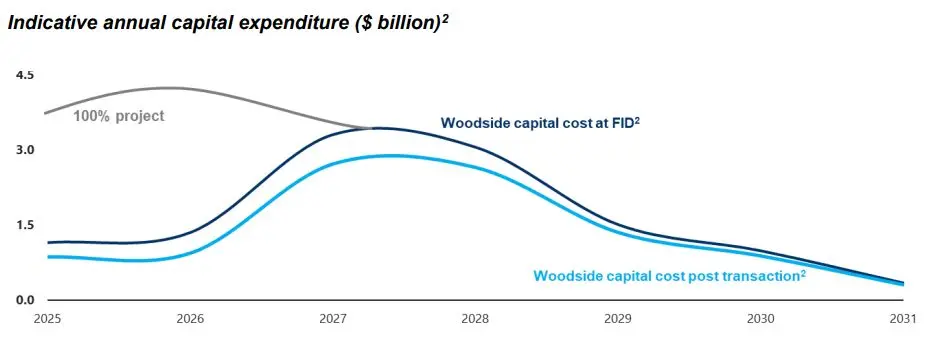

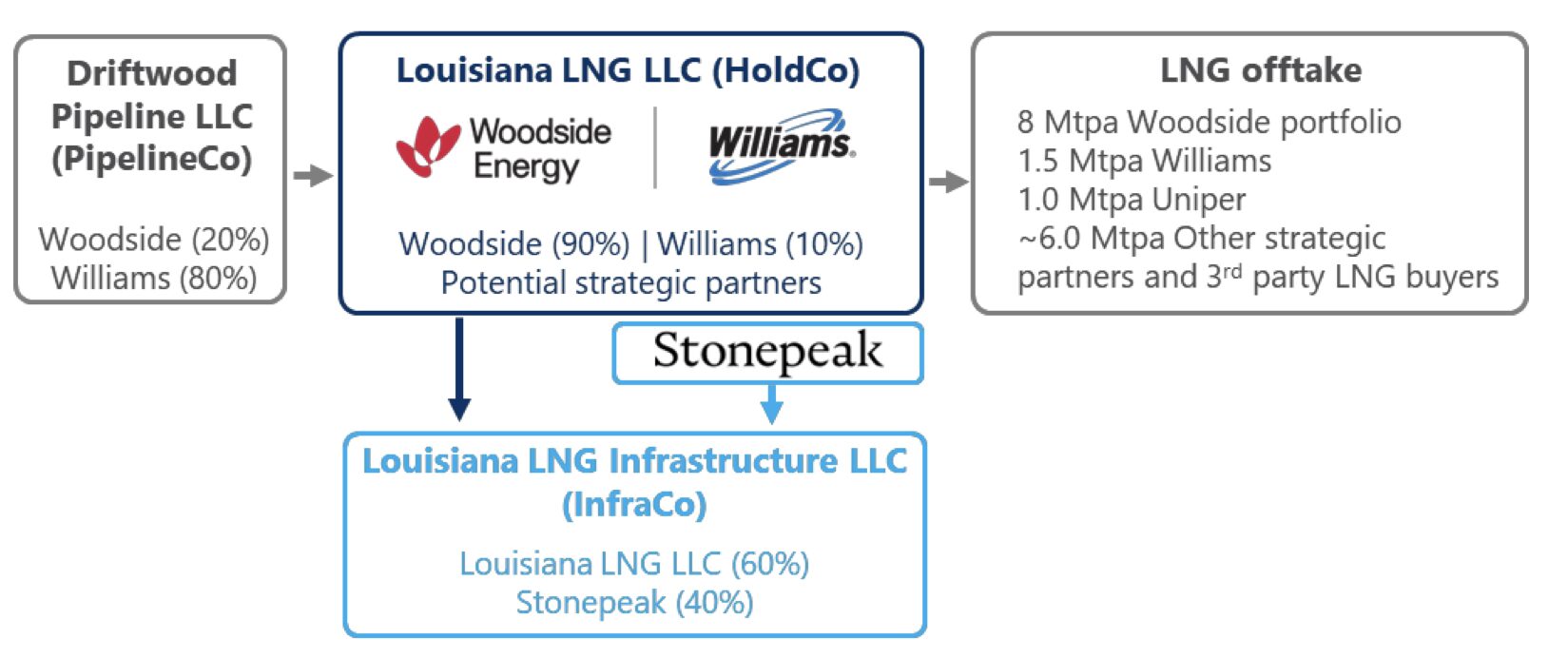

Woodside has sold down 10% in the parent company, which owns 60% of the LNG terminal, and has also sold 80% in the company developing pipelines for the terminal. So in effect, the LNG terminal ownership now looks like: Woodside (54%), Stonepeak (40%), Williams (6%).

For Woodside this releases $1.9bn in capital, and crucially relieves it from most of the front-loaded spend it was due to make on the LLNG pipelines. That works out nicely for Woodside given that oil markets are looking incredibly weak at the moment and the balance sheet was already showing signs of strain at the 1H results in August. It will now be easier to hold out until Scarborough starts up in 2026.

Outside Woodside’s savvy short-term cashflow management, what strikes me about LLNG is how complicated and precarious the whole setup seems to be. Woodside and Williams are taking on the role of commodity traders by acquiring all the feedgas from other US producers, basically paying themselves and a third partner to liquefy it, and then marketing that gas globally – largely to other gas producers and commodity traders, based on Woodside’s recent contracting activity.

Accela had a look at Louisiana’s economics earlier this month in our LNG modelling report and found its economics shaky, with little room for error in terms of lower commodity prices, execution drift and carbon abatement costs.

Although a sell down reduces Woodside’s exposure to those risks, it doesn’t make them go away.

Source: Axel Dalman, Accela Research