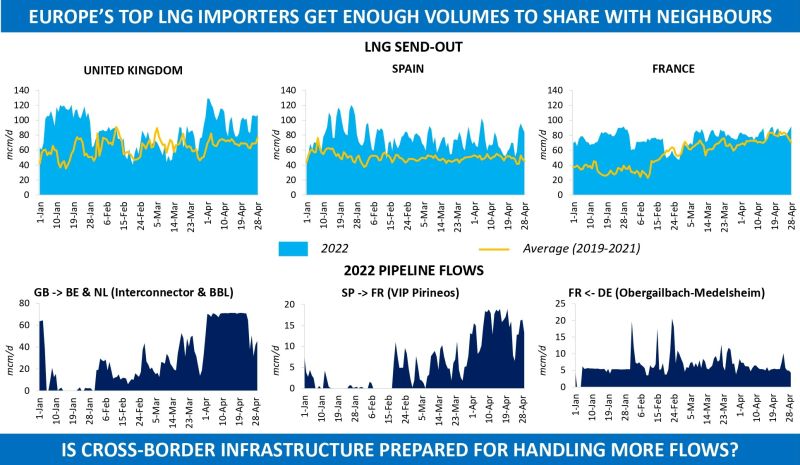

April 2022 saw the second largest monthly number of LNG cargoes delivered to the European terminals, with the continent’s top three importers having received a record total of 6.8 million tons, according to Kpler. A substantial increase in imports to the UK, Spain and France has not only provided more volumes to the three countries’ market areas, but also brought much-needed relief to a stretched regional market.

For many months now, Europe has remained the most attractive destination for spot LNG marketed by producers and trading companies. And this past month was no exception. In April 2022, the total daily average send-out from three British, six Spanish and four French regas facilities increased by 30pc as compared to the similar period in 2019-2021.

Higher LNG imports drove wider discounts for the prompt products at NBP, PVB and PEG to the neighbouring markets. For instance, the spread between the German day-ahead contract and its French counterpart averaged €11.5/MWh in April versus just over €3/MWh in March. The corresponding NBP product was assessed approximately €30/MWh below the TTF equivalent last month, while in March the price difference between the hubs did not exceed €4.5/MWh on average.

Naturally, this created more export opportunities for shippers active on the LNG receiving markets, which is particularly evident in the UK. Between 1 and 29 April, net exports via the Interconnector and BBL pipelines averaged 65 mcm/d compared with 20 mcm/d in the period from January to March 2022. Had the unplanned maintenance begun on the Interconnector in late April, last month’s flows from the UK to Belgium and the Netherlands might have been even higher.

The influx of LNG supply to Europe could not have come at a better time, given traditionally volatile weather conditions during the shoulder period and the necessity to fill the region’s low gas stocks.

At the same time, strong LNG arrivals have highlighted the importance of having adequate cross-border capacity so that volumes are effectively allocated between market areas. Bacton exit capacity limitations and the inability of the Obergailbach-Medelsheim border point as well as VIP Pirineos to accommodate large flows are raising questions as to whether Europe is well placed to absorb abundant regasified volumes on a regular basis, especially in case of future additions to LNG import capacity in France and/or Spain. As the region becomes more dependent on seaborne cargoes, the role played by the exit points like Bacton or VIP Pirineos within the architecture of European gas market continue to evolve. A few years ago regasified LNG that was transported via many of those cross-border connections just complemented pipeline gas imports. In the new reality, easy and timely access to volumes sent from LNG terminals will increasingly define the sustainability of the whole system.

Source: Yakov Grabar (LinkedIn)