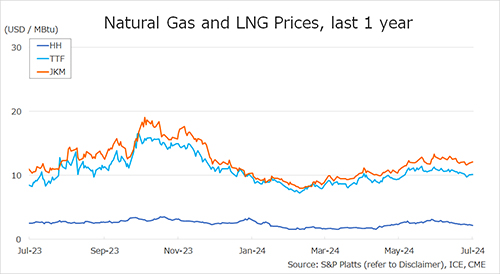

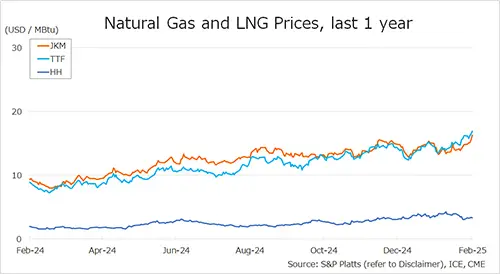

The Northeast Asian assessed spot LNG price JKM (March delivery) for last week (3 – 7 February) rose to low-USD 16s on 7 February from high-USD 14s the previous weekend (31 January).

JKM had been on an upward trend due to supply concerns over continued cargo outflows to Europe and news of China’s retaliatory tariffs on U.S. LNG, further rose significantly in the second half of the week on forecasts of a cold snap in Asia, reaching a 14-month high.

METI announced on 5 February that Japan’s LNG inventories for power generation as of 2 February stood at 2.41 million tonnes, up 0.26 million tonnes from the previous week.

The European gas price TTF (March delivery) for last week (3 – 7 February) rose to USD 16.9/MBtu on 7 February from USD 16.2/MBtu the previous weekend (31 January). TTF fell to high-USD 15s in the middle of the week due to the possibility of increased cargoes to Europe following China’s announcement of retaliatory tariffs on U.S.

LNG, but rose to the high-USD 16s in the second half of the week as demand increased due to cold weather and lower wind and solar power output, as well as increased withdrawals from underground gas storage.

According to AGSI+, the EU-wide underground gas storage was 49.4% on 7 February, down from 53.6% at the end of the previous weekend, down 26.2% from the same period last year, and down 12.6% over the five-year average.

The U.S. gas price HH (March delivery) for last week (3 – 7 February) rose to USD 3.3/MBtu on 7 February from USD 3.0/MBtu the previous weekend (31 January). HH rose to USD 3.3/MBtu at the beginning of the week, partly due to concerns surrounding tariffs, but then remained largely unchanged throughout the week.

The EIA Weekly Natural Gas Storage Report released on 6 February showed U.S. natural gas inventories as of 31 January at 2,397 Bcf, down 174 Bcf from the previous week, down 8.0% from the same period last year, and down 4.4% over the five-year average.

Updated: February 10

Source: JOGMEC