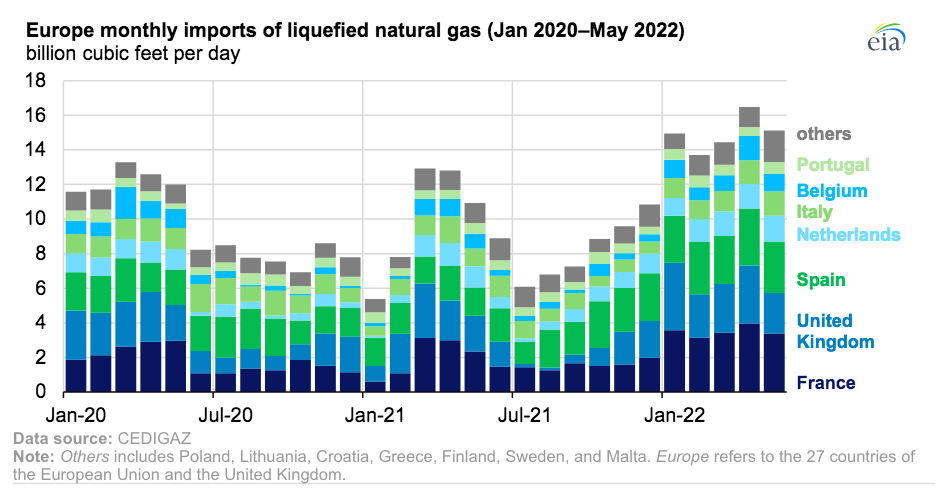

Europe’s (the European Union and the United Kingdom) liquefied natural gas (LNG) imports set an all-time historical record high in April 2022, averaging 16.5 billion cubic feet per day (Bcf/d) monthly and exceeding 19.0 Bcf/d on some days in April.

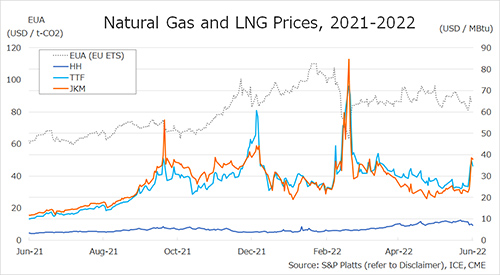

Europe’s LNG imports increased in 2022 because natural gas storage inventories were at historically low levels from fall 2021 through spring 2022. Traditional sources of natural gas (and some substitute fuels) delivered by pipeline have not been meeting Europe’s energy needs, and spot natural gas prices at major European hubs have generally been higher than spot prices in other markets.

The higher spot prices in Europe have resulted in more imports from suppliers with destination flexibility in their contracts, particularly from the United States.

From January through May 2022, LNG imports into the European Union and the United Kingdom averaged 14.9 Bcf/d, which is 5.9 Bcf/d (66%) more than the annual average in 2021 and 4.7 Bcf/d more than the pre-pandemic high of 10.3 Bcf/d in 2019, according to data from CEDIGAZ.

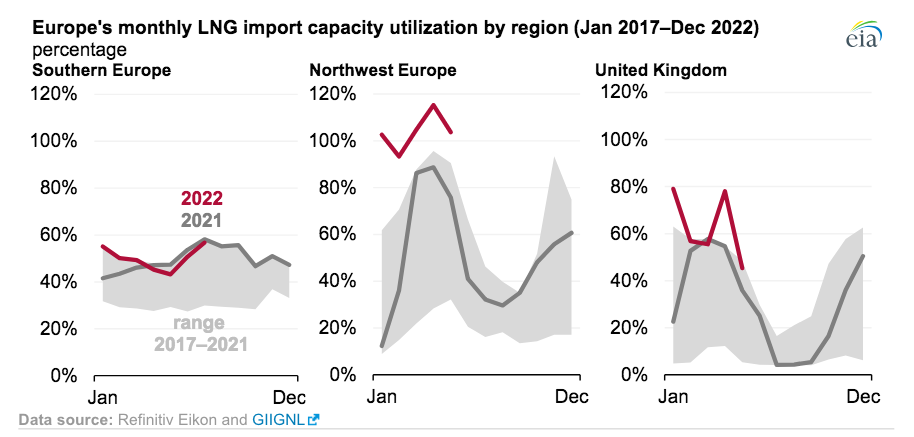

Currently, 14 countries in Europe have LNG import facilities; however, utilization of these facilities varies by region. The northern and southern parts of the European natural gas pipeline grid are not fully integrated. LNG import terminals in Northwest Europe are connected to a more fully integrated pipeline grid, which can transport large volumes of natural gas to major load centers and storage facilities across Northern Europe. LNG import facilities in Southern Europe primarily serve local and regional markets.

From January through May 2022, deliveries of regasified LNG (LNG vaporized from a liquid back to its gaseous form) to the pipeline grid in Spain, Portugal, and Italy in Southern Europe averaged 4.6 Bcf/d, and LNG import (or regasification) terminals in the region were utilized at 58% of their capacity.

During the same period, volumes of regasified LNG delivered to France, Belgium, and the Netherlands in Northwest Europe averaged 5.8 Bcf/d, exceeding the nameplate capacity of regasification facilities and reaching an all-time peak utilization of 115% in April 2022. Utilization rates of regasification terminals can exceed the standard nameplate capacity of 100% during periods of peak use.

Further increases in LNG imports into Northwest Europe will be limited by the availability of regasification capacity in the region.

The United Kingdom has the second-largest LNG regasification capacity in Europe (4.7 Bcf/d), and it can export up to 2.5 Bcf/d of natural gas to the European Union via the Interconnector pipeline into Belgium and the BBL pipeline into the Netherlands.

Regasified LNG volumes in the United Kingdom averaged 2.9 Bcf/d from January through May 2022, and regasification facilities ran at a 63% utilization rate, up from 30% last year. Exports from the United Kingdom via interconnecting pipelines to the European Union have run at close to maximum rates since March 2022.

Source: EIA