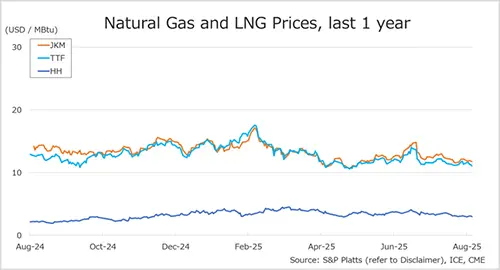

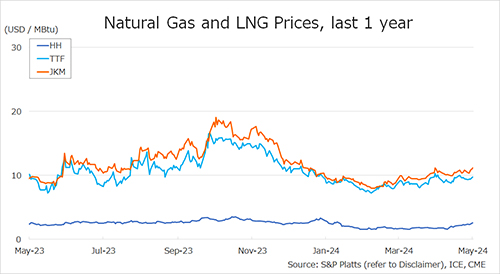

The Northeast Asian assessed spot LNG price JKM for last week (13 May – 17 May) increased to low-USD 11s on 17 May from high-USD 10s the previous weekend.

The price was a downward trend in the first half of the week due to weak demand and high inventories but rose in the latter half of the week due to the shift in delivery months from June to July, as well as supply concerns caused by troubles at Gorgon LNG, Bintulu LNG and Nigeria LNG.

METI announced on 15 May that Japan’s LNG inventories for power generation as of 12 May stood at 2.14 million tonnes, up 0.13 million tonnes from the previous week.

The European gas price TTF for last week increased to USD 9.8/MBtu on 17 May from USD 9.5/MBtu the previous weekend due to firm JKM, as well as maintenance on the Norwegian Continental Shelf which is scheduled for the following week, although fundamentals remain weak.

According to AGSI+, the EU-wide underground gas storage increased to 66.5% as of 17 May from 64.5% the previous week.

The U.S. gas price HH for this week increased to USD 2.6/MBtu on 17 May from USD 2.3/MBtu the previous weekend due to Freeport LNG feed gas supplies increased to their highest level in six months.

The EIA Weekly Natural Gas Storage Report released on 16 May showed U.S. natural gas inventories as of 10 April at 2,633 Bcf, up 70 Bcf from the previous week, up 19.0% from the same period last year, and 30.8% increase over the five-year average.

Updated: May 20

Source: JOGMEC