The LNG market and its participants are under acute stress. Portfolios have been buffeted by extreme price volatility, poor market liquidity and soaring collateral requirements. To say these conditions are unprecedented understates the impact of current market stress.

In Chinese the word “crisis” is composed of two characters: one represents danger, the other opportunity. The danger side of the equation is readily apparent. But this is balanced by opportunities including a new supply wave, rapid regas expansion & a surge in contracting activity.

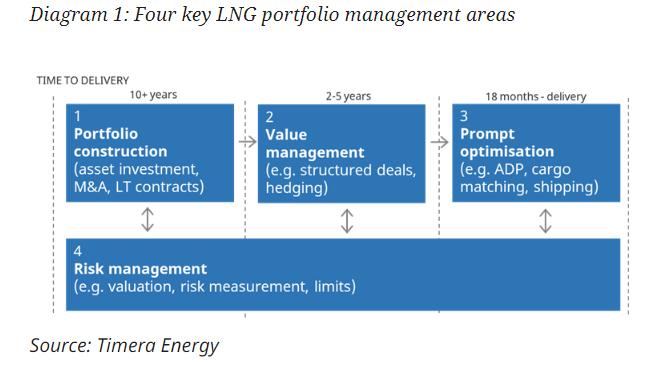

In this article we look at both the danger & opportunity impacts of current market stress on LNG portfolios. We do this by considering each of 4 key areas of LNG portfolio management set out in Diagram 1.

Portfolio construction is everything in a market where liquidity has evaporated. There are two key catalysts currently driving structural changes in LNG portfolios:

