(Montel) China retaliated swiftly against US tariffs on its goods on Tuesday by imposing its own levies on imports of US LNG, but the market impact is likely to be negligible, analysts told Montel.

The new administration of US president Donald Trump imposed a 10% tax on imports of Chinese goods, which went into effect today, while Beijing countered with a 15% import tariff on US LNG, as well as a similar levy on US coal and a 10% one on crude oil.

Currently most Chinese imports of US LNG were tied to long-term contracts, which would remain priced below current and future spot prices, even with a 15% bump, analysts agreed.

Imports of the US fuel to China had also fallen significantly since the last Trump-induced trade war, totalling 4.3m tonnes in 2024, or less than half than the 2021 high of 9m tonnes.

“Contracted US LNG would be priced USD 10/MMbtu below post tariff, so the Chinese buyers will almost 100% continue to take in the long-term contracted US LNG,” Alex Siow, head Asia LNG analyst at consultancy Icis, told Montel.

However, it was already our expectation that increased spot US LNG cargoes “would be going to Europe over coming months”, said Alex Froley, an Icis LNG analyst, referring to the TTF premium.

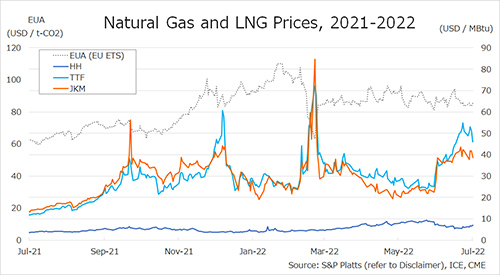

Europe’s benchmark TTF gas contract settled last at its highest in almost 15 months at EUR 53.79/MWh (USD 16.20/MMbtu), compared to the equivalent contract on Asia’s JKM marker of USD 14.40/MMbtu, with the two regions competing in terms of LNG deliveries.

“We have a steep premium for the TTF over East Asia LNG prices, which we can expect to ease a bit in favor of the Europeans, as non-US volumes move into the spotlight for Asia,” said Christoph Halser, gas and LNG analyst at Rystad Energy.

TTF offers a premium on JKM for the remainder of the year.

Seek discounts?

Chinese buyers could also seek US discounts, said Claudio Steuer, energy consultant and faculty member of IHRDC, Boston.

“Chinese buyers could invoke force majeure,” he said. It would require US sellers “to either grant price discounts offsetting the tariff impact or face complete volume loss,” he said.

Memories tend to be short-lived, he added, citing the last time tariffs were imposed against China in 2019-21, with the latter imposing a retaliatory 25% duty on US LNG imports.

Qatar expanded its market share, although Russia’s Novatek and Australian projects also gained ground on the critical Chinese LNG market in the wake of this.

“This time around, China enters this broader trade conflict from a position of enhanced energy security and optionality,” said Steuer.

“Qatar’s expansion volumes, coupled with uncontracted LNG volumes and LNG portfolio from trading houses, provide China with ability to entirely avoid importing US LNG.”

Source: Andrés CALA (Montel)