Germany’s hasty rush into the LNG market was deemed a success story in its initial phase. The speed at which the country managed to build LNG infrastructure and secure supplies to replace dwindling Russian gas supply was coined as new ‘Deutschland-Tempo’.

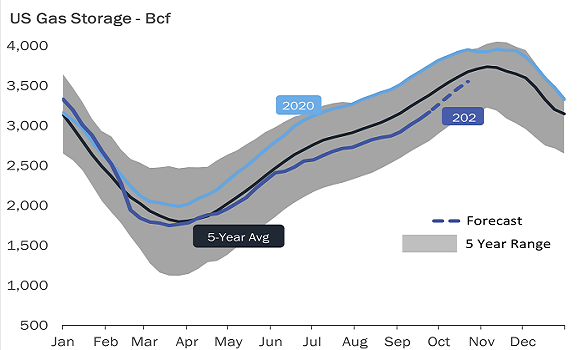

Two years after Wilhelmshaven’s inauguration the market situation is challenging. European LNG terminals had a moderate 2024.

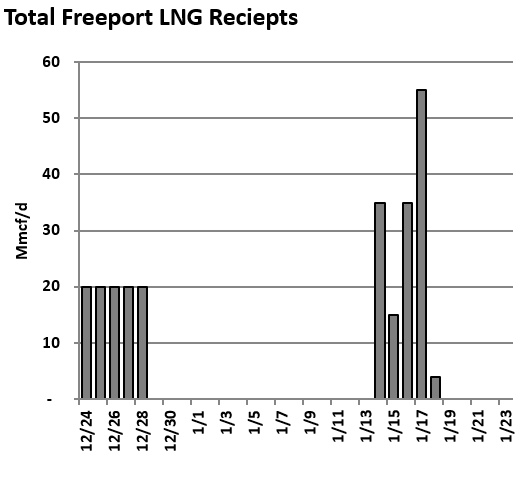

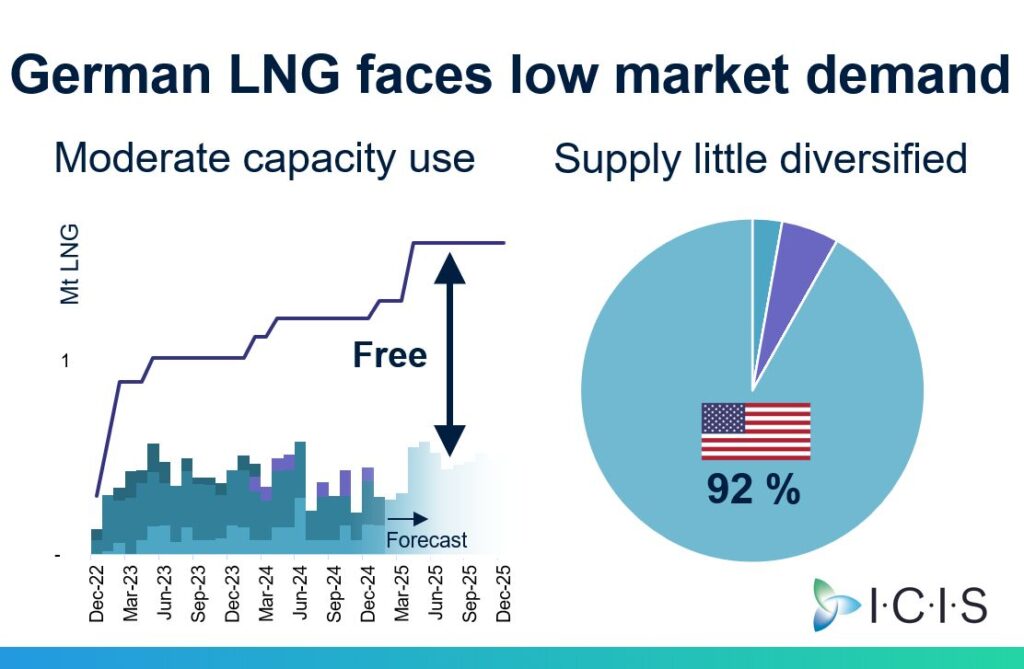

Terminals Stade and Lubmin are hardly utilised at all. Only three vessels unloaded in Germany in January 2025.

German LNG capacity operators (DET Deutsche Energy Terminal GmbH, Deutsche ReGas) are grappling with lower demand under new market conditions.

DET contemplated partially shutting down capacities at Wilhelmshaven over Q1/2025 and the new Stade facility gets postponed repeatedly.

Court action by environmental organisations tie up resources as well as complaints by competitors Deutsche ReGas and Hanseatic Energy Hub on unfair market conditions.

German terminals rely heavily on volumes traded short-term on spot markets, mostly of American origin. The reliance on spot volumes puts German terminals in disadvantage compared to land-based terminals in neighbouring countries as short-term capacity bookings are usually more expensive than long-term capacity bookings.

To close on a positive note: Imports are set to rebound in 2025. The expectation of high gas storage injections and absence of Russian flows over 2025 has sent European gas above Asian prices.

Average European terminal utilisation increased to 45% in January 2025, up from a low 36% in Q3/2024.

Germany’s Wilhelmshaven is 80% utilised at reduced capacity (40% of full capacity), Brunsbüttel 80% of full capacity whereas Stade & Lubmin at zero.

There is room for more LNG entering Germany in 2025. DET auctions for free capacity slots start today 4th of February at a minimum price of 0.6 €/mmBTU.

Source: Andreas Schroeder