(Montel) Benchmark Asian LNG prices eased slightly over the last seven days amid weak fundamentals and easing competition with Europe for the chilled fuel.

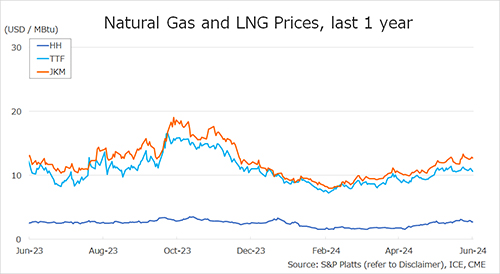

Asia’s JKM LNG benchmark front-month contract settled on Wednesday USD 0.08 lower week on week at USD 15/MMbtu (EUR 48.71/MWh) on Nymex.

Meanwhile, the more liquid February contract, which will rollover into front month next week, fell USD 0.81 over the same period to USD 14.12/MMbtu.

“Comfortable stock”

“Comfortable inventories in northeast Asian are disincentivising spot purchases,” Shruti Shah, senior LNG research specialist with LSEG in Singapore, told Montel. Japanese LNG storage held by major power utilities had also risen 12% this week, supporting “a bearish market”. Lacklustre demand was also “persuading some of the importers” to sell excess cargoes, adding more supply to the Asian market, she said.

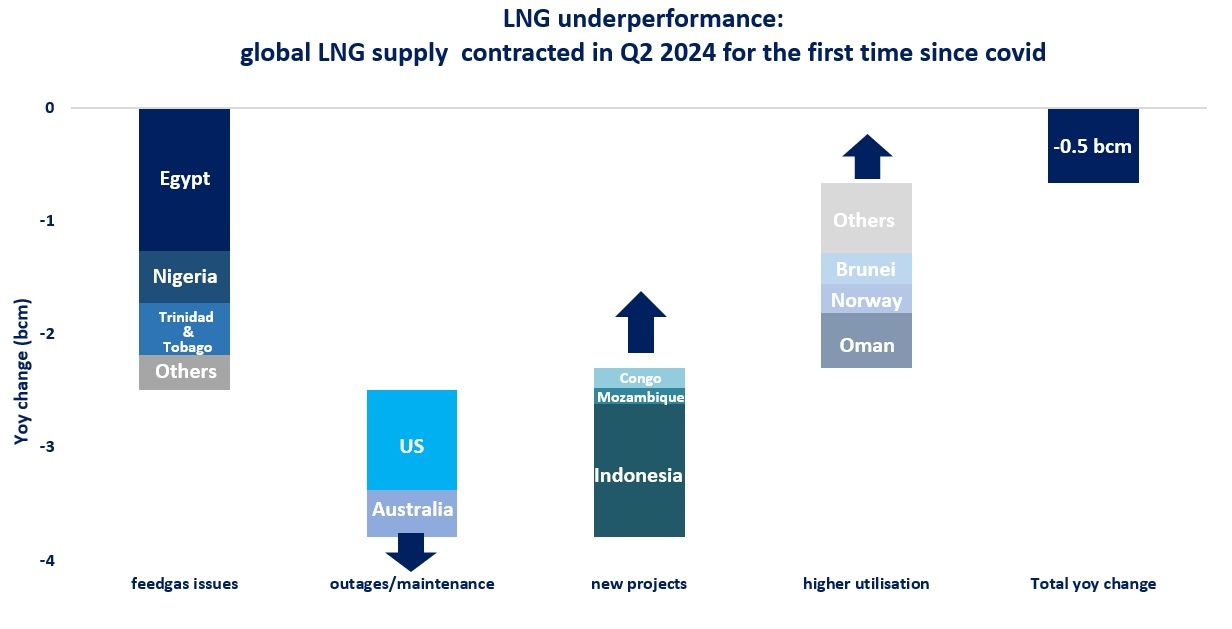

Prices came under more pressure on an improving supply picture after output recovered in a number of Pacific basin export terminals that were impacted in late November by unplanned outages, Miko Tan, LNG analyst at ship-tracking firm Vortexa, told Montel.

