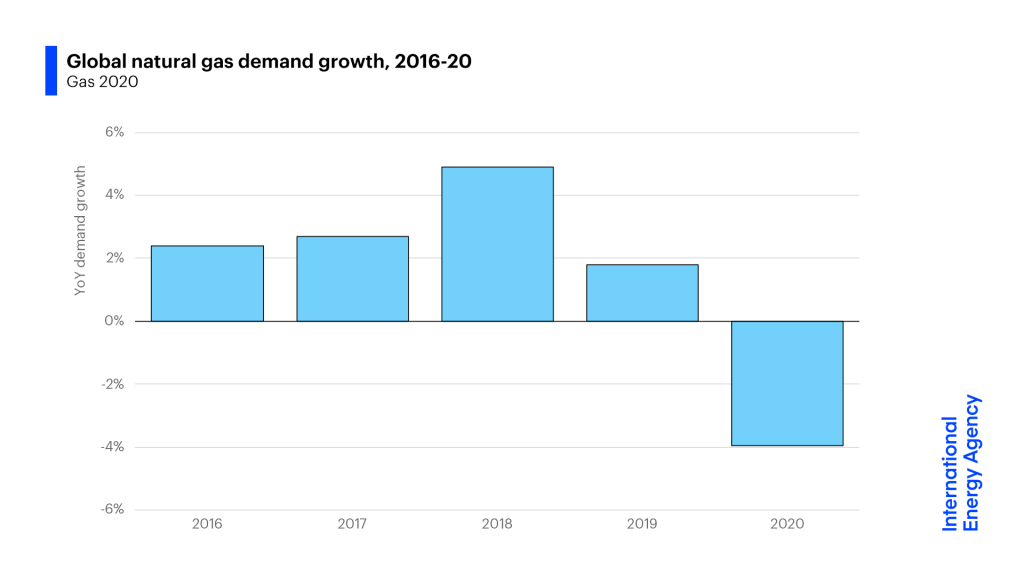

The combination of the Covid-19 crisis and an exceptionally mild winter in the northern hemisphere have put global demand for natural gas on course for its largest annual decline in history, the International Energy Agency said today in a new report. Global gas demand is expected to fall by 4%, or 150 billion cubic metres (bcm) – twice the size of the drop following the 2008 global financial crisis.

Natural gas has so far experienced a less severe impact than oil and coal, but it is far from immune from the current crisis.

As of early June, all major gas markets worldwide are experiencing falls in demand or slumps in growth, according to the IEA’s latest annual market report Gas 2020. For the full year, more mature markets across Europe, North America and Asia are forecast to see the biggest drops, accounting for 75% of the total decline in gas demand in 2020.

“Natural gas has so far experienced a less severe impact than oil and coal, but it is far from immune from the current crisis. The record decline this year represents a dramatic change of circumstances for an industry that had become used to strong increases in demand,” said Dr Fatih Birol, the IEA’s Executive Director.

Global oversupply is pushing major natural gas indices to record lows, while the oil and gas industry is cutting spending and postponing investment decisions to make up for the significant shortfall in revenue. Although a rebound is expected in 2021, the IEA report does not assume a rapid return to the pre-crisis trajectory.

“Global gas demand is expected to gradually recover in the next two years, but this does not mean it will quickly go back to business as usual,” Dr Birol said. “The Covid-19 crisis will have a lasting impact on future market developments, dampening growth rates and increasing uncertainties.”

“Global gas demand is expected to gradually recover in the next two years, but this does not mean it will quickly go back to business as usual,” Dr Birol said

After 2021, most of the increase in demand takes place in emerging Asia, led by China and India where gas benefits from strong policy support. In both countries, the industrial sector is the main source of demand growth, making it highly dependent on the pace of the recovery in domestic and export markets for industrial goods. Repercussions from the Covid-19 crisis are set to result in 75 bcm of lost annual demand by 2025, which is the same amount as the increase in global demand in 2019.

The main drivers of future supply growth – US shale and large conventional projects in the Middle East and Russia – are also under pressure from the current oil price collapse and uncertainty surrounding demand trends over the short and medium term.

Liquefied natural gas (LNG) is set to remain the main driver of the international gas trade. The wave of investment in LNG projects during 2018 and 2019 will bring additional export capacity in North America, Africa and Russia. Slower growth in global gas demand in the coming years is likely to result in capacity outpacing LNG imports through 2025, limiting the risk of a tight LNG market for the time being.

Liquefied natural gas (LNG) is set to remain the main driver of the international gas trade.

New production and infrastructure projects are likely to come online amid growth trends that are markedly below earlier expectations, reinforcing the prospect of overcapacity and low prices. This casts a shadow over future investments, which will be needed in the long term to ensure the renewal of production sources and global security of supply.

Source: IEA, Global gas Report, June 10, 2020

See the JUNE monthly GAS report by the IEA HERE