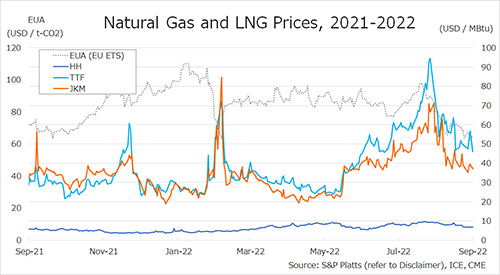

The Northeast Asian assessed spot LNG price JKM for last week (19 May – 23 May, July delivery) rose to mid-USD 12s/MBtu on 23 May from high-USD 11s/MBtu the previous weekend (16 May).

JKM rose to the high-USD 12s in the middle of the week due to a lack of progress in peace negotiations for the Ukrainian war and a shift in market focus to summer trends, but fell to the mid-USD 12s later in the week due to sluggish demand in China and India.

METI announced on 21 May that Japan’s LNG inventories for power generation as of 18 May stood at 1.98 million tonnes, up 0.04 million tonnes from the previous week.

The European gas price TTF for last week (19 May – 23 May, June delivery) rose to USD 12.1/MBtu on 23 May from USD 11.5/MBtu the previous weekend (16 May). TTF rose to low-USD 12s in the first half of the week as the market reacted bullishly to the lack of progress in peace talks between U.S. and Russia.

It then fluctuated around low-USD 12s due to unplanned maintenance at Norwegian gas production facilities. According to AGSI+, the EU-wide underground gas storage was 45.7% on 23 May, up from 44.2% the previous weekend, down 32.9% from the same period last year, and down 19.3% over the five-year average.

The U.S. gas price HH for last week (19 May – 23 May, June delivery) was almost unchanged at USD 3.3/MBtu on 23 May from USD 3.3/MBtu the previous weekend (16 May). HH fell to USD 3.1/Mbtu at the start of the week due to strong production and mild weather, but rebounded to USD 3.4/Mbtu on Tuesday as low prices encouraged buying demand, and has since traded around USD 3.3/Mbtu.

The EIA Weekly Natural Gas Storage Report released on 21 May showed U.S. natural gas inventories as of 16 May at 2,375 Bcf, up 120 Bcf from the previous week, down 12.3% from the same period last year, and 3.9% increase over the five-year average.

Updated: May 26

Source: JOGMEC