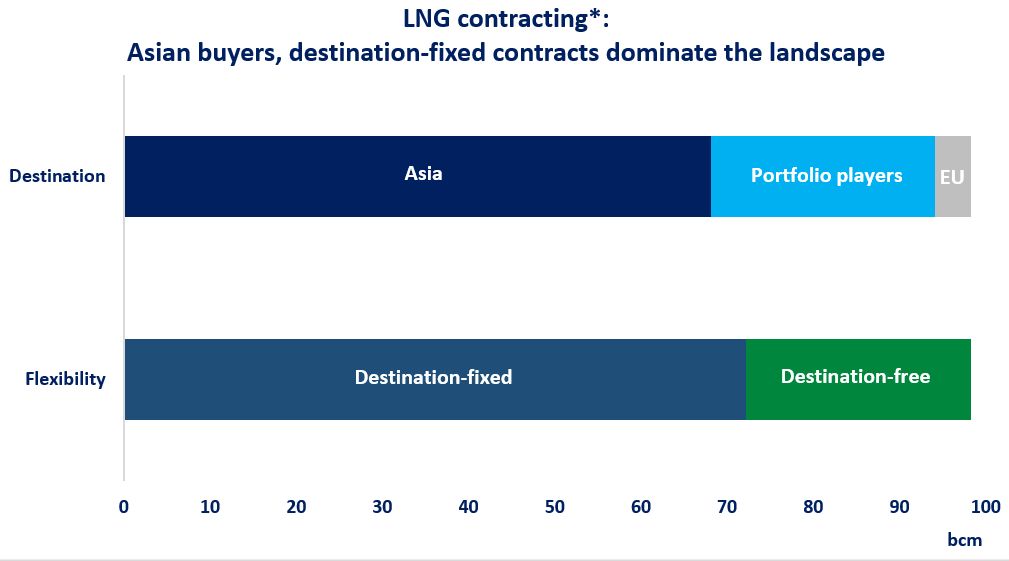

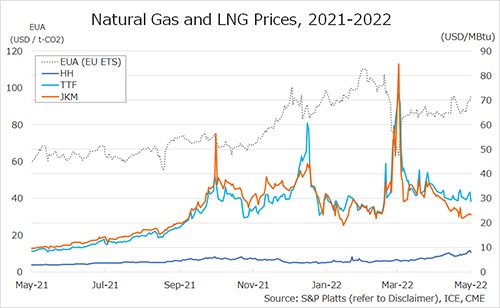

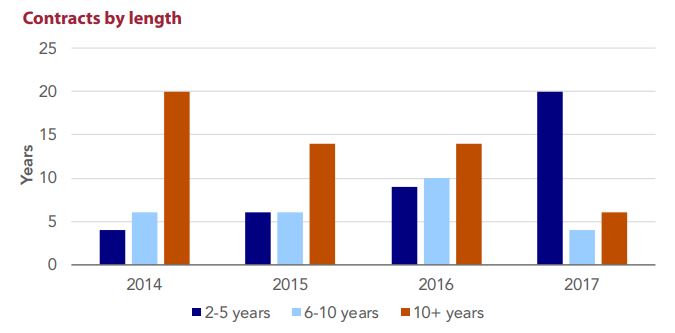

The average LNG contract length fell to a record low in 2017, raising concerns on the future supply of the chilled fuel. But, with just two new LNG projects green-lighted over the past two years, concern is growing that the market may be undersupplied in the medium-term. The number of short-term contracts – those two to five years in length – more than doubled from nine in 2016 to 20 in 2017, after holding steady at an average of about five between 2013 and 2015. Overall contract sales fell to less than 22 million tonnes per year in 2017, down from more than 30 million per year in 2016. Three others were priced against European gas indices, two on a hybrid basis (Brent-Henry Hub) and one against the JKM marker in Asia.

The strong move toward Brent and away from a variety of other benchmarks that have proven popular in recent years – European gas hubs, Henry Hub, LNG indices, gas-oil hybrids, for example – indicates that market participants have yet to gain confidence in alternative benchmarks. This lack of deals associated with projects under development highlights concern about future LNG supply. The question now is whether project sponsors can convince enough buyers to return to long-term contracts to ensure that additional liquefaction capacity is built in time to avoid potential supply constraints in the future.

This article was first published by Poten & Partners