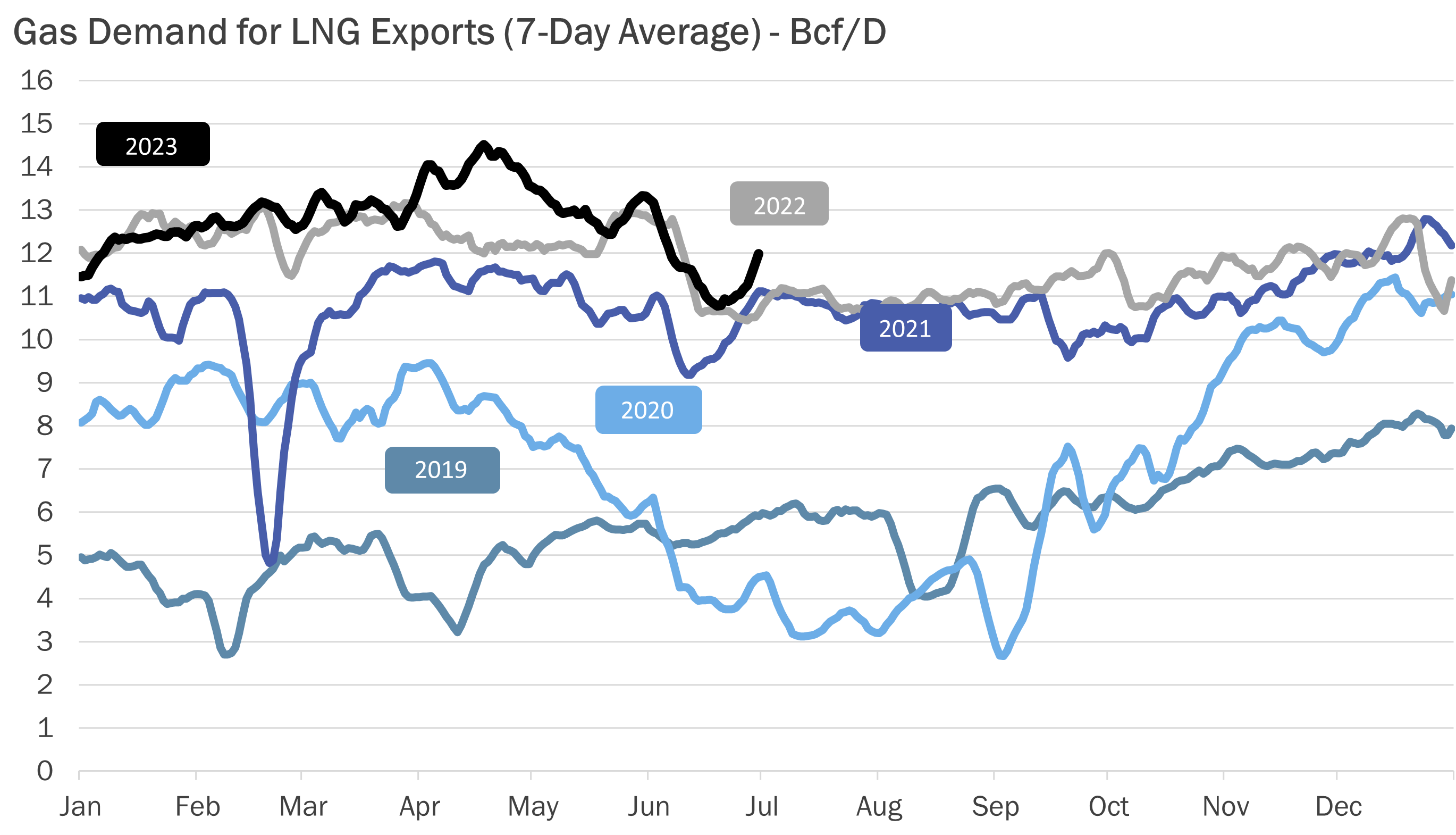

The unwinding of Japan’s LNG imports that increased since Fukushima nuclear accident will have a ripple effect throughout the global LNG market, especially in Asia.

The main impact is that the increase in demand that took place since the Fukushima accident will not be there. The government reversed its policy on nuclear and is now returning nuclear reactors to service.

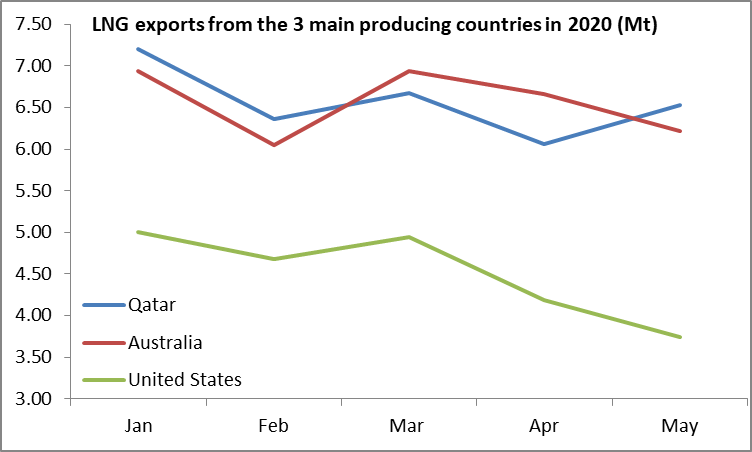

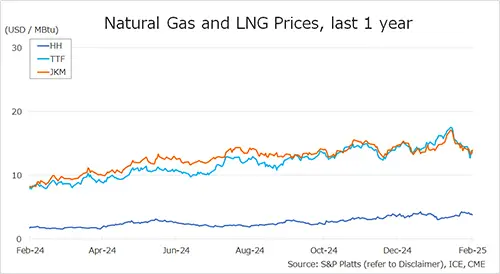

Analysts assumed that the shift to LNG after Fukushima was permanent, but now everything is being reversed. The unwinding of LNG imports will add to the global glut as LNG supplies increase from the US and Qatar and put downward pressure on LNG prices.

However, volatility will also increase as Japan’s LNG demand increases during the maintenance of nuclear power plants. Volatility will also increase when the gap between prices of contracted LNG and spot LNG increases.

Source: Anas ALHAJJI