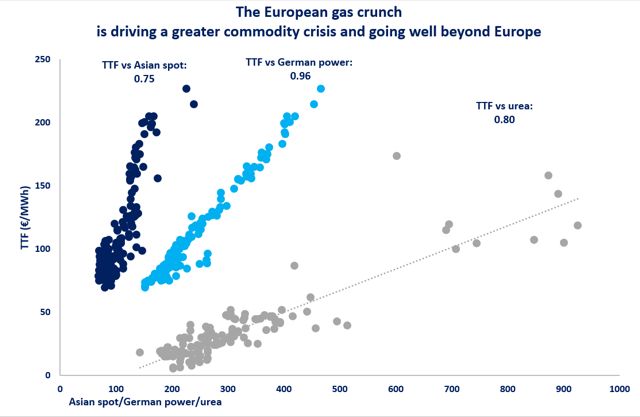

The European gas crunch is driving a greater commodity crisis, with its repercussions felt well beyond Europe.

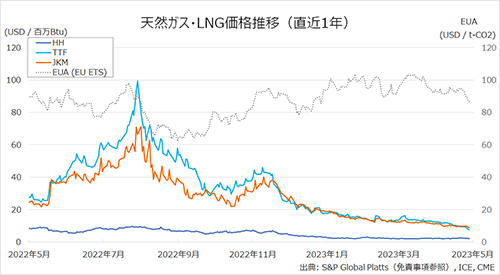

Asian spot LNG prices are trading at record highs, close to $50/mmbtu these days, on the growing competition with Europe for each and every molecule of chilled gas.

In the most price sensitive markets, this translates into growing energy poverty and acute energy supply insecurity.

And while Europe is debating on 15% gas demand cut, 12 hours power cuts have became the norm in Pakistan.

The gas crisis highlights also the intimate interplay with electricity prices in Europe: gas peakers are setting the power price in most European markets. the correlation factor between the two is just over 0.95.

And while this fuels an interesting intellectual debate on market design (with no magic solutions), winter is coming and many vulnerable households will suffer from the combined effect of rising gas, electricity prices and raging inflation.

The gas crisis also exacerbates the food supply crisis: over 10 fertilizer plants curtailed or stopped production in the EU by July 2022, further weighing on an already fragilized food supply system. gas accounts for around 80% of urea’s production costs.

Europe suffers a major gas supply shock, with Russia cutting its gas deliveries to the European Union by over 30 bcm yoy since the beginning of the year.

To put this into perspective, this is a several times greater shock than the one caused by the Fukushima disaster back in 2011, and goes well beyond gas and Europe.

As such, a broader policy response will be required: focusing on gas or energy won’t be sufficient.

And a closer dialogue between consumers and responsible energy producers will be needed more than ever.

Without a coordinated and timely response the global economy and livelihoods will inevitably suffer.

What is your view? what are the other implications of the current gas crisis? and what policy responses should be considered?

Source: Greg Molnar (LinkedIn)