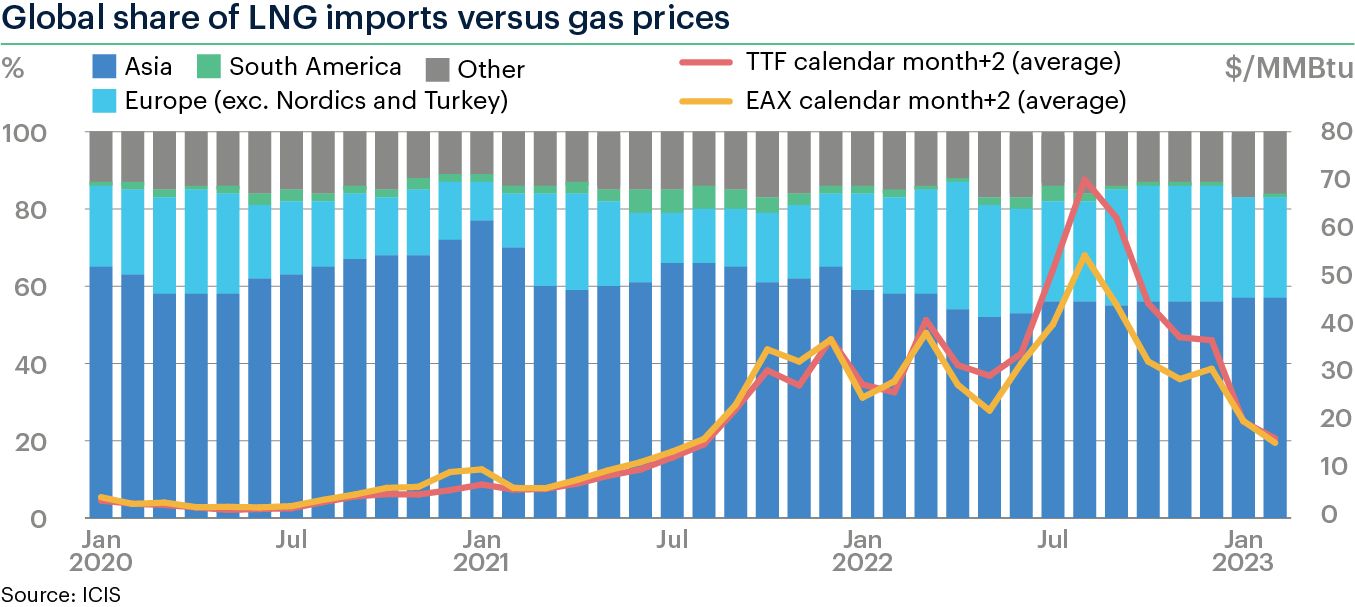

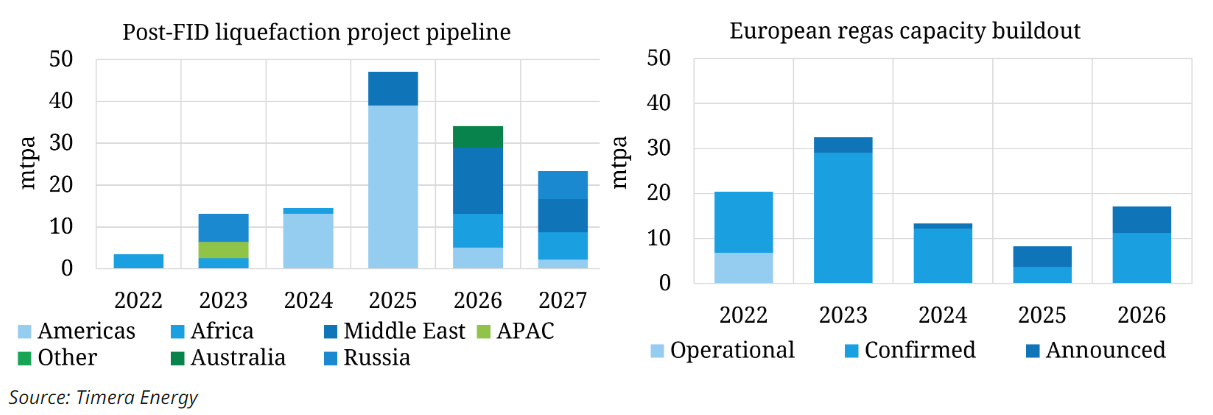

Two key areas of portfolio focus are investment in new supply and European regas capacity as summarised in Chart 1.

Chart 1: Post-FID LNG supply (LH panel) & incremental European regas capacity (RH panel)

Long term price signals for new supply have never been sharper. This has accelerated the FID of more advanced stage liquefaction projects. It is also creating strong tailwinds for earlier stage projects.

New supply is focused on the US, but incremental supply from other sources that have historically been considered too expensive is also looking likely (e.g. Canada, Australia).

Investment in new supply is driving a surge in long term contract activity as portfolio players & regional buyers integrate volumes into their portfolios. Current market conditions mean there is a strong focus on pricing & flexibility terms. This has benefited US contracting activity given a lower Henry Hub cost basis and high flexibility (vs e.g. Qatari offtake, which remains somewhat inflexible and is being offered at a high Brent slope).

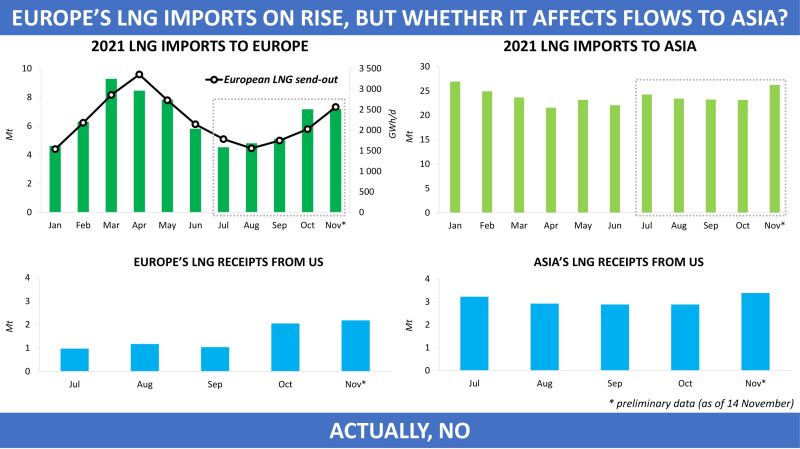

From a European buyer perspective there is a strong focus on back-filling Russian pipeline supply with LNG and ensuring adequate regas capacity to flow this into domestic markets. Committing to long term LNG supply is challenging for European buyers against a backdrop of decarbonisation. This is creating opportunities for LNG portfolio players to ‘bridge the gap’ with more flexible supply terms.

There is strong demand for long term contracts from Asian buyers to reduce portfolio exposure to volatile spot prices, particularly from China.

This frenzy of new supply activity raises a key question: could boom swing to bust in the later 2020s? The world is myopically focused on supply shortages due to Russian supply cuts. But even a partial recovery in Russian exports across the next 5 years (by pipeline or new liquefaction capacity) could tip the market into oversupply later this decade. The risks associated with this are mitigated via effective portfolio construction.

Managing LNG portfolio value depends on an ability to transact in the market. This has been severely hampered in 2022 by extreme collateral & margin requirements. Margin calls of hundreds of millions or even billions of pounds are beyond the funding capacity of many LNG companies (and have created major issues for even the largest players).

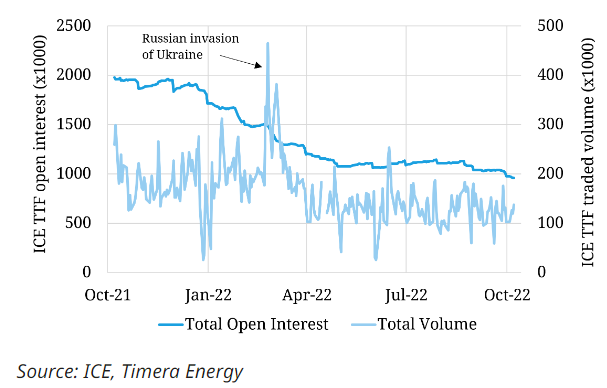

These conditions have driven a pronounced decline in liquidity across the European gas market & regional LNG markets. The fall in traded volumes and open interest since Q4 2021 for ICE’s TTF futures contract is illustrated in Chart 2.

