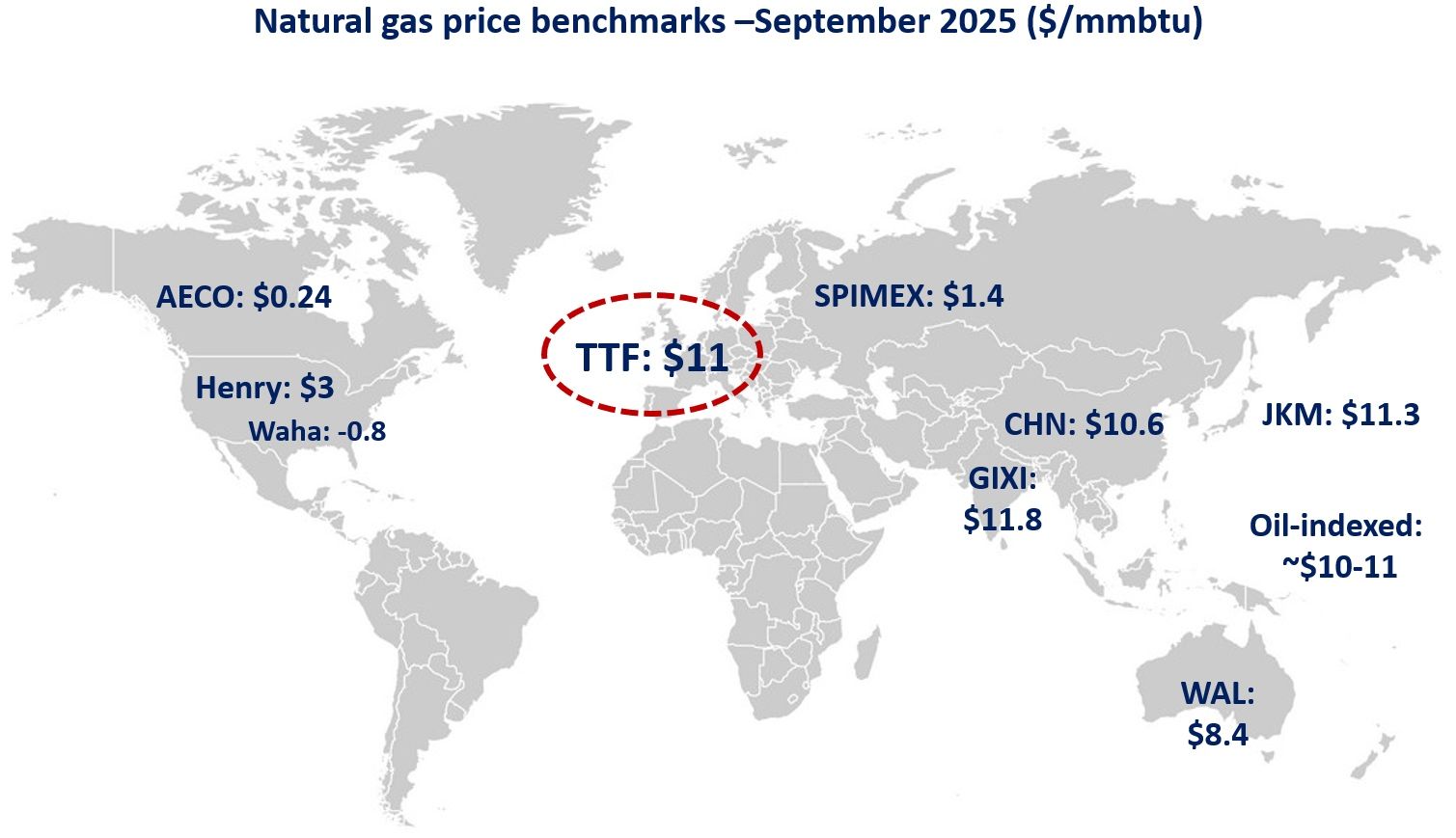

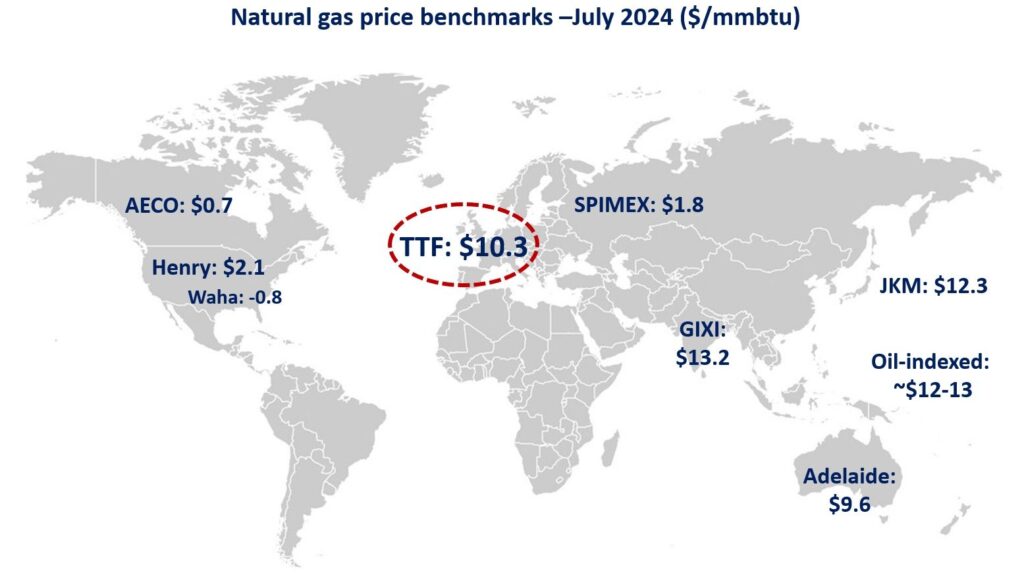

Asian and European gas prices continued to strengthen in July compared to last year’s levels, while North American benchmarks continued to be depressed by oversupply and high storage levels.

In Asia, JKM prices rose by 8% yoy to an average of just above $12/mmbtu in July -which puts them on parity with the estimated average oil-indexed LNG prices.

Strong demand growth from India (up by 40% yoy) and from certain emerging Asian markets provided upward pressure on gas prices. outage at Freeport LNG fuelled additional price volatility.

In Europe, TTF month-ahead prices rose by 7% yoy to just above $10/mmbtu amidst a more intense competition with Asia, the outage at Freeport LNG and renewed tensions in the Middle East (driving up prices towards the end of the month).

In contrast, gas prices remained depressed in North America. in the US, Henry Hub prices plummeted by 18% yoy to average at $2/mmbtu. this was mainly due to the continued strong Permian gas production. in Waha, associated gas drove down gas prices once again into negative territory to an average of -0.8/mmbtu. and similarly there is no relief for Canada’s AECO, averaging at 0.7/mmbtu amidst strong production growth and high storage levels.

Source: Greg Molnar