The current trade tensions between Australia and China create nervousness about whether or not China may target Australian LNG in the same way that it has targeted other exports. China was the second largest market for Australian LNG in 2020 taking 38% of exports.

These fears surfaced again with a Bloomberg report on 10 May that at least two of China’s smaller LNG importers have been told to avoid buying new cargoes from Australia. The report says that the firms have received verbal orders from government officials to avoid purchasing additional LNG from Australia for delivery over the next year.

However, as the report notes, any such action is unlikely to have a material impact on Australia. The limitation to smaller importers substantially narrows the impact of any directions and the smaller LNG buyers plan to continue imports of previously purchased or contracted Australian cargoes, narrowing the focus to spot cargoes or short-term contracts. This reduces any impact even further.

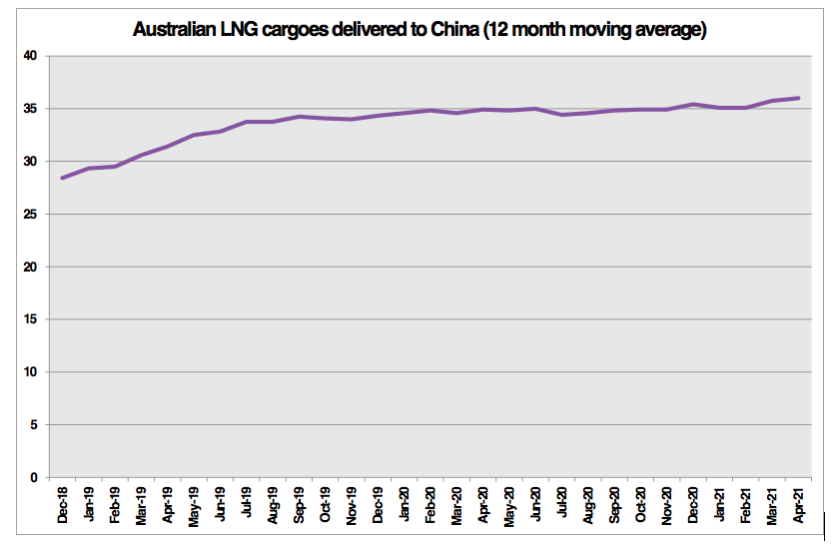

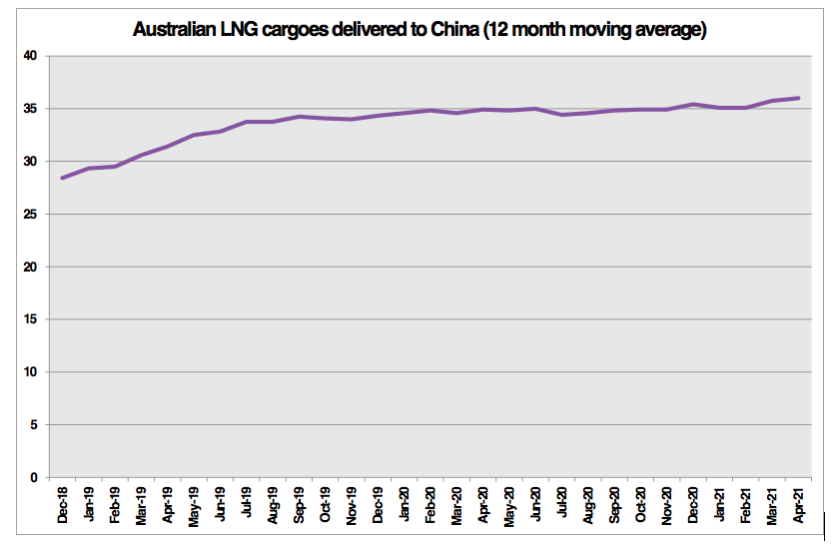

LNG exports to China continue to be remarkably stable. There are seasonal fluctuations but if these are smoothed out using a 12-month moving average, deliveries have been averaging 35 cargoes per month since 2019 (Figure 1).

Australian deliveries to China have actually been growing this year with 29 cargoes in February, 37 in March and 43 in April. Based on our tracking data, the 43 cargoes delivered from Australia to China in April was just short of the record. The record was set in December 2020 when 44 cargoes were delivered to China.

Figure 1 Australian LNG cargoes delivered to China (12 month moving average)

Source: EnergyQuest

The biggest risk to Australian LNG exports is not having enough gas. Bayu-Undan, the field supplying Darwin LNG, is soon expected to decline.

Fortunately, Santos is making progress with the development of the Barossa field to backfill Darwin. However, Platts is reporting that the North West Shelf (NWS) has asked Japanese utilities to defer some LNG cargoes. The deferral is said to be due to water ingress into one of the producing wells.

This is a reminder of the maturity of the NWS, which is soon to move into late-life production decline. The NWS is Australia’s second-largest LNG project. Maintaining production depends on onshore gas plus development of additional gas fields, initially Scarborough, perhaps followed by Browse.

On the east coast, even though GLNG is now producing 6 Mtpa, this is well short of capacity of 8.6 Mtpa due to limited gas supply. The ability of QCLNG to maintain its current level of production depends on development of the Arrow Energy fields, 50% owned by PetroChina. Hopefully this will not be impacted by political issues.

Chinese threats are the ones that grab the headlines but having insufficient gas to maintain exports are potentially more important. Over the last year too technical problems with Gorgon and Prelude have had a greater impact on exports than anything to do with geopolitics.

Source: By Graeme Bethune, Chief Executive Officer, EnergyQuest

Join the debate with Graeme Bethune on Linkedin and Twitter @EnergyQuest