Chart 2: TTF open interest and traded volumes

As always, markets are innovating to address these funding issues. There has been significant growth in bank & hedge fund backed funding mechanisms. For example ‘liquidity swaps’ and spot cargo deals as companies unwind positions ahead of delivery to reduce exchange margin costs.

However this innovation cannot counteract the surge in capital requirements to support business as usual activity and the credit capacity of financial institutions has hit constraints. Balance sheet capacity is under acute pressure and in some cases governments are having to step in to backstop large players (e.g. Uniper, EDF, Axpo).

A decline in liquidity of futures and physical structured deals is causing LNG companies to focus on monetising value in other ways. Market conditions have materially increased the importance of own portfolio optimisation, exercising flexibility with counterparties & re-negotiating contracts.

The new market regime favours players with robust balance sheets, well structured portfolio flexibility and strong portfolio optimisation capabilities.

The importance of near term optimisation of LNG portfolios is being underpinned by (i) poor liquidity and (ii) extreme price volatility.

The value of a cargo has increased more than 10x across the last two years. This value uplift combined with extreme volatility has substantially ‘upped the stakes’ associated with individual optimisation decisions. Tens of millions of dollars can be made in a single optimisation trade. Mistakes in lining up the different ‘legs’ of a trade can cause losses of the same magnitude.

High prices provide very sharp incentivises to deliver as much LNG as possible. This strongly favours oil products vs ‘boil off gas’ in vessel propulsion and aggressive management of LNG heel. Market tightness also incentivises the shortest voyage options and minimising vessel idle time.

Complex physical optimisation models underpin physical cargo schedules & vessel itineraries. These drive the dynamic management of ‘Annual Delivery Programs’ (ADPs) for portfolios as market conditions change. This is resulting in some unusual outcomes e.g. default on delivery obligations given the value of cargo diversion flexibility dwarfs contractual penalties.

Value capture opportunities in an illiquid market are enabled by effective optimisation of own portfolio flexibility. This comes down to portfolio construction but it also depends on commercial expertise, systems & data capabilities.

The renowned philosopher Mike Tyson summed up the risk management challenges of 2022 with his observation that “everyone has a plan until they get punched in the face”.

Market conditions have laid waste to many aspects of conventional market risk management across the last year. Liquidity has vanished, risk metrics (e.g. VaR) don’t work and risk models have been compromised by extreme volatility.

Previously hidden or immaterial inadequacies in risk measurement methodologies are being exposed e.g. passively managed basis risks are exploding as previously stable spread & correlations relationships break down. Historical look back pricing model calibration approaches are also struggling to adapt to a rapidly changing market.

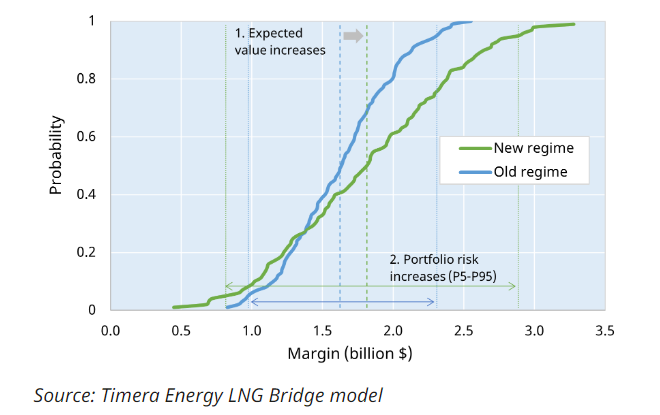

Chart 3 shows analysis we have undertaken in our LNG Bridge portfolio valuation model to quantify the scale of increase in risk for a case study LNG portfolio as a result of the recent market regime shift. See here if you are interested in more details of the portfolio & analysis behind this.

Chart 3: Impact of market regime shift on portfolio risk

LNG trading functions are having to deal with regular limit breaches, inability to hedge exposures and huge swings in mark to market value. This creates a heavy burden on both commercial and risk teams and in many cases the requirement for senior intervention to make risk management decisions in real time.

Credit risk management is the core focus of risk managers in the current market. This encompasses dynamic management of both counterparty risk and collateral & margining requirements. The acute constraint is adequate balance sheet & funding capacity to support ‘business as usual’ activity.

Looking beyond the crisis … 5 longer term implications

We finish with 5 observations on how the new regime is set to shape the LNG market.

Source: Timera Energy