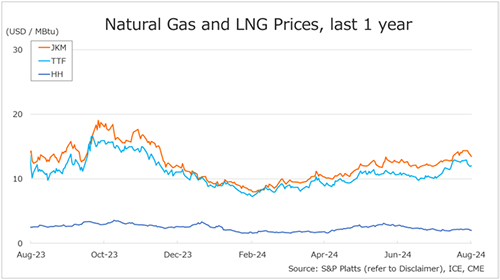

This morning, natural gas prices continued the massive rally we have seen all of July.

Gas prices squeezed to $9.75/MMBtu, a new 14 year high. This price run up from the settle of $8.73 broke through the previous high of $9.66 that came June 8th.

Prices have since pulled back after breaking through the high and have consolidated around $9.08. The fundamentals over the last couple of weeks suggested higher prices due to the excessive heat for July and low storage injections as a result, however, day over day fundamental changes were not the cause of this run up.

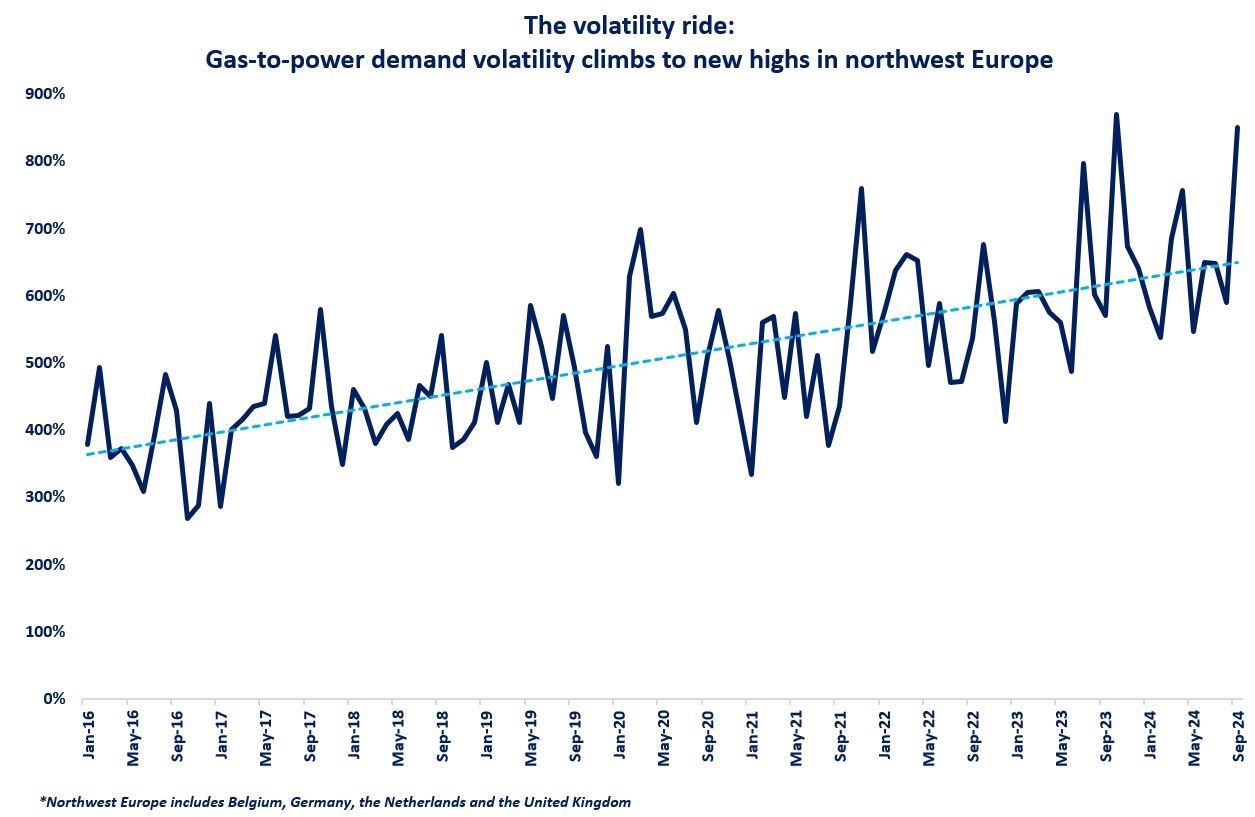

The price action seen today is largely because of the volatility seen at contract prompt month rollover. During August’s time as the prompt month, higher than normal volatility has been observed and this volatility has started to influence the September contract’s volatility as well. There is still upward price risk, but the bull’s time may be running short.

A similar market dynamic in 2007 and the first half of 2008 caused commodity prices to rise dramatically in all markets, especially natural gas.

Unprecedented oil and coal prices, tight gas supply, recessionary fears, heightened demand in new markets, and unseasonable weather conditions were amongst the factors of the strong upward price movement.

During this time, high prices did little to hamper demand, with gas demand growing 6.5% in 2007 and continuing another 4% in early 2008 on the back of a cold winter. These market dynamics have strong parallels to the elevated price action we are seeing this month, with tight supply and a continued storage deficit, the hottest forecasted seasonal temperatures on record, and heightened demand from both domestic and European markets.

Source: Gelber and Associates