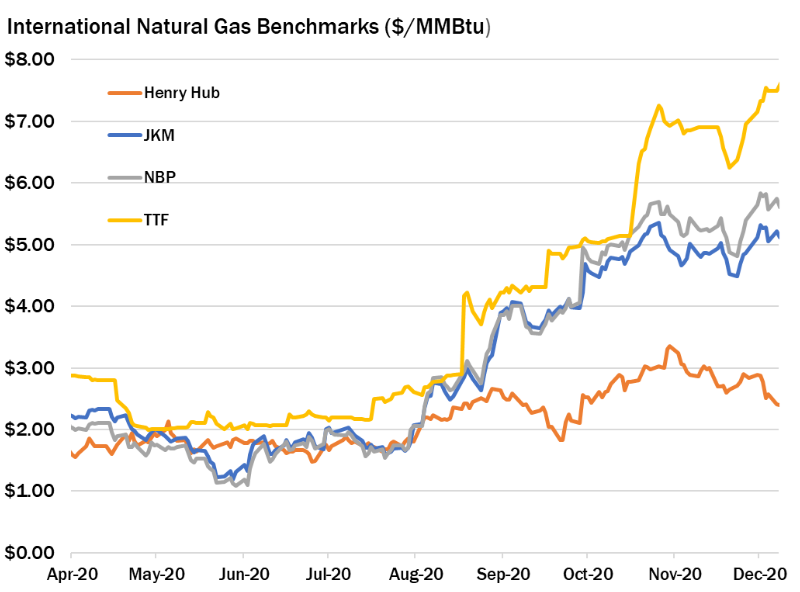

Spring break: natural gas prices moderated down significantly across all key markets in April, albeit remaining well-above last year’s levels.

In the US, Henry Hub prices fell by 15% month-on-month to an average of $3.5/mmbtu. Strong production growth (up by 4.5% yoy) together with milder weather and healthy stockbuilds provided downward pressure on gas prices, with Henry falling below the $3 mark by the end of the month.

Still, gas prices were more than double compared to last year, when Henry collapsed to $1.6/mmbtu and upstream players had to cut production.

In Europe, TTF prices dropped by 12% month-on-month to an average of $11.6/mmbtu -their lowest level since July 2024.

Lower seasonal demand together with healthy LNG supplies (up by 20% yoy) moderated down gas prices compared to March.

Still, TTF prices remained almost 30% higher compared to last year’s levels, amid stronger storage injection needs and lower Russian piped gas deliveries.

In Asia, JKM followed a similar trajectory, with prices down by 9% month-on-month to an average of $12.3/mmbtu. The single most important bearish driver is China, with the country’s LNG imports collapsing by 25% yoy.

Depressed domestic demand together with higher Russian piped gas supplies is weighing on China’s LNG appetite – with the country effectively withdrawing from the spot market, and relying on its long-term, oil-indexed LNG contracts.

What is your view? How will gas markets evolve over the shoulder season? How will storage injections play out? What is your outlook on short-term LNG supply?

Source: Greg MOLNAR