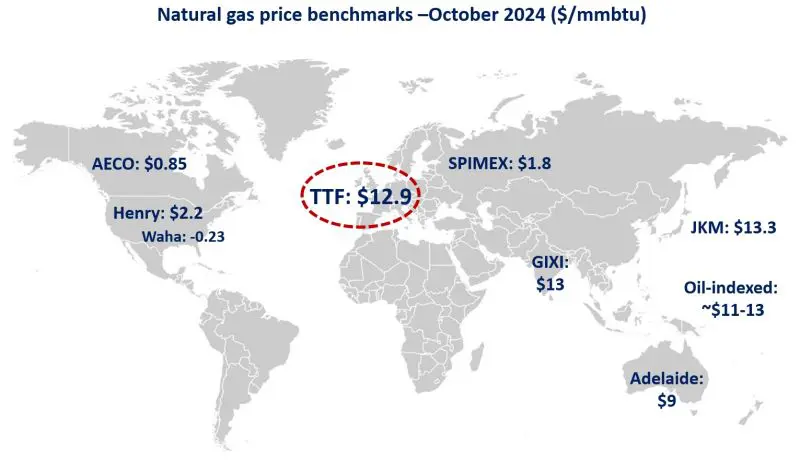

Tight fundamentals and rising geopolitical tensions kept under pressure European and Asian prices in October, while Henry in the US remains depressed amid ample gas domestic production.

In Europe, TTF month-ahead prices rose by almost 10% month-on-month to average at near $13/mmbtu.

Stronger gas demand (up by 5% yoy) together with lower LNG inflows and intensifying tensions in the Middle East provided upward pressure on TTF prices.

This being said, ample storage (95% full) and higher piped gas deliveries kept TTF prices 11% below their Oct23 levels.

In Asia, JKM prices remained broadly flat compared to Sep, and averaged at just above $13/mmbtu. strong demand from China (+20% yoy) and India (+28%) supported spot prices, while improving gas supplies from Indonesia, Malaysia moderated the pressure on gas prices.

A tighter spread with TTF could mean that Europe’s LNG inflows could regain some strength in the coming months.

In the US, Henry Hub prices averaged at $2.2/mmbtu -its lowest Oct price level since 1998. strong associated petroleum gas production in the Permian continue to depress US gas prices, while pushing further up gas-fired powgen (+5% yoy), primarily at the expense of coal-fired power plants.

Waha prices in the Permian remained below zero, amid strong production and infrastructure constraints.

What is your view? What is next for gas prices as we enter the heating season? How will the JKM-TTF spread evolve?

Source: Greg MOLNAR