Global LNG trade more than quadrupled since the beginning of the century. This strong growth was accompanied by a profound qualitative transformation enabling the development of a global traded LNG market.

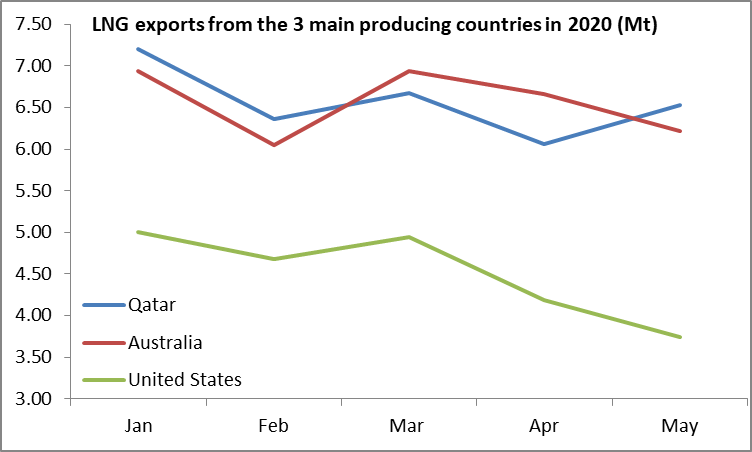

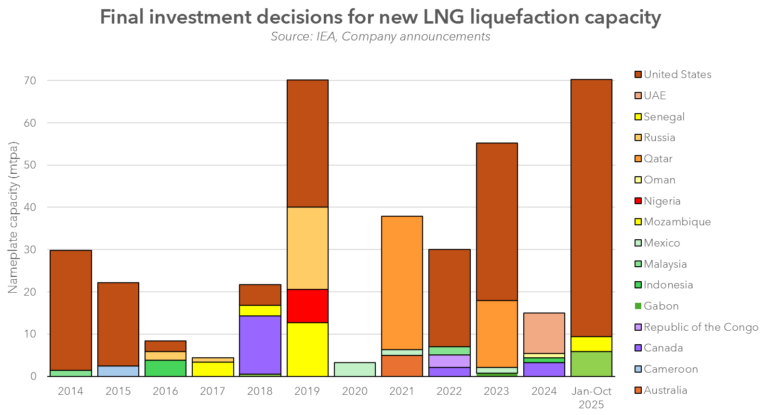

The staggering growth of LNG trade was underpinned by three major investment cycles, respectively driven by Qatar, Australia and the United States. This propelled the share of LNG in global gas demand from just 5% back in 2000 to almost 15% today.

This strong growth was also accompanied by a more profound qualitative transformation.

In its early days, LNG trade was characterised by destination-fixed point-to-point contracts, with LNG shipments essentially functioning as virtual pipelines.

Flexibility improved over the last two decades with the growing share of destination-free contracts, allowing the diversion of LNG cargos when it makes economic sense. The share of destination-flexible contracts grew from less than 30% back in 2015 to nearly half of the total volumes contracted today.

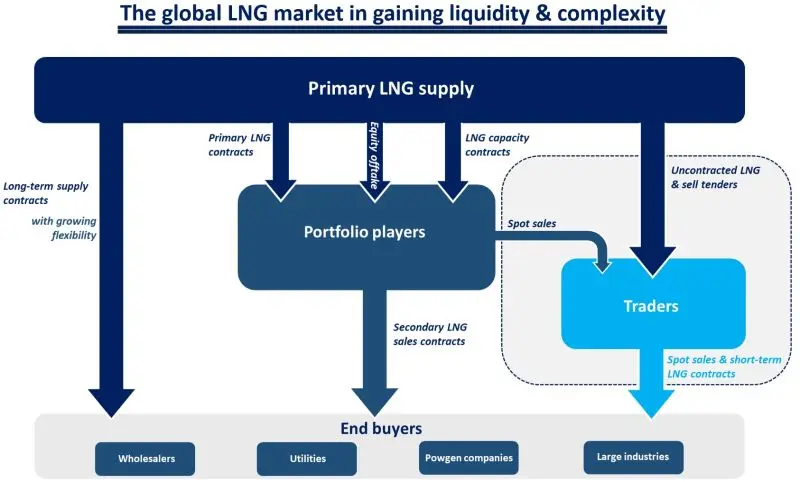

In parallel, some of the largest market players started to develop a portfolio approach to LNG trading: essentially reselling primary LNG supply to end buyers through secondary LNG sales contracts (and benefitting from the price differential between the two).

This allowed more sophisticated risk-sharing mechanisms along the LNG value chain and facilitated the entrance of new, emerging LNG buyers, often with less deep pockets than the traditional Northeast Asian and Northwest European buyers.

In addition, spot and short-term LNG trading started gaining traction, growing from 10% of global LNG trade to 35–40% in recent years. On the demand side, this is largely driven by buyers’ growing flexibility needs and higher short-term variability of gas demand.

From a supply-side perspective this is supported by uncontracted liquefaction capacity, sell tenders and short-term resales from portfolio players.

The unfolding LNG wave will expand global LNG trade by nearly 50% by 2030. Driven by the US, this will reinforce the share of destination-flexible, hub-based LNG contracts, set to account for over half of total volumes contracted by the end of the decade.

And the role of spot and short-term LNG trade is set to further expand: I would not be surprised to see its share growing to 40–50% by 2030. This will certainly require more sophisticated hedging strategies and risk management. It will further increase the importance of well-developed and liquid hubs, such as TTF or Henry Hub.

What is your view? How will the next LNG wave transform the global gas market? How will the share of spot LNG evolve? What role for gas hubs?

Source: Greg Molnar