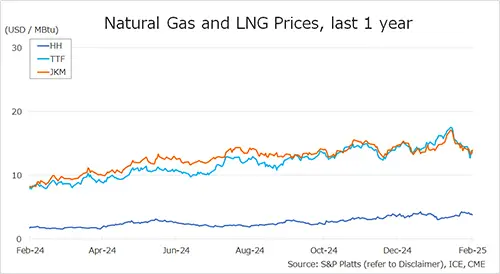

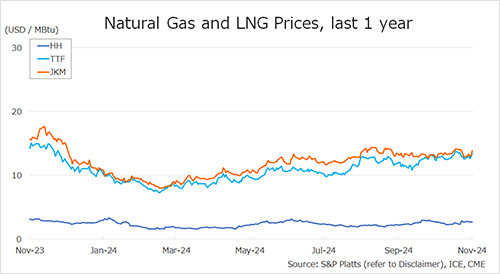

The Northeast Asian assessed spot LNG price JKM (December delivery) for last week (4 – 8 November) rose to high-USD 13s on 8 November from high-USD 12s the previous weekend (1 November). In the first half of the week, JKM rose to low-USD 13s due to a sharp decline in the previous week but temporarily fell on 6 November on the sidelines of the U.S. election.

Later in the week, the price rose to high-USD 13s due to buying interest for winter. METI announced on 6 November that Japan’s LNG inventories for power generation as of 3 November stood at 2.12 million tonnes, up 0.05 million tonnes from the previous week.

The European gas price TTF (December delivery) for last week (4 – 8 November) rose to USD 13.4/MBtu on 8 November from USD 12.5/MBtu the previous weekend (1 November). In the beginning of the week, TTF rose due to a fall in wind power output. In the middle of the week, the price fell due to the warm weather forecast, but the price rose due to a decline in the temperature forecast and a fall in renewable energy output.

According to AGSI+, the EU-wide underground gas storage was 93.8% on 8 November, down from 95.2% at the end of the previous weekend. Withdrawals from underground gas storage continued throughout the week.

The U.S. gas price HH (December delivery) for last week (4 – 8 November) remained almost unchanged at USD 2.7/MBtu on 8 November from USD 2.7/MBtu the previous weekend (1 November). With warm weather forecast, demand has not increased.

The EIA Weekly Natural Gas Storage Report released on 7 November showed U.S. natural gas inventories as of 1 November at 3,932 Bcf, up 69 Bcf from the previous week, up 4.2% from the same period last year, and 5.8% increase over the five-year average.

Updated: November 11

Source: JOGMEC