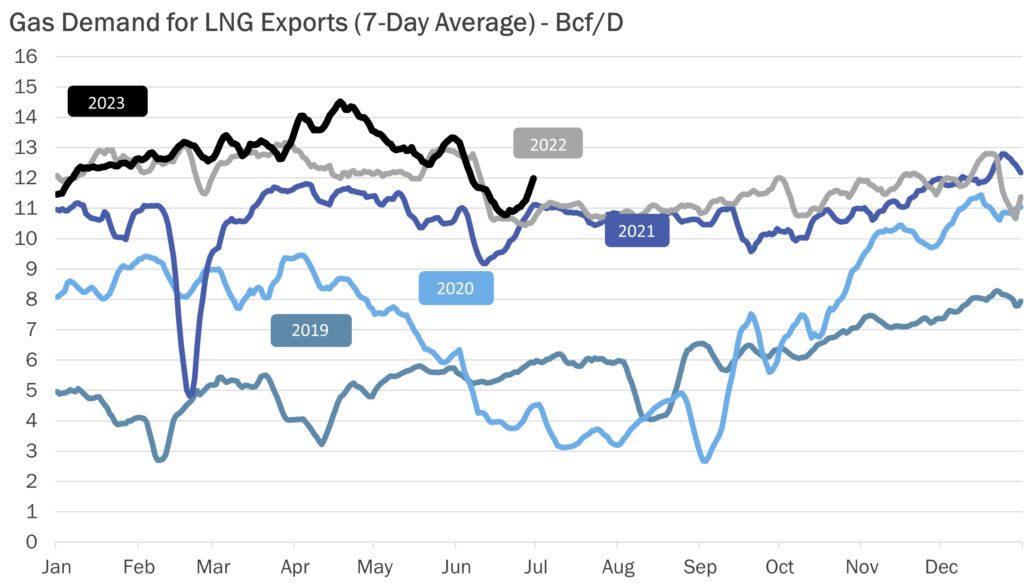

LNG remains consistently bullish for natural gas.

Today marks a one-month high for sendout flows, following an increase to 13.12 Bcf/d.

China appears to remain a consistent buyer of liquid natural gas even as the country’s fuel shortages have eased.

One-third of global long-term LNG volume this year is signed to China, making China on-trend to be the top LNG importer of any nation by the end of 2023.

A leading narrative for China’s continued demand is LNG’s lower price volatility compared to other fuel sources.

Some speculate, however, that broad influence as LNG’s largest buyer would be a powerful geopolitical lever for China as the transition away from coal continues globally.

Either way, the country’s consistent buying shows no sign of slowing.

US LNG terminals are wrapping up maintenance as they attempt to return to their 14.5 Bcf/d capacity and meet the growing demand.

Source: Gelber & Associates