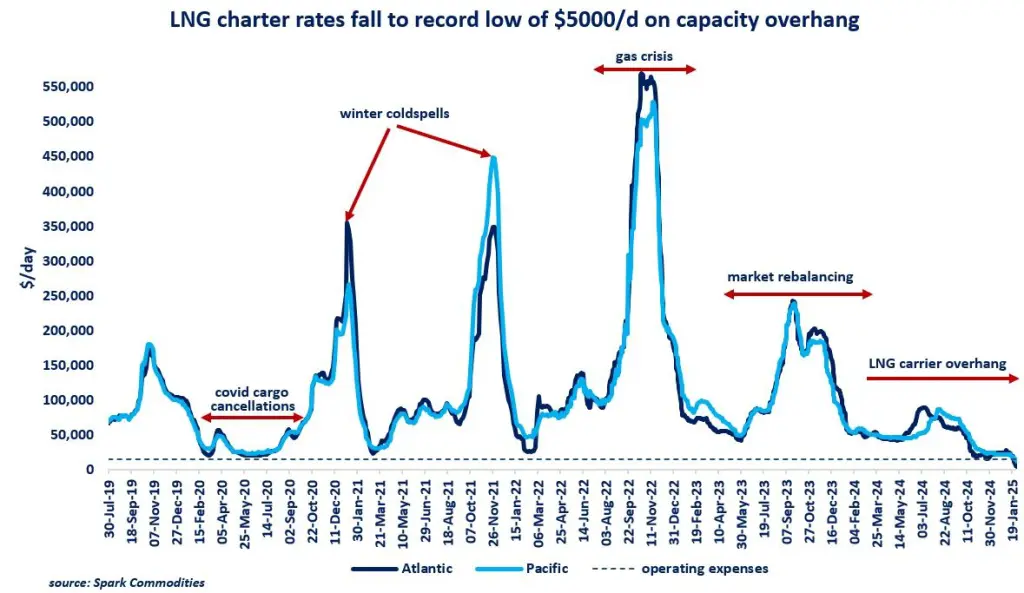

Spot LNG charter rates in the Atlantic dropped by 80% since the start of the year to a record low of $5000/day, not sufficient to cover operating expenses.

LNG charter rates have been on a steep downward trend since November 2023, falling from just over $200k/d to an average of around $50k/d in 2024 amid a massive overhang in LNG carrier capacity.

The rapid growth in the global LNG fleet, (up by 10%), outpaced the rather limited growth in LNG trade (up by 2.5%) in 2024 which put downward pressure on charter rates, despite lengthier trading routes (due to canal issues).

The capacity overhang intensified in early 2025, with new vessels hitting the water, and driving down LNG spot charter rates to a deep low of $5000/day. This compares with a 5y average of $100k/d for January charter rates. most importantly, this is well-below the operating expense of LNG vessels, which are around $15k/day.

And current forwards suggest that LNG charter rates will remain rather depressed throughout 2025, to average at just around $25k/day.

There are two key reasons for this continued depression:

(1) LNG carrier capacity growth is set to outpace incremental LNG supply once again, with a record 88 vessels expected to hit the waters in 2025;

(2) most of the incremental trade (around 80%) is expected to be concentrated in the Atlantic basin, between US-EU which leads to shorter routes (vs US-Asia).

So, these days it costs 4 times less to rent an LNG carrier than a yacht in Monaco. as a gas guy, you know what would be my choice:)

What is your view? How will the LNG shipping market evolve over the medium-term? When do you expect a rebalancing?

Source: Greg MOLNAR