“Comfortable supplies in the absence of any major outages are enabling suppliers to meet pockets of spot demand in Asia despite arbitrage to Asia being closed,” said Shah.

In terms of prices, the JKM premium to Europe’s front-month gas contract on the TTF widened to more than USD 1.25, although it narrowed to around USD 0.30 for February. As such, there had been at least a couple of diversions from Europe to Asia this week, Vortexa data showed.

Potential upside?

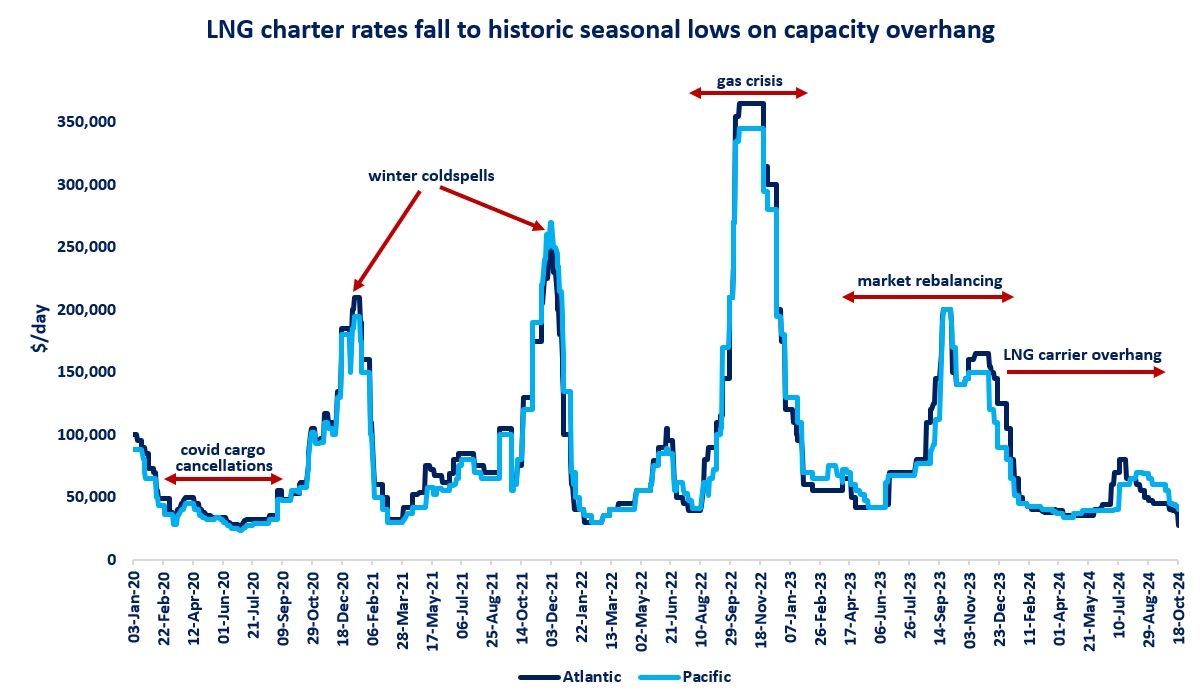

“These diversions show potential upside to January demand for Asia,” Tan said. However, when freight and other costs are included, it was more almost USD 0.40/MMbtu more profitable for a US vessel loaded in January to sell into Europe than into Asia through the Cape of Good Hope, according to Spark Commodities data.

Asian LNG imports into 14 countries were forecast to edge up to 5.6m tonnes this week, while month to date supply had increased nearly 10% month on month to 9.9m tonnes, according to preliminary Kpler ship-tracking data. But tepid demand from China, mild weather and lower industrial output were expected to curb regional demand for the time being, said market participants.

Source: Andres CALA, Montel Group